📈 Your Retirement Plan

Your Ultimate Teacher Retirement Calculator Guide

Planning for retirement can feel like a monumental task, especially on a teacher’s salary. You’ve dedicated your career to shaping future generations, and you deserve a future where you can relax and enjoy the fruits of your labor. But how do you know if you’re saving enough? How does your pension fit into the bigger picture? This is where a reliable teacher retirement calculator becomes your most valuable tool.

For years, I’ve worked with educators just like you, helping them navigate the complexities of their financial futures. I’ve seen the relief that comes with clarity and the confidence that a solid plan provides. This guide is designed to walk you through everything you need to know about using a teacher retirement calculator to map out your post-career life. We’ll move beyond the numbers and explore what they mean for you, your goals, and your peace of mind.

This isn’t just about punching in figures. It’s about understanding the story they tell. We’ll cover everything from setting retirement savings goals by age to understanding how your investments grow. By the end, you’ll be able to use our powerful teacher retirement calculator not just as a tool, but as a trusted partner in your retirement planning journey.

Why a Specialized Teacher Retirement Calculator Matters

Not all retirement calculators are created equal. Many generic tools fail to account for the unique financial landscape of an educator. A dedicated teacher retirement calculator is different because it’s built with your profession in mind. It understands the nuances of teacher pensions, which are often the bedrock of an educator’s retirement strategy.

A retirement calculator for teachers with pension considerations is crucial. Your pension provides a steady stream of income, but it’s only one piece of the puzzle. You also need to account for personal savings, investments, and the rising cost of living. This specialized calculator helps you see how all these elements work together. It provides a holistic view of your financial future, something a generic tool simply can’t offer.

Using a teacher pension benefits estimator is a great starting point, but integrating that information into a comprehensive plan is the next step. Our teacher retirement calculator allows you to do just that, giving you a clear picture of your total retirement readiness.

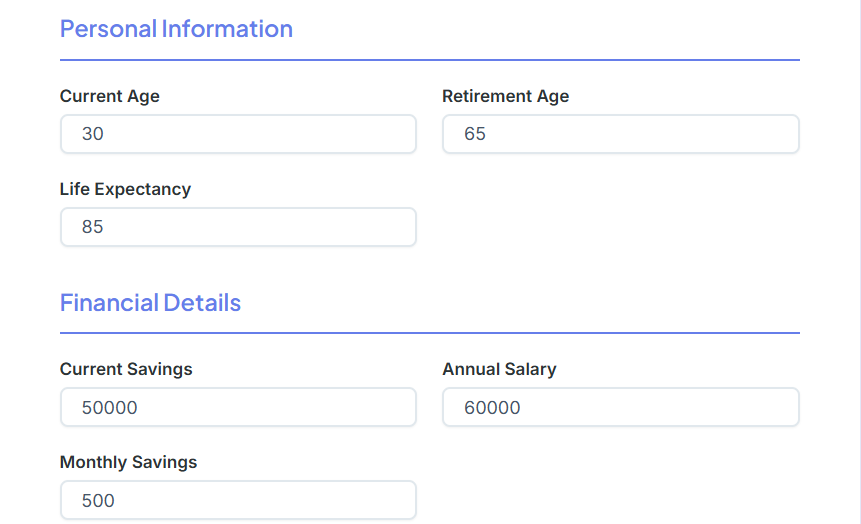

Your Step-by-Step Guide to Using the Teacher Retirement Calculator

Let’s walk through how to use the calculator. The goal is to make this process as simple and insightful as possible. Follow these steps to get a clear projection of your retirement savings.

Step 1: Gather Your Information

Before you start, grab your latest pay stub, your pension statement, and your investment account balances. Having accurate numbers ensures the teacher retirement calculator gives you a reliable projection.

