Product Information

How to Use a Pricing Calculator to Optimize Product Pricing for Maximum Profit

In the competitive landscape of modern business, finding the “sweet spot” for your goods or services is often the difference between struggling to break even and achieving sustainable growth. Pricing is not merely a number on a tag; it is a complex psychological and financial lever that dictates your market position, revenue flow, and brand perception. For business owners, SaaS founders, and finance teams, the challenge is consistent: how do you balance competitiveness with profitability?

This guide explores the functionality of a comprehensive Pricing Calculator, a tool designed specifically to help you optimize product pricing without relying on guesswork. By inputting specific data points—from unit costs to competitor benchmarks—you can generate data-driven strategies that align with your business goals.

The Importance of Precision in Pricing Strategy

Many entrepreneurs start by looking at a competitor’s price and undercutting it by a few dollars. While this might secure early sales, it is rarely a sustainable strategy. To optimize product pricing effectively, you must consider the entire financial ecosystem of your product. This includes the cost of goods sold (COGS), fixed overheads, desired profit margins, and market demand elasticity.

A robust pricing optimization tool moves you away from “gut feeling” decisions. It provides a structured environment where you can test different scenarios. What happens to your margin if raw material costs rise by 5%? What is the impact on monthly revenue if you switch from a “Budget” position to a “Premium” position? The ability to simulate these outcomes is critical for anyone looking to optimize product pricing in a volatile market.

Step 1: Establishing the Baseline with Product Details

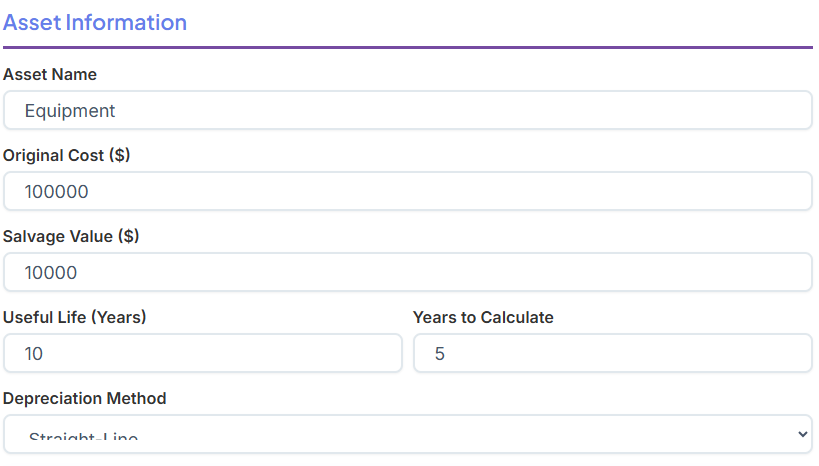

The journey to profitable pricing begins with accurate data entry. The calculator starts by asking for the fundamental identity of the item: the Product Name. While this seems simple, it allows you to organize multiple pricing scenarios for different SKUs or service tiers.

inputting Cost Per Unit

The most critical variable in the equation is the Cost Per Unit. To optimize product pricing, you must be ruthless about calculating this figure. It should not just include the manufacturing price. A truly optimized price accounts for packaging, shipping to the warehouse, tariffs, and handling fees. The calculator uses this base figure as the floor from which all profit is built. If this number is inaccurate, every subsequent recommendation will be flawed.

Estimating Volume

Next, the tool requires an Estimate of Expected Units Sold Per Month. Pricing is volume-dependent. A high-volume strategy (selling thousands of units at a low margin) requires a different price point than a low-volume, high-touch luxury strategy. By inputting your sales forecast, the tool helps you optimize product pricing to ensure that your total revenue targets are met, not just your per-unit goals.

Step 2: Setting Profit Goals and Margins

Once the costs and volume are established, the conversation shifts to profitability. The calculator allows users to Set Desired Profit Margin. This is where business strategy meets mathematics.

Do you want a 20% margin to stay safe, or are you aiming for a 65% margin to fund rapid expansion? When you use this tool to optimize product pricing, you can instantly see how changes in your desired margin affect the final shelf price. This feature is particularly useful for finance teams who need to work backward from a quarterly profit target to determine what the individual unit price must be.

Step 3: Market Analysis and Competitor Comparison

No business exists in a vacuum. A key feature of this tool is the ability to Compare Competitor Pricing. You can input the current market rates for similar products. This context is vital. You cannot optimize product pricing if you are completely unaware of what the customer is willing to pay for an alternative solution.

Choosing Your Market Positioning

The tool goes a step further by allowing you to Choose Market Positioning. You can select from:

- Premium: Comparison against the highest-priced competitors.

- Competitive: Matching the market average.

- Value: Slightly undercutting the average.

- Budget: Aggressive low-end pricing.

Your selection here instructs the calculator on how to optimize product pricing relative to the competitor data you entered. For example, if you select “Premium,” the algorithm will suggest a price point higher than the competitor average, assuming your brand value justifies the cost.

