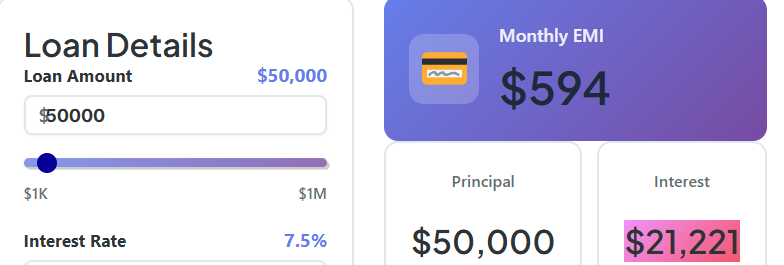

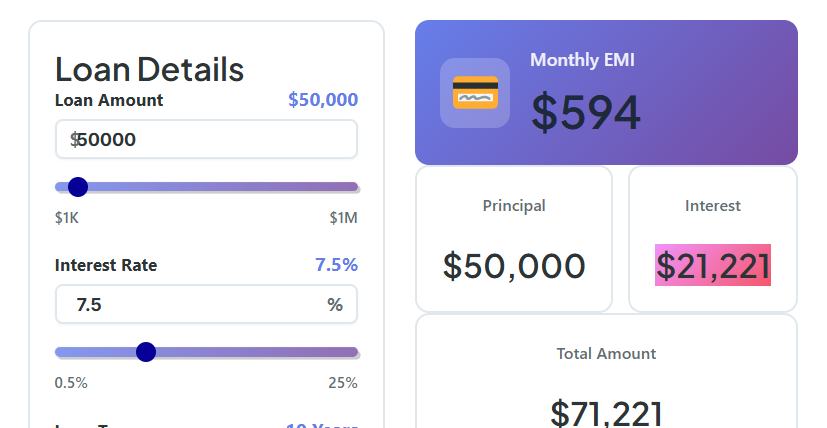

Loan Details

Monthly EMI

$593

Principal

$50,000

Interest

$21,139

Total Amount

$71,139

Breakdown

📋 Payment Schedule

| Month | Opening | EMI | Principal | Interest | Closing |

|---|---|---|---|---|---|

|

📊

Click Calculate to view schedule |

|||||

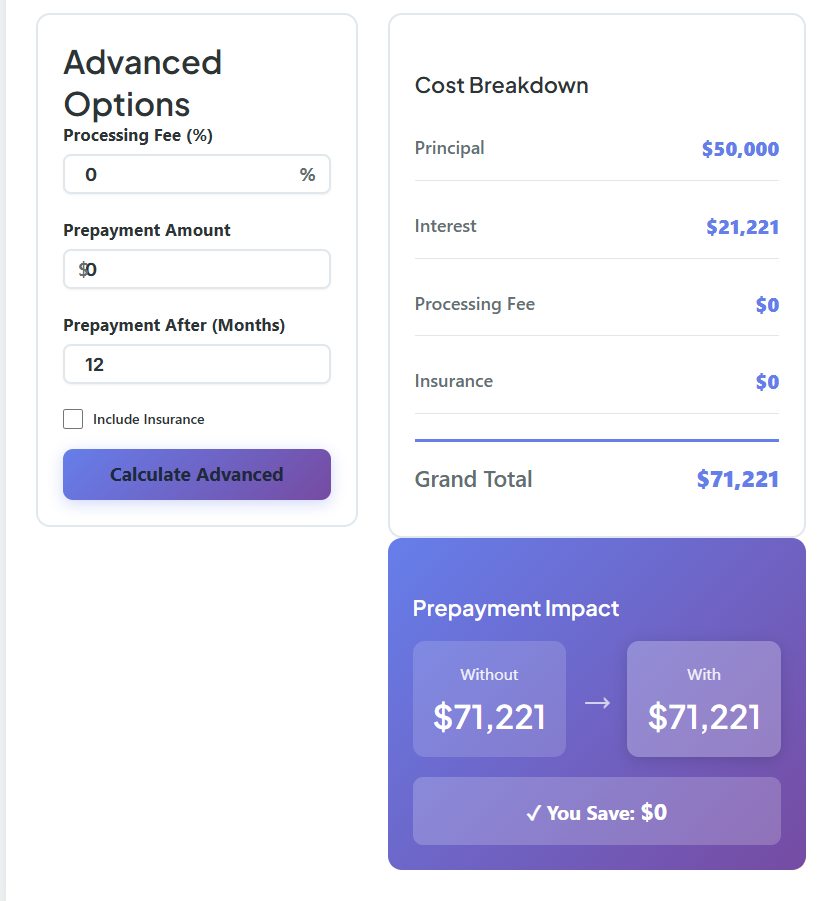

Advanced Options

Cost Breakdown

Prepayment Impact

Without

$0

With

$0

Loan A

Monthly EMI

$0

Total: $0Loan B

Monthly EMI

$0

Total: $0Loan C

Monthly EMI

$0

Total: $0Your Definitive Guide to the LIC Housing Loan EMI Calculator

The journey to owning a home is one of life’s most significant milestones. It is a path filled with excitement, aspiration, and often, a great deal of complexity. As you move closer to turning this dream into a reality, you will inevitably encounter the world of home finance. If you are considering a LIC Housing Loan, you are likely facing a barrage of financial terms: principal, interest rates, tenure, amortization. It can feel like learning a new language. This is precisely where our LIC Housing Loan EMI Calculator becomes your most valuable asset—a tool designed to bring clarity and confidence to your financial planning.

Think of this calculator not just as a piece of software, but as your personal financial navigator. Its primary goal is to cut through the confusion and empower you with knowledge. Instead of guessing or relying on estimates, you can see the precise Equated Monthly Installment (EMI) for your potential LIC Housing Loan. This comprehensive guide will explore every facet of the calculator, providing real-life examples and expert insights. By the end, you will be able to approach the loan process not as a hopeful applicant, but as an informed and strategic buyer.

Our LIC Housing Loan EMI Calculator allows you to simulate and compare different financial scenarios right from your screen. You can instantly see how a larger down payment might reduce your monthly burden, or how choosing a shorter loan term could save you a fortune in interest payments. The beauty of a LIC Housing Loan is that you have flexibility at every stage—from the initial application to repayment and even prepayment options later.

