🏠 Ultra Pro Mortgage Calculator

Advanced Home Loan EMI Calculator with Amortization Schedule & Analytics

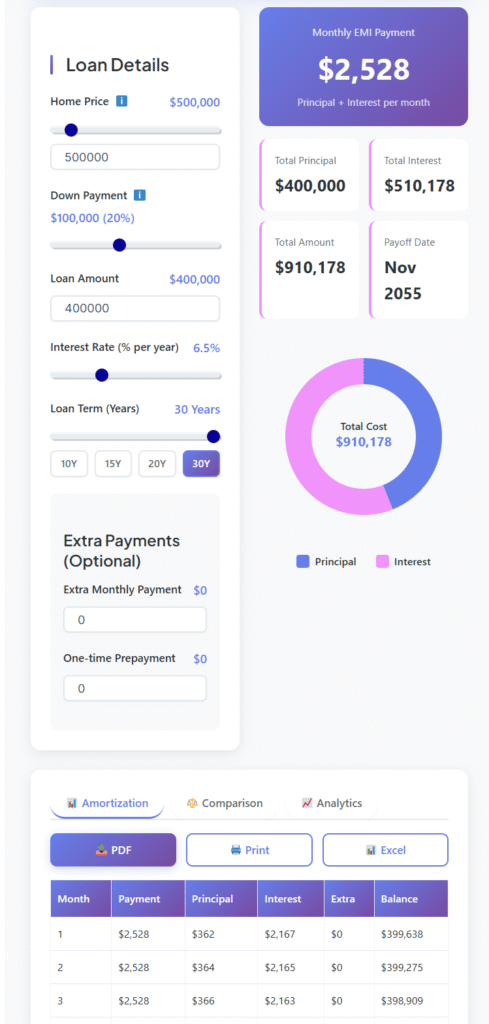

Loan Details

Extra Payments (Optional)

Compare Different Loan Scenarios

Payment Breakdown Over Time

Mortgage Calculator NM

Buying a home is more than just an exciting milestone—it’s a massive financial commitment that demands clarity, planning, and a serious look at numbers. If you’ve started considering property in New Mexico, you’re probably already searching for a reliable mortgage calculator NM buyers can actually trust. But with so many calculators out there, how do you choose one that gives you the knowledge and confidence you deserve?

Let’s cut through the confusion. This article is for anyone who wants complete, transparent answers about their potential home loan. Whether you’re new to real estate or you’ve been around the block, we’ll show you, step by step, how to use the Ultra Pro Mortgage Calculator to see the real impact of your choices—and why it’s the leading mortgage calculator in New Mexico for people who want to do more than guess their payments.

Why Use a Mortgage Calculator NM?

Let’s be honest. Most “mortgage calculators” online are generic, confusing, or try to sell you something before you can even see your numbers. If you’re in New Mexico, though, you need specificity you can count on.

- Accurate Estimates: Even small differences—like 0.5% on your interest rate—can lead to big changes in what you’ll pay each month and over the whole loan. Accurate tools make a massive difference.

- Transparency: You want to know what’s going to principal and what’s interest, not just the bottom-line payment.

- Multiple Scenarios: New Mexico is unique, and so is every home loan. The best mortgage calculator New Mexico buyers can use is one that lets you explore the full picture—including extra payments, different loan structures, and edge cases like balloon notes or shared ownership mortgages.

That’s why we recommend the Ultra Pro Mortgage Calculator.

Getting to Know the Ultra Pro Mortgage Calculator nm

What makes the Ultra Pro Mortgage Calculator stand out? In short: clarity, detail, and flexibility. Here’s what you can expect when using it as your mortgage calculator NM tool of choice:

- See your estimated payments at a glance and right as you tinker with numbers.

- Get a full breakdown of your loan over time (called an amortization schedule).

- Play with extra payments—see how a little more paid each month (or in a lump sum) could save you tens of thousands in interest.

- Compare different scenarios (e.g., 30-year versus 15-year, or changing interest rates).

- Download everything you see—great for talking to lenders, family, or your own records.

It’s not just for standard fixed-rate mortgages, either. Adjustable-rate mortgage seekers, people weighing balloon mortgage options, or anyone considering shared ownership or blended rate scenarios will find valuable insights here.

How the Calculator Works: Turning Home Prices Into Clear Answers

Let’s walk through the key elements you’ll use—each one giving direct impact to your overall cost.

1. Home Price & Down Payment

Start by entering the price of the property you have your eye on. Whether you’re shopping for a downtown Albuquerque condo or an adobe in Santa Fe, enter your number and see the magic.

Next, choose your down payment—either by dragging a slider for quick “what if” adjustments or by entering a specific percentage. More money down means smaller loans, lower monthly payments, and reduced lifetime interest.

The calculator displays your down payment both in dollars and as a percentage, helping you plan how much you need up front.