Step 4: Accounting for Fixed Costs and Elasticity

Variable costs are straightforward, but fixed costs often kill profitability. The calculator includes a field for Fixed Monthly Costs. This covers rent, software subscriptions, insurance, and salaries that do not change based on the number of units sold.

To truly optimize product pricing, your revenue must contribute to covering these overheads. The tool distributes these fixed costs across your expected sales volume to ensure that your “profit per unit” is real profit, not just a contribution margin.

Adjusting Price Elasticity

One of the most advanced features available to the user is the ability to Adjust Price Elasticity. Price elasticity of demand measures how sensitive customer demand is to changes in price.

- High Elasticity: A small price increase causes a large drop in sales (common in commodities).

- Low Elasticity: Price changes have little impact on demand (common in luxury goods or essential software).

By adjusting this setting, you can optimize product pricing based on the nature of your specific market. If you know your customers are price-sensitive, you adjust the elasticity setting, and the recommended price will be more conservative to protect sales volume.

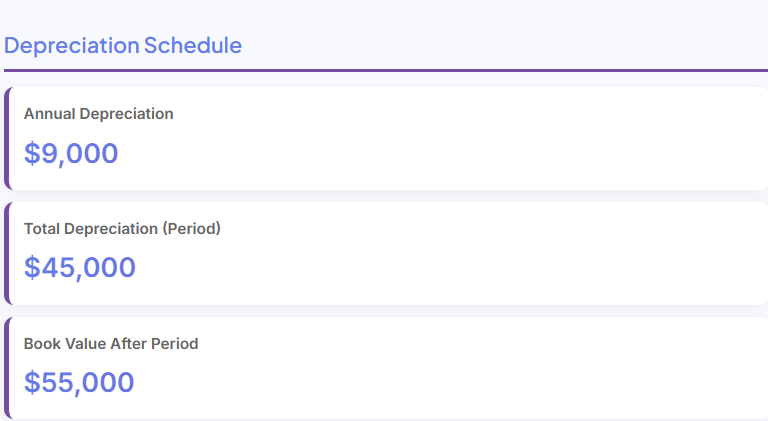

Analyzing the Output: Your Pricing Roadmap

After inputting these variables, the calculator generates a comprehensive set of results. The most immediate output is the Recommended Product Price. This is the specific dollar amount that balances your costs, margin goals, and market positioning. However, the value of the tool lies in the deeper metrics provided to help you optimize product pricing.

Profit Per Unit and Monthly Metrics

The tool breaks down the financial health of the product by displaying Profit Per Unit. This granular view helps you understand exactly how much you earn every time a customer clicks “buy.”

Simultaneously, it projects Monthly Revenue & Profit. This is essential for cash flow planning. You might find that a lower price point results in higher volume and, consequently, higher total monthly profit. This insight allows you to optimize product pricing for the bottom line rather than just the highest possible price tag.

Visualizing the Data

For those who prefer visual data, the tool generates a Visual Bar Chart Comparison. This graph places your recommended price side-by-side with your costs and competitor prices. Visualizing the gap between your cost and your price helps you instantly spot whether your margin is too thin or if you are pricing yourself out of the market. It is a powerful visual check to ensure you optimize product pricing logically.

Exploring Alternative Pricing Strategies

One of the standout features of this calculator is that it doesn’t just give you one answer. It acknowledges that there are multiple ways to skin a cat—or in this case, price a product. It generates Alternative Pricing Strategies so you can compare different methodologies.

Cost-Plus Pricing

This is the most straightforward method: Cost + Markup = Price. The tool calculates this to show you the “safe” baseline. While simple, it doesn’t always account for customer perception. However, it is a necessary benchmark when you look to optimize product pricing.

Competitive Pricing

This strategy sets your price based primarily on what others are charging. The calculator shows you what your price would be if you strictly followed the market leaders. This is useful for commoditized products where differentiation is difficult.

Break-Even Pricing

What is the absolute lowest price you can sell for without losing money? The tool calculates the Break-Even point. Knowing this floor is vital for clearance sales or aggressive market entry strategies. You cannot optimize product pricing for promotions if you don’t know your break-even number.

Psychological Pricing

The tool also offers a Psychological Pricing suggestion. This involves adjusting the number to end in .99 or .95 (e.g., $49.99 instead of $50.00). This subtle psychological trigger is proven to increase conversion rates. By adopting this suggestion, you optimize product pricing for human behavior, which can improve sales velocity without significantly impacting margins.

Why SaaS Founders Need This Tool

For Software as a Service (SaaS) founders, pricing is often the most difficult lever to pull. Unlike physical goods, the cost per unit in SaaS is negligible, but the fixed costs (development salaries, server costs) are high.

SaaS founders can use this calculator to optimize product pricing by heavily weighting the “Fixed Monthly Costs” and “Expected Units (Users)” fields. By experimenting with different user volume tiers, founders can determine the subscription price needed to cover their burn rate. Furthermore, the “Premium” vs. “Budget” positioning helps SaaS companies decide if they are building an enterprise tool or a mass-market utility.

