Enter Details

Payoff Time

Total Paid: $0

Principal Paid

$0

Total Interest Paid

$0

Amortization Schedule

| # | Payment | Principal | Interest | Balance |

|---|---|---|---|---|

| — | ||||

Online Free: My Guide to Clarity

There’s a certain weight that comes with credit card debt. It’s not just numbers on a statement; it’s a feeling that follows you around. I remember staring at my own statements, feeling a knot in my stomach. The balance seemed static, a stubborn mountain I was trying to climb with a teaspoon. The minimum payments felt like I was just treading water, not actually swimming toward the shore of being debt-free. It was frustrating and, honestly, a little hopeless.

That’s when my perspective started to shift. I realized that what I lacked wasn’t the desire to pay it off, but a clear map. I needed a tool that could turn my vague anxiety into a concrete plan. This is where I discovered the power of a good credit card interest calculator online free. It wasn’t just a widget; it was a beacon of clarity. Suddenly, the abstract numbers became a tangible path forward. This tool helped me see the end of the tunnel and, more importantly, showed me exactly how to get there.

Over the years, I’ve guided many friends and readers through this same journey. The most common feedback I get is how a simple online tool can feel so empowering. It’s about taking back control. So, I want to walk you through my experience using a top-tier credit card interest calculator online free, not as a math lesson, but as a journey from confusion to confidence. We’ll explore it section by section, just as you would, and see how each feature is designed to help you build a smarter financial future.

First Impressions: The Hero Section

The moment the page loads, you’re greeted with what designers call the “hero section.” But I think of it as the “calm down, you’ve got this” section. The best tools I’ve used don’t bombard you with ads or complicated jargon. Instead, they present a clean, welcoming interface.

The Title and Visuals

Typically, you’ll see a clear, bold title like “Credit Card Payoff Calculator.” It’s direct and reassuring. You know you’re in the right place. The visual tone is just as important. I’ve found the most effective designs use soft colors—blues, greens, maybe a friendly gray—that feel professional but not intimidating. There’s often a simple, intuitive icon, like a piggy bank, a calendar, or a graph trending upward. It’s a small detail, but it subconsciously communicates progress and positivity before you even type a single number. This initial feeling is crucial. It sets the stage for a productive session, not a stressful one.

A Feeling of Clarity

My first impression when I load a great credit card interest calculator online free is one of relief. The layout is uncluttered. The instructions are minimal because the design is so intuitive it doesn’t need them. Everything is exactly where you expect it to be. This immediate sense of order is powerful. It takes the chaotic mess of numbers from your credit card statement and places them into a structured, manageable framework. You instantly feel that this process is going to be simpler than you feared.

The Heart of the Tool: The Input Area

Right below the welcoming hero section is where the magic begins: the input area. This is where you translate your financial situation into the calculator’s language. A well-designed credit card interest calculator online free makes this step feel less like data entry and more like telling your story.

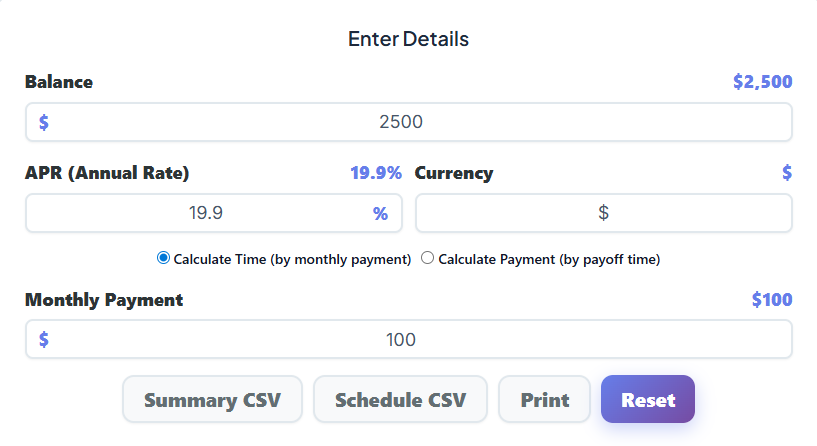

Balance and APR: Your Starting Point

The first two fields are almost always “Current Balance” and “Annual Percentage Rate (APR).” The balance field is straightforward—you just enter the total amount you owe. The APR field is where you input your interest rate. What I appreciate in a good tool is the subtle guidance. You might see a little question mark icon next to “APR.” Clicking it gives you a simple tip: “You can find this on your monthly credit card statement.” It’s a small touch that prevents you from getting stuck.