This guide will walk you through everything from basic calculations to advanced prepayment strategies, ensuring you have all the final details needed to make the best decision for your future with a LIC Housing Loan that’s tailored to your needs. Leveraging our calculator and this guide means your experience with LIC Housing Loan products will be smarter, more transparent, and more rewarding overall.

Deconstructing the LIC Housing Loan EMI Calculator

We built this calculator with a core principle in mind: simplicity empowers. You do not need to be a financial wizard to master this tool. The interface is clean, intuitive, and guides you through the essential components of any home loan. By entering a few key details about your prospective LIC Housing Loan, you allow the calculator to perform the complex mathematics in the background, presenting you with clear, actionable results.

LIC Housing Loan applicants will notice how the calculator’s design makes comparing loan options a breeze. Whether you’re new to the process or already have experience with LIC Housing Loan offerings, the steps are straightforward.

Let’s break down each input field. Understanding these components is the first step toward mastering your home loan planning.

Loan Amount (Principal)

This is the starting point of your calculation. The Loan Amount is the total sum of money you intend to borrow from LIC Housing Finance. It is calculated by taking the total price of the property and subtracting the down payment you plan to make from your own savings.

- Real-Life Example: Imagine you have found a property you love for $250,000. Through years of diligent saving, you have accumulated $50,000 for a down payment. The loan amount you would enter into the EMI calculator is $200,000. This figure is the foundation upon which your entire LIC Housing Loan structure is built. Smart planning at this stage ensures you do not overborrow and keeps your LIC Housing Loan manageable in the long run.

Interest Rate of LIC Housing Loan EMI Calculator

The interest rate is the percentage that the lender charges for the use of their money. For a LIC Housing Loan, this rate can be fixed (remaining the same throughout the loan) or floating (changing based on market conditions). Even a seemingly small difference in the interest rate can have a massive impact on the total cost of your loan over time.

