📊 EMI Results

| Principal Amount | $0 |

| Total Interest | $0 |

| Total Amount Payable | $0 |

| Month | Opening Balance | EMI | Principal | Interest | Closing Balance |

|---|

Your Guide to the Agricultural Loan EMI Calculator

The monsoon had been generous this year. Rain fell steadily, nurturing the land of Ramesh’s small farm in rural Maharashtra. His cotton fields flourished, a rare blessing after seasons of uncertainty. Yet, as the harvest ripened, so did his expenses—hiring pickers, buying storage, arranging speedy transport. Money was tight as ever.

Ramesh often recalled his father’s lessons about the burdens of debt. “The land gives, but the market takes. And loan repayments can keep you awake at night.” His family’s history—one filled with the struggle to repay a seasonal crop loan—left Ramesh cautious about borrowing. This year, needing funds for post-harvest logistics, Ramesh hesitated. Then he found a digital solution he never expected: the agricultural loan emi calculator.

What was once complex—understanding interest, EMIs, and total repayment—now became simple and clear. This tool didn’t just give him numbers; it provided peace of mind and a strategy. This article offers a comprehensive professional overview of the agricultural loan emi calculator, combines insights from farmer experiences, and includes practical advice for using tools like the farm loan emi calculator, tractor loan emi calculator, and kisan loan emi calculator.

Why Smart Borrowing Matters for Farmers

To farm is to live with uncertainty. Sun, rain, pests, market fluctuations—every season tests your resolve. Amid it all, debt is sometimes unavoidable. Whether you’re buying seeds, upgrading tractors, or investing in dairy, financial support is often required. Efficient planning isn’t just helpful; it’s essential for sustainability.

Sunita’s journey highlights this clearly. After losing her husband, she became the sole manager of their small Punjab wheat farm. With only $70,000 available to borrow, Sunita needed direction. Banks offered different rates and repayment terms, and the sheer amount of paperwork was daunting. A bank officer introduced her to the kisan loan emi calculator, helping her see exact monthly payments, total interest, and final settlement using her loan amount, interest percentage, and tenure. Suddenly, her uncertainty turned to confidence thanks to this simple tool.

Understanding the Agricultural Loan EMI Calculator

The agricultural loan emi calculator is designed for clarity and user-friendliness. Available on banks’ digital portals and agricultural finance sites, this financial assistant shapes your repayment plans before you ever sign a loan document. Whether you’re looking at a general loan or something specialized (like a farm loan emi calculator for agribusiness expansion or a tractor loan emi calculator for machinery), it works the same way.

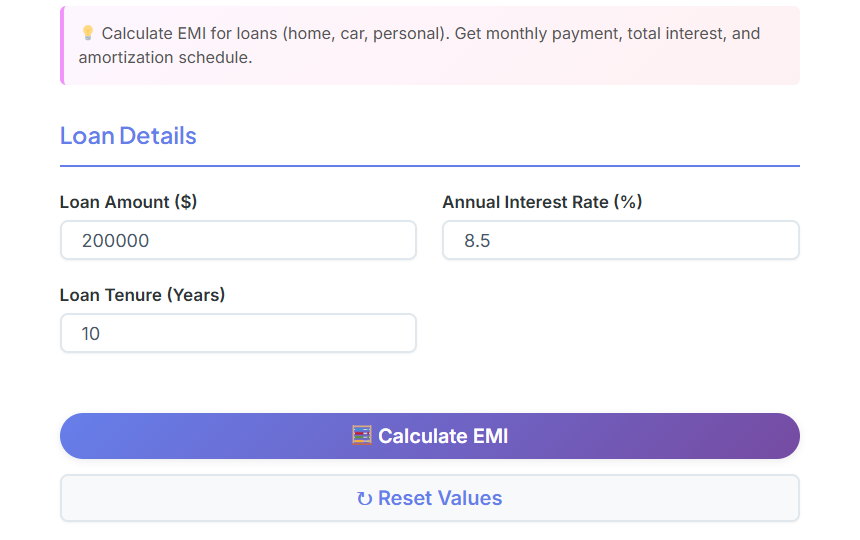

How the Interface Works

Professional in design but welcoming in appearance, the agricultural loan emi calculator typically features:

- Visual Layout: The calculator greets you with a clearly sectioned, attractive panel. Its warm color palette is both professional and inviting, easing the calculation process.