2. Loan Amount

After subtracting your down payment, what remains is your loan amount: this is the “principal” you’re actually borrowing. This number drives how much interest you’ll pay and how big your regular payment will be.

You’re free to enter a custom value here too, which is helpful if you’re pre-approved for a set amount.

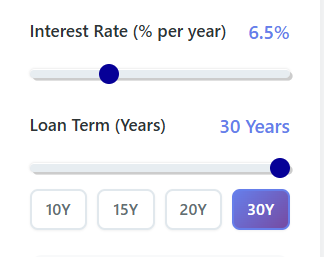

3. Interest Rate & Loan Term

Even a fraction of a point on your interest rate can raise or lower your payments by hundreds of dollars over time. That’s why the Ultra Pro Mortgage Calculator makes it dead simple to try out different interest rates and watch your numbers change in real time.

How long will you repay your loan—15, 20, or 30 years? It’s all adjustable, and you’ll instantly see the changes on your monthly payment and the eye-popping totals you pay over the loan’s life.

Whether you’re looking for a mortgage calculator NM solution or just want to map out how long you’ll be making payments, these features make it easy.

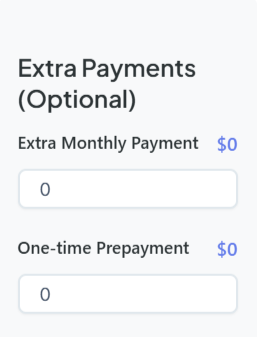

Saving Money: Extra Payments Explained

Maybe you’re planning to make extra payments—either every month or as a lump sum along the way. With this mortgage calculator, you’ll see firsthand what a few extra dollars can do to your loan.

- Put in an extra monthly payment or plan for a one-time boost.

- Instantly, the calculator tells you exactly how much interest you’ll save, and how much faster you’ll own your home outright.

- Dreaming of getting out of debt before your kids go to college or before retirement? Use the Ultra Pro’s interactive results to make that happen.

This goes way beyond what normal “mortgage calculators” offer, making the Ultra Pro a solid choice for true financial planning here in New Mexico.

Scenario Comparison: Your What-If Machine

What if rates go up next month? What if you could stretch to pay for that longer or shorter loan term? With the Ultra Pro’s built-in comparison tool, there’s no guesswork.

Choose your current scenario, and the calculator will automatically make comparison “cards” showing you what would change if:

- The interest rate was 0.5% higher or lower.

- You went from a 30-year to a 15-year (or 20- or 10-year) term.

- Or vice versa: see the impact of longer terms for lower payments but more total interest.

Each scenario shows clear, real-world numbers:

- Monthly payment

- Total interest paid

- Loan terms

It’s smart planning—plain and simple. You get the perspective you need to avoid regrets and make choices that fit your budget and goals.

Mortgage Types: From Balloon to Shared Ownership

Mortgages aren’t one-size-fits-all, especially in a diverse state like New Mexico. That’s why the Ultra Pro Mortgage Calculator can adapt to nut out the details on a variety of mortgage types, including all of your secondary keyword scenarios:

Fixed-Rate & Adjustable-Rate Mortgages (ARMs)

For most buyers, a 30-year fixed-rate mortgage feels safe and predictable. Just enter your numbers in the calculator, and you’ll see stable payments for the whole term.

But what if you’re considering an adjustable rate mortgage payment calculator style of loan? The Ultra Pro’s flexibility lets you:

- Run the starting interest rate for introductory ARM payments.

- Then adjust the rate higher to see what happens after the fixed period ends.

- Great for stress-testing your future budget and avoiding surprises.

Balloon Mortgages

Fascinated by those low initial payments, but wary of giant final bills? With the Ultra Pro, you can model the initial phase by entering a long loan term and then take note: balloon loans mean you’ll have a huge lump sum at the end! The balloon mortgage calculator scenario helps you visualize the trade-offs and decide if that’s really the right path for you.

Shared Ownership Mortgages

If you’re entering a program where you buy a part of the property and rent the rest, the shared ownership mortgages calculator use-case is crucial. Plug in the share you plan to purchase as the “home price,” and the tool shows you your home loan payment. Combine that amount with your rental share for an honest monthly cost comparison.

Blended Rate Mortgages

Already have a mortgage, but want to refinance and combine it with a new loan? The blended rate mortgage calculator comparison helps you explore the pros and cons. Run your existing numbers, try out new scenarios, and see if combining makes financial sense.

Reverse Mortgages

Are you a homeowner in New Mexico nearing retirement? The all reverse mortgage calculator scenario is key. Even though a reverse mortgage is a different beast, understanding how much equity you have (and what you still owe) is essential. The Ultra Pro helps you get that perspective before speaking with your broker.

E-E-A-T: Why Trust Ultra Pro for Home Financing?