I remember helping a friend who was completely overwhelmed by her debt. She didn’t even know her APR. We pulled up her statement, found the number, and plugged it in. The act of simply inputting those two numbers was a huge first step for her. It was the first time she had actively engaged with her debt instead of just worrying about it.

Currency and Live Updates

Most modern calculators include a currency selector, which is a thoughtful feature for users around the world. But the most impressive part of this section is the live-updating labels. As you type your balance, you might see a label below the box that says something like “$5,000.00.” It formats the number cleanly, confirming you’ve entered it correctly. This instant feedback is incredibly satisfying. You’re not just typing into a void; the tool is listening and responding in real-time. This interactive element makes the entire experience feel more like a conversation.

Choosing Your Path: The Modes Section

This is where a truly useful credit card interest calculator online free distinguishes itself. Most offer two primary modes, and understanding them is key to creating a plan that works for you.

Mode 1: “Calculate Time by Payment”

This mode is my personal favorite for getting started. It answers the question: “If I can afford to pay a certain amount each month, how long will it take to be debt-free?” You enter your desired monthly payment, and the calculator tells you the payoff timeline.

This is for the budgeter. It’s for someone like my client, Mark, who had just started a new job. He had a fixed amount of money he could allocate to debt each month after his expenses. Using this mode, we plugged in his balance, his APR, and the $300 he could comfortably afford. The calculator instantly showed him it would take 2 years and 8 months to clear his debt. For the first time, he had a finish line. The date on the calendar became his goal, his motivation. This mode gives you a target to aim for based on your current reality.

Mode 2: “Calculate Payment by Time”

The second mode flips the question around. It asks: “If I want to be debt-free by a specific date, how much do I need to pay each month?” This is for the goal-setter.

I used this mode when I was planning to buy my first home. I needed to clear a lingering credit card balance within 18 months to improve my debt-to-income ratio for the mortgage application. I selected this mode, entered my 1-year and 6-month goal, and the calculator told me the exact monthly payment required. It was higher than my minimum payment, but seeing it laid out so clearly made it feel achievable. I adjusted my budget, cut back on a few subscriptions, and committed to that number. This mode turns your dream timeline into an actionable monthly payment. A solid credit card interest calculator online free must have this functionality.

The Interactive Experience: Dynamic Fields

The fields in the “Modes” section are dynamic, meaning they change based on which mode you’ve selected. This is where the tool really comes to life.

The Monthly Payment and Time Boxes

In “Calculate Time” mode, the “Monthly Payment” box is an input field where you type your payment amount. The “Years & Months” box becomes a result field, instantly updating as you type. If you enter $100, it might say “10 years, 2 months.” If you change it to $150, it might immediately update to “5 years, 1 month.” Watching that timeline shrink with every extra dollar you can afford is one of the most motivating experiences you can have.

Conversely, in “Calculate Payment” mode, the “Years & Months” box is where you enter your goal, and the “Monthly Payment” box displays the required amount. This seamless switch makes using the tool incredibly fluid. The design guides you without you even realizing it. The best credit card interest calculator online free I’ve found makes this transition flawless.

The “Uh-Oh” Moment: Error Messages

A great calculator also handles errors with grace. What if you enter a monthly payment that’s too low to cover the interest? Instead of a harsh red error code, a good tool will display a friendly, helpful message. I’ve seen some that say, “Your payment is too low to cover the interest. Your balance will continue to grow.” Some even add, “Try a payment of at least $X to start making progress.” This isn’t a scolding; it’s a gentle course correction. It’s a critical piece of feedback that educates you on how interest works, preventing you from making a plan that would actually put you further in debt.

Saving Your Plan: The Buttons Area

Once you’ve found a plan that works, you need to be able to save it. A good credit card interest calculator online free doesn’t just give you answers; it gives you tools to take those answers with you.

