Budget Planning

Enter your income and expensesIncome Sources

Fixed Monthly Expenses

Variable Expenses

Additional Budget Items

| # | Item Name | Category | Amount | Action |

|---|

Monthly Budget Calculator: Your Blueprint for Financial Freedom

Money. It’s one of the few things in life that touches almost every aspect of our existence, yet it remains a source of significant stress for millions. We earn it, we spend it, and often, we wonder where it all went at the end of the month. This cycle of “earning and burning” is the primary barrier standing between you and your financial goals. Whether you want to buy a dream home, travel the world, or simply sleep better at night knowing you have an emergency fund, the solution starts with a single, powerful habit: budgeting.

But let’s be honest—traditional budgeting can feel like a chore. Spreadsheets can be intimidating, and pen-and-paper methods are easy to lose or ignore. That is exactly why a digital monthly budget calculator is a game-changer. It transforms the abstract concept of “managing money” into a clear, visual, and actionable plan.

In this comprehensive guide, we will explore the psychology of money management, break down the essential components of a healthy financial life, and provide a detailed walkthrough of our advanced monthly budget calculator. This tool isn’t just a calculator; it’s a mirror that reflects your financial reality, empowering you to make changes that last.

The Psychology of Spending: Why We Need a Monthly Budget Calculator

Why is it so hard to save money? It’s rarely a math problem; it’s almost always a behavioral one. We are wired for instant gratification. When we see a shiny new gadget or smell fresh coffee at a cafe, our brains release dopamine, urging us to spend now and worry later.

A monthly budget calculator acts as a “pre-frontal cortex” for your wallet. It forces you to slow down and engage the logical part of your brain. By inputting your numbers, you move from emotional spending to intentional living. You aren’t restricting yourself; you are giving your money permission to go where it matters most.

The Visibility Gap

Most financial anxiety stems from the unknown. If you don’t know exactly how much you spend on dining out versus groceries, your brain fills that gap with worry. Using a monthly budget calculator closes the visibility gap. It lays everything out in black and white (or red and green). When you see that you spend 15% of your income on subscription services you rarely use, the decision to cancel them becomes obvious rather than painful.

How to Use Our Monthly Budget Calculator: A Step-by-Step Guide

Our tool is designed to be intuitive, flexible, and comprehensive. It handles the math so you can focus on the strategy. Below is a detailed guide on how to navigate each section of the monthly budget calculator to maximize its effectiveness.

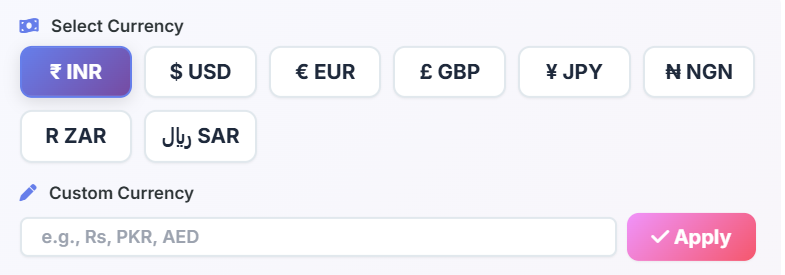

1. Setting the Stage: Budget Name and Currency

Financial planning is personal. The first thing you will notice at the top of the tool is a dedicated section to name your budget.

- Budget Name: Don’t just call it “Budget.” Give it a name that motivates you, like “March 2025 Freedom Plan” or “Operation Debt-Free.” This psychological trick helps you take ownership of the numbers.

- Currency Selection: Whether you earn in Dollars, Rupees, Euros, or Yen, the tool adapts to you. You can select from the pre-set currency buttons for instant formatting. If your currency isn’t listed, use the “Custom Currency” input field to type your own symbol (e.g., “AED” or “Rm”) and click “Apply.” The entire monthly budget calculator will update to reflect your local economy.

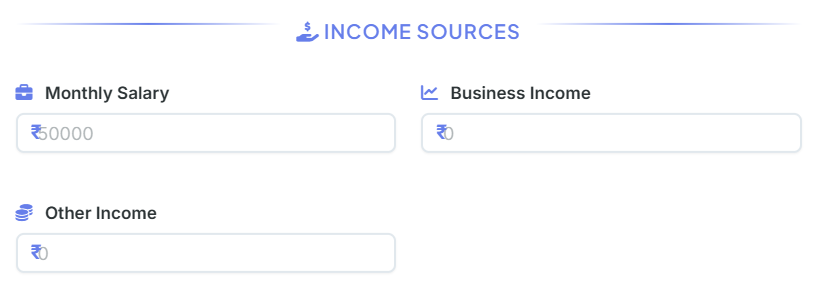

2. Income: Understanding Your Inflow

The foundation of any budget is knowing exactly what is coming in. It is dangerous to budget based on what you think you earn versus what actually hits your bank account.