- Loan Amount ($) Field: Simply enter how much you plan to borrow. The label and placeholder text (“Enter Loan Amount”) help you avoid errors and move quickly to the next step.

- Interest Rate (% per annum) Field: Here, type the offered annual interest rate—say, 9%. Changing this figure updates all results in real time, allowing you to see how rate changes affect your budget.

- Loan Tenure Selector: Select repayment terms from a dropdown menu (e.g., 1–7 years). No need to calculate in months; the intuitive selector does it for you.

- Calculate Button: With all details in place, click the highlighted “Calculate” button. Instantly, the calculator works out your monthly EMI and more.

- EMI Result Box: The output appears in bold. This tells you the exact amount you’ll owe monthly.

- Total Interest and Total Payable: Below, you see comprehensive totals—how much interest you’ll pay and the grand sum you’ll repay.

These features ensure the agricultural loan emi calculator empowers users of all backgrounds, making loan planning accessible to everyone.

Farmer Stories: Bringing the Calculator to Life

Digital calculators are only as valuable as the change they inspire in real families and fields. Across India and beyond, these tools have made a tangible difference.

Govind’s Case: Making Tractor Dreams Real

In rural Uttar Pradesh, Govind, a young farmer, wanted to purchase his first tractor. Bullock rentals were expensive, slowing his operations. At a dealership, he was offered a $60,000 loan at an 11% rate. Uncertain, Govind turned to a tractor loan emi calculator.

With the handy fields—loan amount, interest, and tenure—he tried both 5-year and 7-year options. The calculator immediately revealed: $1,304 per month for five years, $1,022 for seven. This information let him balance loan duration against monthly budget realities. The outcome? Govind moved ahead, his confidence borne from knowledge, not guesswork.

Meena’s Dairy Expansions: The Power of the Farm Loan EMI Calculator

Meena and her husband ran a small Gujarat dairy. With the help of a subsidized NABARD loan, they aimed to add ten cows and improve their shed. Offered $40,000 at 7.5% interest for five years, Meena used a farm loan emi calculator. She learned her EMIs would be $801, and her total interest $8,084. This quick result, presented visually in the calculator, reassured her that dairy expansion was well within reach.

Karthik Overcomes Adversity: How the Agriculture Loan Interest Calculator Helps

Karthik, cultivating chilies in Andhra Pradesh, invested in drip irrigation with a well-planned loan. When pests hit, Karthik struggled to cover EMIs for three months—but he’d used an agriculture loan interest calculator at the outset. Armed with a clear record of loan terms and payment history, he approached his bank, securing a temporary moratorium. The right calculations, visible in professional output boxes and printouts, paved the way for flexibility and eventual repayment relief.

These stories show how the agricultural loan emi calculator helps with diverse loan types—from the tractor loan emi calculator for machinery to tools tailored for seasonal or dairy credit needs.

Comparing Lenders, Boosting Financial Control

With so many financial institutions and offers, how can you tell which deal is truly better? The agricultural loan emi calculator becomes indispensable in side-by-side lender comparisons.

Let’s say you seek $20,000:

- Bank A: 9% for four years

- Bank B: 8.5% for five years

By entering both offers into your calculator, you quickly notice—Bank A’s plan brings a higher EMI ($497) but a lower total interest payment. Bank B seems easier monthly ($410) but costs you more overall. The clear outputs empower you to choose based on your individual needs, not a lender’s sales pitch.

Regularly, sophisticated farmers now use the agricultural loan emi calculator and its family of tools to run these comparisons before visiting any office.

Building Habits: Using Calculators for Any Farming Need

For the modern farmer, the agricultural loan emi calculator forms the core of a digital budgeting toolkit. It’s not just for new loans—it’s equally invaluable for reviewing current obligations or planning future investments.

- Using the farm loan emi calculator before upgrading irrigation.

- Checking the tractor loan emi calculator when weighing machinery purchases.

- Exploring the kisan loan emi calculator with every new cropping season.

- Calculating the impact of changing rates or prepayments with the agriculture loan interest calculator.

Many supplement their calculations with specialized finance tools such as a Compound Interest Calculator, FD Calculator, Inflation Calculator, EMI Calculator, Tax Calculator, and Simple Interest Calculator.

Combining these instruments ensures a thorough and professional analysis before every big decision.