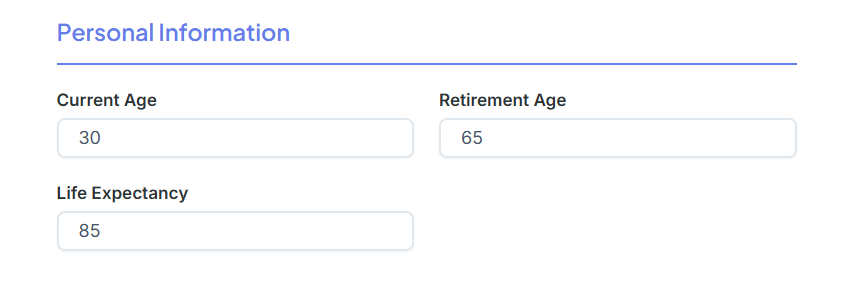

Step 2: Input Personal Details

Start with the basics. Enter your current age and the age you plan to retire. Be realistic here. While we all dream of retiring at 50, most teachers aim for somewhere between 55 and 65. Also, input your life expectancy. It’s better to overestimate this number to ensure you don’t outlive your savings.

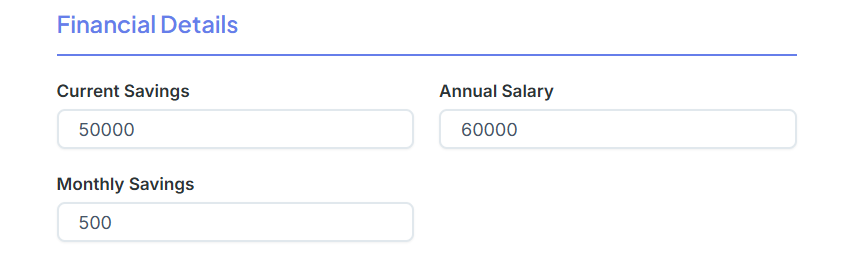

Step 3: Enter Financial Data

Next, plug in your current savings and annual salary. Don’t forget to include your monthly savings contributions. This is where you can see the impact of increasing your savings rate. If you’re unsure about your take-home pay, you might want to use a Salary Calculator to get a precise figure.

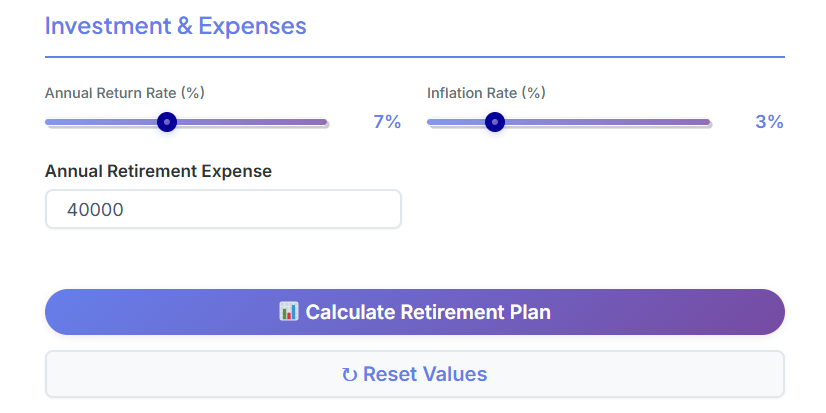

Step 4: Adjust Investment & Expense Variables

This is the fun part. Use the sliders to adjust your expected annual return and inflation rate. If you’re conservative, stick to lower returns. Also, estimate your annual retirement expenses. Be honest about the lifestyle you want.