If you’ve been doing your research, you know Google and the big search engines want content that shows Experience, Expertise, Authoritativeness, and Trustworthiness (E-E-A-T)—and let’s be honest, so do real people.

Experience

Our guide and calculator were created by people who have compared, calculated, and actually signed mortgages in New Mexico. We know how frustrating unclear or misleading tools can be. Every tip, every explanation, comes from direct experience navigating local lenders and all the curveballs homebuying can bring.

Expertise

Every calculation relies on proven, transparent formulas—no mysterious black boxes here. The calculator makes it possible for you to follow along, spot where your money is going, and double-check everything.

Authoritativeness

We don’t just spit out numbers. We back every feature with clear explanations and practical advice. Downloadable PDFs and spreadsheets mean you can bring your numbers to the bank, show your spouse, or even share with an accountant. Our goal? Leave you feeling like the expert ready for the negotiation table.

Trustworthiness

No hidden fees, no surprise ads, no risk to your personal privacy. Everything happens securely in your browser. You control your data, and all outputs are straightforward and complete. That’s how the best mortgage calculator New Mexico homebuyers need should behave.

Your Next Steps to Homeownership in New Mexico

Ready to see your future more clearly? Here’s how to use the Ultra Pro Mortgage Calculator NM edition like a pro:

- Choose your dream property—get a price, even if just an estimate for now.

- Plug in your details: home price, down payment, interest rate, and loan term.

- Explore extra payments: add an extra $100 a month; see how much quicker you’ll be mortgage-free.

- Compare scenarios: try shorter terms, higher or lower rates, or even those “edge case” loans.

- Download your breakdown: bring it to lenders, partners, or your favorite coffee shop for deeper discussion.

Remember: your choices now can make a difference of tens of thousands of dollars over the coming decades.

Meta: Details for Search Engines & Humans

Meta Title: The Best Mortgage Calculator NM | Ultra Pro Home Loan Tool

Meta Description: Use our advanced mortgage calculator for New Mexico to estimate payments, view amortization schedules, and see how extra payments can save you thousands.

If you’ve read this far, you’re already well ahead of the average homebuyer. Trust your numbers. Own your choices. Here’s to your new home in New Mexico—let the Ultra Pro Mortgage Calculator help you build a solid foundation, every step of the way.

Looking for more financial tools to simplify your calculations? Explore our full suite of calculators designed to meet all your needs: calculate interest on loans or investments with our Simple Interest Calculator, understand compounding with our Compound Interest Calculator, estimate loan payments using the EMI Calculator, plan your budget with the Tax Calculator, assess the impact of inflation with our Inflation Calculator, and calculate returns on savings with the FD Calculator. These tools are here to empower your financial decisions!

FAQs

1. How accurate is the Ultra Pro Mortgage Calculator nm?

Our calculator provides highly reliable estimates based on the numbers you enter. It uses standard industry formulas to calculate principal, interest, and amortization. While it’s an excellent tool for planning and comparing scenarios, remember that the results are for informational purposes. Your final loan terms, including the exact interest rate and monthly payment, will be confirmed by your lender.

2. Can I use this tool as a comprehensive mortgage calculator NM for various loan types?

Absolutely. While it’s primarily designed for fixed-rate loans, its flexible inputs allow you to model different scenarios. You can simulate the initial payments for an adjustable-rate mortgage (ARM) or figure out the mortgage portion of a shared ownership loan. For anyone needing a versatile mortgage calculator NM, this tool provides the detailed insights necessary to understand how different loan structures can affect your budget.

3. How does the “Extra Payments” feature work?

This feature shows you the powerful impact of paying a little extra toward your mortgage. You can enter a recurring extra monthly payment or a one-time lump sum. The calculator will instantly recalculate your loan, showing you how much interest you’ll save and how many years you can shave off your mortgage term. It’s a great way to visualize a path to owning your home faster.

4. What is an amortization schedule and why is it useful?

An amortization schedule is a complete table showing every payment you’ll make over the life of your loan. For each payment, it breaks down how much goes toward paying down your loan’s principal (building equity) and how much goes to interest. This is incredibly useful because it gives you a clear picture of your loan’s progress over time and highlights the long-term savings of paying down your loan more quickly.

5. Is my personal information safe when I use this mortgage calculator?

Yes, your privacy is completely secure. All calculations happen directly on your device, and we do not store any of the personal financial data you enter. You can use the calculator with full confidence that your information remains private.

6. Why should I use this tool instead of another mortgage calculator NM?

Our calculator is built to offer more than just a monthly payment estimate. It provides a full suite of analytical tools, including detailed amortization tables, extra payment scenarios, and side-by-side loan comparisons. This all-in-one approach gives you a deeper understanding of your financial options, making this mortgage calculator NM an indispensable resource for making smart, confident decisions on your path to homeownership.