- Real-Life Example: Let’s say you are offered a LIC Housing Loan at an 8.5% interest rate. Another lender offers a similar loan at 8.75%. On a $200,000 loan over 20 years, that 0.25% difference could save you over $6,000 in total interest payments. Our EMI calculator helps you quantify these differences instantly and helps you maximize the benefits of your LIC Housing Loan choices.

Loan Tenure of LIC Housing Loan EMI Calculator

The tenure is the duration over which you agree to repay the loan. It is typically expressed in years. A longer tenure will result in a lower monthly EMI, making payments more manageable. However, it also means you will pay significantly more in total interest. Conversely, a shorter tenure leads to a higher EMI but substantial long-term savings.

- Real-Life Example: For your $200,000 LIC Housing Loan, a 30-year tenure might result in an EMI of around $1,538. A 15-year tenure would increase the EMI to about $1,969. While the monthly payment is higher, the shorter tenure would save you nearly $200,000 in interest. The calculator allows you to find the sweet spot between affordability and long-term savings with your LIC Housing Loan.

Advanced Features: Processing Fee & Prepayment

Our calculator goes beyond the basics. The “Advanced” tab allows you to input the Processing Fee, a one-time charge for setting up your LIC Housing Loan. Factoring this in gives you the true cost of borrowing. The Prepayment field is a powerful feature for strategic planning. Here, you can simulate the effect of making extra payments toward your principal, showing you how to become debt-free faster and get the most out of your LIC Housing Loan.

Why This LIC Housing Loan EMI Calculator is Essential

LIC Housing Loan EMI Calculator! You might wonder why you need a calculator when the bank can provide the EMI figure. The answer is simple: control. Relying solely on a lender for information puts you in a passive role. This tool puts you in the driver’s seat of your financial future and makes you a confident LIC Housing Loan applicant.

Gaining an Instant Financial Reality Check

House hunting is an emotional journey. It is easy to get swept up and consider properties that are just outside your budget. Our EMI calculator serves as an impartial financial advisor, grounding your decisions in facts, not feelings. By inputting the numbers for a more expensive home, you can immediately see the tangible impact on your monthly budget, helping you avoid overextending yourself on a LIC Housing Loan.

A Foundation for Strategic, Long-Term Planning

A LIC Housing Loan is a commitment that spans decades. Knowing your exact EMI is the cornerstone of your entire household budget. It dictates how much you can allocate to other important goals, such as retirement savings, investments, or your children’s education. This home loan guide emphasizes that your EMI is not just a payment; it is a central piece of your long-term financial strategy—especially when your loan choice is a LIC Housing Loan. Planning your future around the stability of a LIC Housing Loan can unlock new possibilities.

The Power of Unbiased Offer Comparison

You should always shop around for a home loan. You might be comparing a LIC Housing Loan with offers from other banks or financial institutions. Each offer will have a different combination of interest rates, fees, and terms. Our calculator’s side-by-side comparison feature allows you to model each offer accurately, revealing which one is truly the most cost-effective over its entire lifespan. Getting the lowest rate on your LIC Housing Loan can mean big savings, and a clear comparison empowers you to negotiate better terms or choose the right lender.

Understanding Amortization: The Principal vs. Interest Split

In the initial years of a loan, a large portion of your EMI goes toward paying interest. It can be disheartening to see how slowly your principal balance decreases. The calculator’s amortization schedule provides a clear, year-by-year breakdown of this split. This visual representation often motivates borrowers to make prepayments, as they can see how extra funds directly attack the principal and accelerate their journey to full ownership of their property with their LIC Housing Loan.

A Beginner’s Step-by-Step Guide to Using the LIC Housing Loan EMI Calculator

If you are new to the world of home loans, the process can seem daunting. This simple, step-by-step workflow will help you use our EMI calculator to plan your LIC Housing Loan like a pro.

- Gather Your Core Data: Before you start, know your numbers. What is the property’s price? What is your down payment? Your Loan Amount is the property price minus your down payment. Every LIC Housing Loan starts here.