Step 5: Analyze the Results

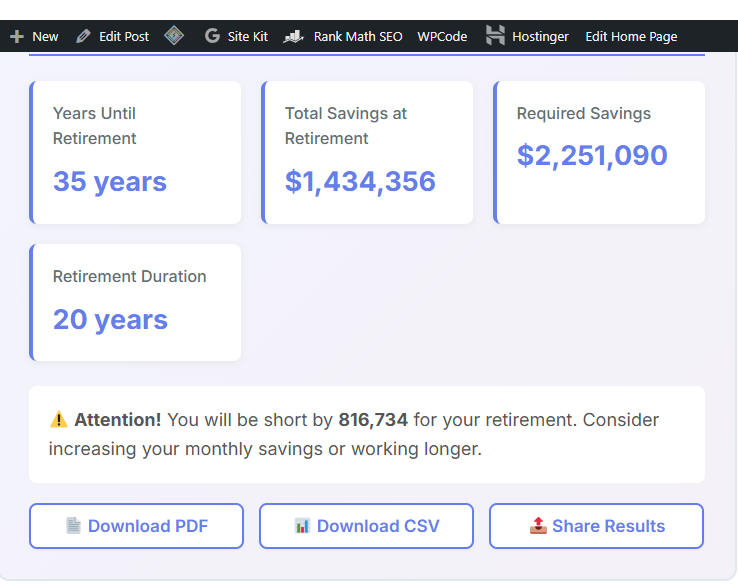

Hit “Calculate” and review the output. The teacher retirement calculator will show you your total savings at retirement, required savings, and whether you have a surplus or shortfall.

Deep Dive: What Each Input Means

To get the most accurate results from the teacher retirement calculator, it’s essential to understand what each input represents. Garbage in, garbage out, as they say. Let’s break it down.

Personal Information

- Current Age: Your starting point. The earlier you start, the more time your money has to grow.

- Retirement Age: When you plan to hang up your teaching hat. This impacts how long you have to save and how long your savings need to last.

- Life Expectancy: How long you need your money to last. Planning for a longer life is always safer.

Financial Details

- Current Savings: This includes everything you’ve saved so far—IRAs, 403(b)s, and other investments.

- Annual Salary: Your gross yearly income. This helps in estimating future contributions and pension benefits.

- Monthly Savings: The amount you tuck away each month. Consistent contributions are key to building a substantial nest egg.

Investment & Expenses

- Annual Return Rate (%): This is the growth rate of your investments. While the stock market has historically returned around 10%, a conservative estimate of 6-7% is safer for planning. If you’re curious about how different investments perform, checking a TD monthly income fund performance review can provide some real-world context on income-focused funds.

- Inflation Rate (%): The rate at which money loses value over time. Standard planning uses 3%, but this can fluctuate. Understanding the impact of inflation is vital; sometimes using an Inflation Calculator can help visualize how much purchasing power you might lose over 20 years.

- Annual Retirement Expense: What you expect to spend yearly in retirement. This is often 70-80% of your pre-retirement income, but it depends entirely on your lifestyle choices.

Here is a table to help you gather the right information:

| Input Field | What It Means | Where to Find It / How to Estimate | Common Mistake |

|---|---|---|---|

| Current Savings | Your total retirement investment balance today. | Check your 403(b), IRA, and other account statements. | Including the cash value of a home or pension. |

| Monthly Savings | Regular contributions to your retirement accounts. | Look at your paystub or automatic transfer records. | Forgetting to include employer matching contributions. |

| Annual Return Rate | The expected growth rate of your investments. | Review your account’s historical performance or use a conservative 6% estimate. | Being overly optimistic (e.g., expecting 12%+ consistently). |

| Annual Retirement Expense | Your estimated yearly spending in retirement. | Use 80% of your current income as a starting point, then adjust for your lifestyle. | Underestimating healthcare costs or travel desires. |

This powerful teacher retirement calculator can give you the insights needed to adjust your financial plan.

Deep Dive: What Your Results Mean

After you hit “Calculate,” the teacher retirement calculator will present you with a summary of your retirement outlook. It’s more than just a pass/fail grade; it’s a roadmap.

- Total Savings at Retirement: This is the projected total value of your personal savings when you reach your target retirement age. This figure demonstrates the power of compound growth over your career.

- Required Savings: This is the estimated lump sum you’ll need to fund your desired lifestyle throughout retirement, taking inflation into account. The teacher retirement calculator calculates this based on your annual expenses and life expectancy.