- Monthly Salary: Enter your net income here—this is your take-home pay after taxes and deductions. Do not use your gross salary, or you will over-budget.

- Business Income: If you are a freelancer, entrepreneur, or have a side hustle, input your average monthly profit here. If your income fluctuates, it is safer to use a conservative estimate (e.g., the lowest amount you earned in the last 6 months).

- Other Income: This catches everything else: dividends, rental income, child support, or monetary gifts.

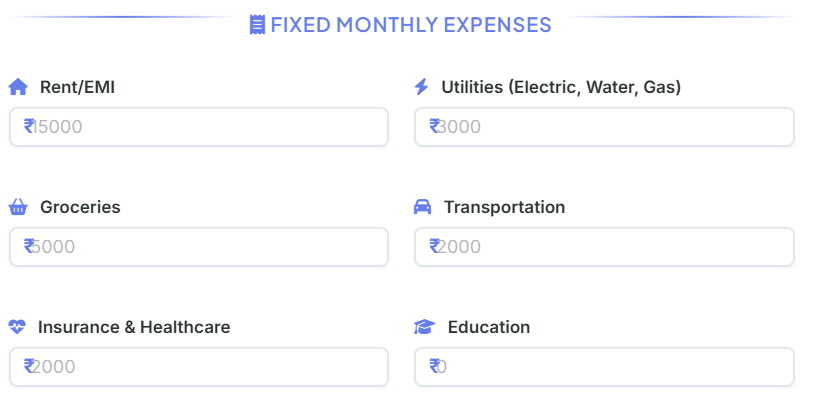

3. Fixed Expenses: The Non-Negotiables

These are the bills you must pay to keep your life running. They typically stay the same month-to-month and should be the first thing deducted from your income in the monthly budget calculator.

- Rent/EMI: Usually your largest expense. Include your monthly rent or mortgage payment.

- Utilities: Combine your electricity, water, gas, and waste management bills here. If these vary by season, use an average of the last 12 months.

- Groceries: This is for essential food items and household supplies. Do not include dining out here; that belongs in variable expenses.

- Transportation: Include car payments, fuel, public transit passes, or ride-share costs related to commuting.

- Insurance & Healthcare: Life insurance, health insurance premiums, and regular prescription costs go here.

- Education: Tuition fees, school supplies, or professional development courses.

4. Variable Expenses: The Lifestyle Costs

This is where budgets usually live or die. Variable expenses are discretionary—they are the “wants” rather than the “needs.”

- Dining Out & Entertainment: Movies, concerts, Friday night dinners, and even your morning latte run fall into this category. Be honest here; underestimating this section is the most common budgeting mistake.

- Shopping & Personal Care: Clothes, haircuts, cosmetics, and gadgets.

- Phone & Internet: Your mobile plan, home Wi-Fi, and streaming subscriptions.

- Miscellaneous: The “catch-all” for unexpected small costs, like a birthday gift or a parking ticket.

5. Customization: Tailoring the Tool to You

No two lives are the same, and a rigid template often fails. Our monthly budget calculator includes a powerful “Additional Budget Items” section.

- Add Custom Item: Click this button to dynamically add a new row to your budget.

- Categorization: You can label the item (e.g., “Dog Food,” “Gym Membership,” “Charity”) and specify whether it is an Income or an Expense.

- Flexibility: This feature allows you to use the calculator for complex scenarios, like managing a small event budget or tracking specific debt repayments.

6. The Results Dashboard: Analyzing Your Financial Health

Once you click “Calculate Budget,” the tool processes your data instantly. The results section is designed to give you a high-level overview and a granular breakdown simultaneously.

- Summary Cards: You will see four key metrics:

- Total Income: Your entire financial inflow.

- Total Expenses: The sum of fixed, variable, and custom costs.

- Net Savings: The “Moment of Truth.” This is Income minus Expenses. A positive number means you are building wealth; a negative number means you are living beyond your means.

- Savings Rate: This percentage shows how efficient you are. Financial experts often recommend aiming for a 20% savings rate.

- Visual Breakdown: A dynamic list generates bars for every expense category. This visual aid quickly highlights problem areas. If the “Dining Out” bar is longer than your “Rent” bar, you know exactly where to cut back.