Practical, Field-Tested Loan Management Tips

Adopting the agricultural loan emi calculator as a regular part of your planning process fosters discipline and enables smarter borrowing. Here’s how you can maximize your chances of financial success:

- Simulate Before Signing: Enter every possible rate and tenure scenario into your calculator before you agree to any terms.

- Borrow Conservatively: The total interest box gives you a full picture. Use this to justify taking only what you require—not more.

- Budget for EMI: Factor your EMI result box into harvest-time and off-season planning. Use the professional output to check against projected farm earnings.

- Maintain a Safety Net: Set extra income aside to cover several payments. Even the best harvest can face disruption.

- Ask About Fees: Apart from EMI, look for insurance, processing, or prepayment costs by comparing scenarios.

- Return Regularly: Digital calculators are dynamic—update your entries as seasons, products, or rates change.

Financial literacy brings freedom—knowledge enables you to challenge aggressive lenders, avoid hidden fees, and remain on track even when markets shift.

Stress Reduction and Smart Growth: The True Power of Calculators

Borrowing, even with the best rates and intentions, creates anxiety for any farmer. The unknown—fluctuating prices, weather risks, health emergencies—translates into financial pressure. But through the regular use of the agricultural loan emi calculator, that uncertainty diminishes.

Farmers have shared that seeing exact, professional results (monthly EMI, total interest, overall repayment) puts them in control. It transforms a loan from a mystery into a manageable responsibility. With transparent, predictable figures, it becomes easier to create realistic budgets, negotiate refinancing, and approach banks from a position of strength.

This is just as true when using the farm loan emi calculator for broad operations, a tractor loan emi calculator for equipment, a kisan loan emi calculator for rural banking, or an agriculture loan interest calculator for comparing offers. Each tool, designed with farmers in mind, delivers results in logical, professional displays that support informed choices.

Conclusion: Moving Toward Sustainable, Confident Farming

Farming is a vocation of resilience, adaptability, and hope. Knowledge is as valuable as any tool in the barn or machine in the shed. The agricultural loan emi calculator delivers that knowledge with clarity, professionalism, and accessibility.

Every farmer deserves to approach financing decisions equipped with precise information—whether determining the right EMI, forecasting interest costs, or planning loan tenures. With digital calculators—general or specific, like the tractor loan emi calculator, kisan loan emi calculator, farm loan emi calculator, and agriculture loan interest calculator—this becomes easy, fast, and trustworthy.

Let these calculators become your partners. Use them before every finance decision, consult them when the market turns, and let their outputs guide you toward a more stable, hopeful, and prosperous future. By making smart financial planning as routine as checking the weather or walking your fields, you invest in both your crops and your peace of mind.

The future of farming is grounded in tradition but guided by knowledge. With your calculator in hand, you can borrow, invest, and grow—confidently and sustainably.

1. What is an agricultural loan EMI calculator and how can it help me?

An agricultural loan EMI calculator is a free online tool that helps you calculate the Equated Monthly Installment (EMI) for a loan. It simplifies financial planning by showing you the exact monthly payment you will need to make, helping you understand if you can comfortably afford the loan before you apply. This reduces financial stress and empowers you to make smarter borrowing decisions for your farm.

2. What information do I need to use the calculator?

Using the calculator is simple. You only need three key pieces of information:

Loan Amount: The total amount of money you wish to borrow.

Interest Rate: The annual interest rate offered by your bank or lender.

Loan Tenure: The total time you have to repay the loan, usually in years.

Once you enter these details, the calculator instantly shows you your monthly EMI.

3. Can I use this tool to compare loan offers from different banks?

Yes, absolutely. This is one of the most powerful features of the calculator. You can enter the loan amount, interest rate, and tenure from different lenders to see how the EMI and total interest payable change with each offer. This allows you to easily compare options and choose the loan that best fits your financial situation.

4. Does the calculator show me the total interest I will pay?

Yes. In addition to your monthly EMI, the calculator also displays the total interest payable over the entire loan period. This is a crucial piece of information that helps you understand the true cost of borrowing, encouraging more responsible financial decisions.

5. Is the result from the EMI calculator final?

The calculator provides a very accurate estimate based on the numbers you provide. However, the final EMI amount from the bank might be slightly different due to other charges like processing fees or insurance. Always use the calculator as a planning tool and confirm the final figures with your lending institution before signing any loan agreement.