The Role of E-commerce in Pricing Strategy

E-commerce sellers operate on razor-thin margins. Between platform fees, advertising costs, and shipping, every cent counts. An E-commerce owner must optimize product pricing to ensure that a high volume of sales doesn’t result in a “profitless prosperity.”

Using the Profit Margin Percentage output is crucial here. If the calculator shows a 5% net margin, the seller knows one return or lost package could wipe out the profit from ten sales. The tool allows the seller to adjust the price upward until a safer margin is reached, ensuring the business remains viable.

Generating and Sharing Reports

Pricing decisions are rarely made in isolation. They often require approval from partners, investors, or management teams. This Pricing Calculator includes a feature to Download a PDF Pricing Report.

This document compiles all the inputs, the market analysis, the visual charts, and the recommended strategies into a professional format. Instead of sending a messy spreadsheet, you can present a clean, data-backed document. This report serves as the blueprint for how you intend to optimize product pricing for the upcoming quarter or product launch.

Overcoming Common Pricing Mistakes

Without a dedicated tool, businesses often fall into traps. One common mistake is underestimating fixed costs, leading to a price that looks profitable on a unit basis but causes the company to bleed money monthly. Another is ignoring price elasticity—raising prices to increase revenue, only to see demand collapse.

By forcing the user to fill out specific fields for these variables, the calculator acts as a guardrail. It forces you to consider factors you might otherwise overlook. It structures your thinking and ensures that when you set out to optimize product pricing, you are doing so with a complete picture of the financial landscape.

When to Re-evaluate Your Pricing

Pricing is not a “set it and forget it” task. Market conditions change. Supplier costs fluctuate. Competitors launch new products. To truly optimize product pricing, you should return to the calculator periodically.

If your supplier raises the cost of raw materials, you can update the “Cost Per Unit” field and instantly see how much you need to raise your price to maintain your margin. If a new competitor enters with a low-ball offer, you can adjust the “Competitor Pricing” field to see if you can afford to match them. Continuous use of the tool ensures your strategy remains agile.

Related Financial & Business Tools

Managing a business requires a suite of financial insights beyond just pricing. To fully control your operational health, consider utilizing these complementary resources:

- Discount Calculator: Once you set your base price, you will eventually run promotions. This tool helps you Calculate discounts and sale prices to ensure your markdown strategy doesn’t erode your profits.

- Stock Calculator: For those managing business assets or personal investments, this tool allows you to Calculate stock returns and dividends, providing a broader view of financial growth.

- Rent vs Buy Calculator: Whether you are looking at office space or warehousing, this tool helps you Compare renting vs buying for business property, ensuring your overhead costs—which impact your pricing—are optimized.

Conclusion: Data-Driven Decisions for Growth

In the end, the price you put on your product is the ultimate signal of value to your customer and the primary driver of your business’s sustainability. Relying on intuition or simple competitor matching is a recipe for mediocrity or failure. To build a thriving business, you must utilize tools that allow you to optimize product pricing with mathematical precision.

By leveraging a Pricing Calculator, you gain control over your margins, understand your competitive landscape, and prepare for market fluctuations. Whether you are launching a new software platform, stocking an e-commerce store, or consulting for a client, the ability to optimize product pricing is a superpower. Start inputting your data, testing your assumptions, and discovering the price point that maximizes your profit today.

FAQs of Optimize Product Pricing

How does the Pricing Calculator ensure my recommended price covers all my business expenses?

To truly optimize product pricing, looking at just the manufacturing cost isn’t enough. Our calculator allows you to input two distinct types of expenses: Variable Costs (like raw materials, packaging, and shipping per unit) and Fixed Monthly Costs (such as rent, software subscriptions, and salaries).

By factoring in your fixed overheads and distributing them across your estimated monthly sales volume, the tool calculates a break-even point and a recommended price. This ensures that every sale contributes not just to the product cost, but to keeping your business operational, preventing you from setting a price that looks profitable on paper but leads to a loss at the end of the month.

Can I use this tool to see how my prices compare to my competitors?

Yes. Understanding your market position is critical for an effective pricing strategy. The tool features a Competitor Comparison section where you can input the current market rates for similar products.

Once you enter this data, you can select your desired Market Positioning (Premium, Competitive, Value, or Budget). The calculator will then adjust the recommended price based on your selection. For example, if you choose “Premium,” the tool will suggest a higher price point to reflect higher perceived value, whereas choosing “Value” will suggest a price slightly below the market average to attract price-sensitive customers.

What is the benefit of adjusting the “Price Elasticity” setting?

Price elasticity measures how sensitive your customers are to price changes. Adjusting this setting allows you to fine-tune the calculator based on your specific industry or product type:

High Elasticity: Suggests that a small price increase might significantly drop sales volume (typical for non-essential or highly competitive goods).

Low Elasticity: Suggests that demand will remain stable even if prices rise (typical for essential services or luxury items).

By selecting the correct elasticity level, the calculator provides a more realistic revenue projection, helping you find the balance between maximizing per-unit profit and maintaining high sales volume.