7. Taking Action: Exporting Your Plan

A budget is only useful if you stick to it. The monthly budget calculator offers three ways to take your plan offline:

- Print Budget: Get a hard copy to stick on your fridge or bulletin board.

- Download PDF: Create a professional, clean digital document for your records.

- Download Excel: Get a spreadsheet version if you want to manipulate the data further or track changes over time.

Strategies to Improve Your Numbers

If you ran the numbers through the monthly budget calculator and didn’t like what you saw, don’t panic. A budget isn’t a grade; it’s a starting point. Here are three proven strategies to adjust your inputs and turn a negative budget into a positive one.

1. The 50/30/20 Rule

This is the gold standard for balanced budgeting.

- 50% Needs: Limit your fixed expenses (Rent, Utilities, Groceries) to half of your income. If your rent is 60% of your income, you are “house poor” and may need to consider downsizing or getting a roommate.

- 30% Wants: Limit discretionary spending (Dining, Shopping) to 30%. This allows you to enjoy life without sabotaging your future.

- 20% Savings: Dedicate the final 20% to debt repayment, emergency funds, and investments.

Use our calculator to tweak your numbers until they align roughly with these percentages.

2. The Zero-Based Budget

This strategy gives every single dollar a job. The goal is for your Income minus Expenses to equal exactly zero. This doesn’t mean you spend everything! It means if you have $500 left over, you assign it to “Savings” or “Debt Payment” as an expense line item.

Using the “Custom Item” feature in our monthly budget calculator, you can add a “Transfer to Savings” expense to ensure your net calculation hits zero, ensuring no money is left sitting idly in your checking account where it might get spent accidentally.

3. The “Gap” Method

Focus on widening the gap between your income and expenses. There are only two ways to do this: increase income or decrease expenses.

- Decreasing Expenses: Look at your “Variable Expenses” in the calculator results. Can you cook at home two more nights a week? Can you switch to a cheaper phone plan? Small cuts add up fast.

- Increasing Income: Use the “Income” section to simulate scenarios. What if you picked up a freelance gig earning $300 a month? Enter that in “Other Income” and hit calculate to see how drastically it improves your Savings Rate.

Common Budgeting Pitfalls (and How to Avoid Them)

Even with a sophisticated monthly budget calculator, human error can derail your plans. Watch out for these common traps.

The “Gross vs. Net” Trap

We touched on this, but it bears repeating. If you budget based on your $60,000 annual salary, you are budgeting money that the government has already taken in taxes. Always use your net, take-home pay in the calculator.

Forgetting Irregular Expenses

Christmas happens every December. Car insurance might be due every six months. If you don’t account for these, they will destroy your monthly budget when they arrive.

- Solution: Estimate your annual irregular costs, divide by 12, and add this as a “Miscellaneous” or custom expense in the monthly budget calculator. Treat it like a monthly bill you pay to yourself into a savings account.

Being Too Restrictive

If you currently spend $500 on dining out and you set your budget to $0, you will fail. You will feel deprived, rebel against your budget, and likely binge-spend.

- Solution: Be realistic. Cut the $500 down to $300 first. Success builds momentum. A budget should feel like a diet you can stick to for life, not a crash starvation plan.

The Role of Emergency Funds in Budgeting

One of the key insights you might gain from using a monthly budget calculator is the fragility of your finances. If your “Net Savings” is zero, one flat tire or medical bill could push you into debt.

Your first budgeting goal should be building a small emergency fund (typically $1,000). Once that is secure, aim for 3-6 months of essential expenses.

- Tool Tip: Look at the “Fixed Expenses” total in the calculator results. Multiply that number by 6. That is your “Full Emergency Fund” target. Seeing this specific number gives you a concrete goal to work toward.

Conclusion: Your Financial Future Starts Now

A budget is more than just a spreadsheet or a list of restrictions. It is a declaration of your values. It is you deciding that your long-term security and dreams are more important than temporary impulses.

By using this monthly budget calculator, you have taken the hardest step: facing the numbers. You now have a clear picture of your financial ecosystem. You know what flows in, what flows out, and exactly what remains. You have the power to adjust those variables. You can experiment with spending less on entertainment to save for a house, or working a side job to pay off debt faster.

Financial freedom is not a lucky break; it is a planned event. It requires consistency, honesty, and the right tools. Bookmark this page, return to it monthly to adjust your plan as your life changes, and watch as those small monthly savings compound into a life of stability and abundance. The path to wealth is boring, predictable, and mathematical—and it starts right here, with one calculation.