- Surplus/Shortfall: This is the bottom line. It shows you the difference between what you’re projected to have and what you’re projected to need. A surplus is great news! A shortfall is a call to action.

Understanding which of the following is an inflation-adjusted return is key to interpreting these results. Your “real return” is your investment return minus the inflation rate. The calculator handles this for you, ensuring your “Required Savings” reflects future purchasing power. If your savings are not keeping up with inflation, their real value decreases.

Real-World Scenarios with the Teacher Retirement Calculator

Let’s see the teacher retirement calculator in action with a few common scenarios.

Scenario 1: The Early Career Teacher

- Name: Sarah, age 28

- Goal: Understand her retirement savings goals by age.

- Inputs: Current Savings: $15,000; Monthly Savings: $300; Retirement Age: 65.

- Result: The teacher retirement calculator shows a significant shortfall.

- Action Plan: Sarah sees she needs to increase her monthly savings. She decides to bump her 403(b) contribution from $300 to $500 per month. Rerunning the calculation shows her projected to be much closer to her goal. She now has a clear target and understands the ideal retirement savings milestones by age. To see how her monthly contributions grow specifically, she might also consult a SIP Calculator.

Scenario 2: The Mid-Career Teacher

- Name: David, age 45

- Goal: Check if he’s on track after years of inconsistent saving.

- Inputs: Current Savings: $150,000; Monthly Savings: $800; Retirement Age: 62.

- Result: The teacher retirement calculator projects a modest surplus.

- Action Plan: David is relieved but wants a bigger cushion. He explores investment options with potentially higher returns. After reviewing the TD US monthly income fund 2460 and similar conservative income funds, he considers diversifying a small portion of his portfolio. He also uses the teacher retirement calculator to see what would happen if he worked until age 64, which significantly boosts his surplus.

Scenario 3: The Nearing-Retirement Teacher

- Name: Maria, age 58

- Goal: Finalize her retirement date and confirm her funds are sufficient.

- Inputs: Current Savings: $600,000; Monthly Savings: $1,200; Retirement Age: 63.

- Result: The teacher retirement calculator shows a comfortable surplus.

- Action Plan: Maria uses the calculator to “stress test” her plan. What if inflation is higher? What if her investment returns are lower? She finds she is still in a good position. This gives her the confidence to start the formal retirement process with her district. The teacher retirement calculator has validated her years of diligent saving. She might double check the tax implications of her withdrawals using a Tax Calculator.

This comparison shows how the teacher retirement calculator is a versatile tool for educators at any stage.

| Scenario | Age | Key Challenge | How the Calculator Helped |

|---|---|---|---|

| Sarah | 28 | Lacks a clear savings target. | Quantified the impact of increasing monthly contributions. |

| David | 45 | Unsure if past efforts are enough. | Confirmed he was on track and allowed him to model different scenarios (e.g., retiring later). |

| Maria | 58 | Needs confidence for the final step. | Validated her plan and allowed for stress testing against market variables. |

Advanced Insights for Pros

Once you’ve mastered the basics of the teacher retirement calculator, you can use it for more advanced strategic planning.

1. The Power of “One More Year”

Run the calculation with your ideal retirement age. Then, run it again adding just one more year of work. You’ll likely be shocked at the difference. That extra year provides more time for your investments to grow, another year of contributions, and one less year of drawing down your funds.

2. The Impact of Your Pension

While this teacher retirement calculator focuses on your personal savings, don’t forget your pension. Let’s say your pension will provide $40,000 per year. If your desired “Annual Retirement Expense” is $65,000, you only need your personal savings to cover the $25,000 gap. Input $25,000 as your expense to see how much you need to save to supplement your pension. This makes the retirement savings goal calculator even more powerful.

3. Diversifying Your Income Streams

Many teachers rely heavily on their 403(b). However, diversifying into other vehicles can be beneficial. For instance, you might explore fixed deposits for a safer portion of your portfolio. Checking an FD Calculator can help you compare those guaranteed returns against market-linked options.