- Establish Your Baseline EMI: Start by setting the loan tenure to the maximum period (e.g., 30 years). This will show you the lowest possible monthly EMI. Assess if this amount fits comfortably within your budget for a LIC Housing Loan.

- Challenge the Timeline for Savings: Now, reduce the tenure in five-year increments. Watch how the EMI increases, but also note the dramatic drop in total interest paid. Can you afford the higher payment for a shorter term? This is where significant wealth is built, particularly when you’re optimizing a LIC Housing Loan.

- Stress-Test Your Budget: Most home loans have floating interest rates. To prepare for potential market changes, manually increase the interest rate in the calculator by 1-2%. If your budget can handle this higher payment, you have a solid financial plan for your LIC Housing Loan journey.

- Factor in All Costs: Use the advanced features to include the processing fee. This gives you a more accurate picture of the upfront costs associated with your LIC Housing Loan. Factoring in every rupee today will save you stress tomorrow.

- Analyze the Amortization Schedule: Take time to review the year-by-year breakdown. Understanding how your payments are allocated over time is crucial for long-term financial literacy and planning with your LIC Housing Loan.

A common pitfall for first-time buyers is choosing the longest tenure simply to get the lowest EMI. While this helps short-term cash flow, it is the most expensive way to finance a home. The goal should be to find the shortest possible tenure with an EMI that you can sustain without undue financial stress. A well-structured LIC Housing Loan enhances your financial security.

Real-World Scenarios: Putting the Calculator to Work

Let’s explore how different individuals can use the LIC Housing Loan EMI Calculator to make informed decisions. Real stories can provide fresh perspective and show how the right LIC Housing Loan strategy changes lives.

Scenario 1: The First-Time Homebuyer

Meet Maya, a 28-year-old graphic designer. She wants to buy her first apartment, priced at $180,000. She has saved $36,000 for a down payment, so she needs a LIC Housing Loan for $144,000.

- Calculation: At an 8.6% interest rate, a 30-year tenure results in an EMI of approximately $1,109. A 20-year tenure increases the EMI to $1,260.

- Insight: The EMI calculator shows that by paying an extra $151 per month, Maya can save over $75,000 in interest and own her home ten years sooner. She reviews her budget and realizes she can cut back on subscriptions and dining out to afford the shorter tenure. This proactive use of her LIC Housing Loan puts her on a fast track to financial freedom.

Scenario 2: The Growing Family

Consider the Patels, who are upgrading to a larger home to accommodate their two children. They need a new LIC Housing Loan of $350,000. Their priority is to be debt-free by the time their oldest child starts college in 15 years.

- Calculation: They input $350,000 as the loan amount, 8.4% as the interest rate, and 15 years as the tenure. The calculator shows a monthly EMI of $3,415.

- Insight: While the payment is high, it aligns with their financial goals. The calculator’s amortization schedule confirms they will have paid off the loan entirely in 15 years, freeing up significant cash flow for college tuition. This gives them the confidence to proceed with their plan. The right LIC Housing Loan lets them align their home ownership timelines to their family’s milestones.

Scenario 3: The Savvy Investor

Raj is a real estate investor looking to purchase a rental property using a LIC Housing Loan. He needs a loan of $150,000. His primary concern is cash flow—the rental income must cover the mortgage payment and other expenses.

- Calculation: He uses the EMI calculator to determine his monthly payment. He then adds estimated costs for property taxes, insurance, and maintenance.

- Insight: The tool helps him calculate his exact break-even point for rent. He knows he needs to charge at least a certain amount to make the investment profitable. This analysis is crucial for any real estate investment decision involving a LIC Housing Loan.

An often overlooked aspect is that with a LIC Housing Loan you gain the support and flexibility of a trusted institution with decades of experience in helping Indian families achieve their homeownership dreams. Personalized customer service, up-to-date market information, and the backing of LIC build trust for every borrower.