4. Inflation-Adjusted Returns

Understanding which of the following is an inflation-adjusted return allows you to see the “real” growth of your money. If your investment grows by 7% but inflation is 3%, your purchasing power only grows by roughly 4%. Our calculator simplifies this, but knowing the concept helps you set realistic expectations. An inflation-adjusted return calculator can be a handy separate tool for deep dives into specific investment performance.

Benefits of Using This Calculator

Why should you make the teacher retirement calculator a regular part of your financial check-up?

- Clarity: It turns abstract worries into concrete numbers.

- Motivation: Seeing your progress can encourage you to save more.

- Flexibility: You can model different life choices (retiring early, working part-time, etc.).

- Confidence: Knowing you have a plan reduces financial anxiety.

- Accuracy: It helps you avoid the common trap of underestimating how much you need.

Expert Tips for Accuracy

To get the most out of your teacher retirement calculator experience, follow these pro tips:

- Be Conservative: It’s better to end up with more money than you expected than less. underestimate your returns and overestimate your expenses.

- Update Regularly: Life changes. Review your plan at least once a year or whenever you have a major life event (marriage, new baby, raise).

- Don’t Forget Taxes: Remember that withdrawals from traditional retirement accounts are taxable. If you’re buying significant items post-retirement, a GST Calculator might even help you budget for consumption taxes on big purchases.

- Consider Healthcare: Medical costs are a huge expense in retirement. Factor these into your “Annual Retirement Expense.”

Frequently Asked Questions (FAQs)

1. How accurate is the teacher retirement calculator?

It’s a projection based on the data you provide. While it can’t predict the future (like market crashes), it gives you a statistically sound estimate to base your planning on.

2. Does this calculator include my state pension?

This specific tool focuses on your personal savings gap. You should use your state’s specific teacher pension benefits estimator to get your pension number, then subtract that from your total needs before using this calculator.

3. What is a good retirement savings goal by age for a teacher?

A general rule is to have 1x your salary saved by 30, 3x by 40, 6x by 50, and 8-10x by 60. However, having a pension changes these multiples significantly.

4. I have a 403(b) and a 457(b). Should I combine them in the calculator?

Yes! Add the total balances of all your accounts into the “Current Savings” field for a complete picture.

5. What inflation rate should I use?

I typically recommend 3%. If you want to be very safe, use 4%.

6. How do I account for Social Security?

Many teachers don’t qualify for Social Security, or their benefits are reduced. If you do expect Social Security, treat it like a pension: subtract the expected annual amount from your required expenses.

7. Can I use this as a general retirement savings goal calculator?

Absolutely. The math of compound interest applies to everyone, not just teachers.

8. What if the calculator shows a shortfall?

Don’t panic. You have options: save more, retire later, or adjust your expected retirement lifestyle. Small changes now can have a huge impact later.

9. Is the TD US monthly income fund 2460 a good option for my retirement portfolio?

I can’t give specific investment advice, but funds like TD US monthly income fund 2460 are often designed for income generation. Always research funds thoroughly or consult an advisor.

10. How often should I use the teacher retirement calculator?

I suggest running your numbers annually, perhaps during the summer break when you have time to think about your long-term goals.

Conclusion

Retirement planning is a journey, not a destination. The teacher retirement calculator is your compass, helping you navigate the choppy waters of financial planning with confidence. By inputting your personal data, understanding the variables, and regularly reviewing your results, you are taking control of your future.

You’ve spent your career looking out for others. Now, it’s time to look out for yourself. Use the teacher retirement calculator today, explore the scenarios, and build a retirement plan that allows you to enjoy the freedom you’ve earned. Whether you are just starting out or are counting down the days, clarity is just a calculation away. Your future self will thank you for the time you spend planning today. So go ahead, bookmark this teacher retirement calculator, and start building your path to a secure and happy retirement.