Advanced Strategies: Prepayment and Refinancing

The utility of the LIC Housing Loan EMI Calculator extends beyond initial planning. It is also an invaluable tool for managing your loan throughout its life. If you are already paying a LIC Housing Loan, you can still use the calculator to find areas for improvement, revisit your prepayment schedule, or start planning for refinancing.

Optimizing Your Prepayment Strategy

Making prepayments is the single most effective way to reduce your loan burden. Our calculator’s prepayment feature allows you to see the impact of different strategies. You can simulate making a recurring extra payment each month or applying an annual lump sum, like a bonus. The tool will show you exactly how many months or years you will shave off your tenure and the total interest you will save. Prepayment options are a hallmark of the flexibility offered by a LIC Housing Loan.

Analyzing Refinancing Opportunities

Over the life of your LIC Housing Loan, interest rates may fall. Refinancing—taking out a new loan to pay off the existing one—can be a smart move. Use the calculator to analyze a refinancing offer. Enter your outstanding principal as the new loan amount and the new, lower interest rate. Compare the new EMI and total interest payable against your current loan. If the savings outweigh the costs of refinancing (like new processing fees), it is a move worth considering, especially when upgrading from one LIC Housing Loan product to another or from another lender to LIC.

Planning to switch to a LIC Housing Loan for better rates? Use the calculator before applying to understand how much you’ll actually save by refinancing.

Final Details: Your Comprehensive FAQ

1. Is the EMI from the calculator a guaranteed amount?

No. The calculator provides a highly accurate estimate. The final EMI on your LIC Housing Loan agreement will be based on the lender’s terms at the time of disbursement.

2. Can I use this for loans other than a LIC Housing Loan?

Absolutely. The mathematical principles of EMI calculation are universal. You can use this EMI calculator to model and compare a home loan from any financial institution, but the most customized experience comes with a LIC Housing Loan.

3. What if my interest rate changes?

If you have a floating-rate LIC Housing Loan, your EMI may change if market rates fluctuate. It is wise to use the calculator to “stress-test” your budget against potential rate increases. Also, the LIC Housing Loan team can guide you through market changes and your available options.

4. How does prepayment really work?

Any amount paid over your scheduled EMI goes 100% toward reducing your principal balance. This means less interest accrues in the following month, and more of your future payments go toward equity. It is a powerful wealth-building strategy—an intelligent use of your LIC Housing Loan.

5. Can you transfer your loan to LIC?

Yes, many borrowers transfer existing loans to a LIC Housing Loan to get better interest rates or improved conditions. The calculator can help show your new monthly outflow and savings after transfer.

6. Does a LIC Housing Loan enhance credit score?

Paying your LIC Housing Loan EMIs on time helps build a positive credit profile, which will help you secure future loans whether personal, auto, or business-related.

Conclusion: Take Control of Your Home Buying Journey

LIC Housing Loan EMI Calculator! The path to homeownership is one of the most rewarding you will ever take. While it involves significant financial planning, it does not have to be intimidating. The LIC Housing Loan EMI Calculator is more than just a tool; it is a resource designed to empower you with knowledge, clarity, and control. By understanding the final details of your loan structure, from the monthly payment to the long-term interest costs, you can make decisions that align with your financial goals. Your LIC Housing Loan becomes not just a necessity, but an asset in your wealth-building journey.

Use this home loan guide and calculator to explore all your options. Test different scenarios, compare offers, and build a strategic plan. A LIC Housing Loan is a long-term partnership, and the choices you make today will shape your financial future for years to come. With careful planning and the right tools, you can move forward with confidence, ready to unlock the door to your new home. Every smart homeowner knows the value of a trustworthy LIC Housing Loan.

Explore More Tools and Guides

- Rent vs Buy Calculator: Analyze which option is financially better for you.

- Budget Calculator: See how your EMI fits into your overall monthly expenses.

- Tax Calculator: Estimate your potential tax savings on home loan repayments.

- SIP Calculator: Compare prepaying your loan versus investing for potential returns.

Leverage these resources alongside your LIC Housing Loan EMI Calculator to make the most informed and confident decisions for your future. Whether you are planning, applying, or already repaying, a LIC Housing Loan gives you security and flexibility at every step.