Exporting and Printing

You’ll typically see a few buttons: “Summary CSV,” “Schedule CSV,” “Print,” and “Reset.” The “Print” button is perfect for those who like to have a physical copy to stick on their fridge or bulletin board as a daily reminder. It usually formats the results into a clean, printer-friendly page.

The “CSV” buttons are for the spreadsheet enthusiasts. “Summary CSV” gives you a simple file with the key takeaways: your total interest, total payments, and payoff date. “Schedule CSV,” however, is the real powerhouse. It exports the entire amortization schedule (which we’ll get to next). This allows you to import your plan into Excel or Google Sheets, where you can track your progress, add your own notes, or integrate it into your larger monthly budget.

The All-Important “Reset” Button

Finally, there’s the “Reset” button. This simple feature is more important than it seems. It allows you to start over with a clean slate, encouraging experimentation. What if you paid $50 more? What if you found a balance transfer card with a lower APR? The reset button makes it easy to compare scenarios without having to manually clear each field. It turns the credit card interest calculator online free into a sandbox for financial planning.

The Big Picture: Result Summary Section

After you’ve entered your details, the results are displayed in a clear, impossible-to-misunderstand summary. This is the “aha!” moment.

The most important number—either your payoff time or your required monthly payment—is usually displayed in a huge font. There’s no ambiguity. You don’t have to search for it. It’s right there, commanding your attention. For someone who has been living with the vague stress of debt, seeing a result like “You will be debt-free in 3 years and 4 months” is a moment of profound relief and empowerment.

The goal is no longer a fuzzy concept; it’s a specific point in time. I’ve seen people tear up at this moment. It’s the light at the end of the debt tunnel, finally visible. The best credit card interest calculator online free will make this section the focal point of the results.

Breaking It Down: The KPI Cards

Below the main result, you’ll usually find a set of three or four “Key Performance Indicator” (KPI) cards. These are small boxes that break down the total cost of your debt. They typically include:

- Total Principal: This is the initial amount of debt you entered.

- Total Interest: This is the “cost” of your debt—the total amount you’ll pay in interest over the life of the loan.

- Total Paid: This is the sum of the principal and the interest.

Seeing the “Total Interest” card is often a shocking but necessary wake-up call. I once worked with a young man who had a $7,000 balance. He was only making minimum payments. When the calculator showed he would end up paying over $8,000 in interest alone, his jaw dropped. He had no idea the cost was so high. This revelation motivated him to double his monthly payments. These cards transform the abstract concept of interest into a hard dollar amount, providing powerful motivation to pay off your debt faster. Using a credit card interest calculator online free for this insight alone is worth it.

The Month-by-Month Blueprint: Amortization Schedule Table

This, for me, is the most valuable part of any credit card interest calculator online free. The amortization schedule is a detailed, month-by-month table that shows you exactly how your payments are working.

How It Looks and Feels

Each row in the table represents one month. The columns typically show the beginning balance, the payment you make, how much of that payment goes toward interest, how much goes toward the principal, and the ending balance.

The experience of scrolling through this table is transformative. In the beginning, you’ll notice that a significant chunk of your payment is eaten up by interest. It can feel disheartening. But as you scroll down through the months and years, you see a beautiful shift. The amount going to interest decreases each month, while the amount going to your principal increases. Your payment starts chipping away at the debt more and more effectively.

Watching the Balance Drop

The most powerful column is the “Ending Balance.” Watching that number go down, row by row, until it finally hits zero is incredibly rewarding. It’s a visual representation of your progress. I often advise people to print this schedule and cross off each month as they make a payment. It turns debt repayment into a game you can win. You are no longer just sending money into a black hole; you are executing a clear, predictable plan. This table proves that your efforts are making a difference. A quality credit card interest calculator online free provides this detailed breakdown.

This detailed schedule is the ultimate planning tool. It helps you see how even a small extra payment one month can accelerate your journey. It shows you the tangible benefit of your discipline. It’s not just about getting out of debt; it’s about understanding the mechanics of your own financial freedom. This is why a good credit card interest calculator online free is so much more than a math tool.

In conclusion, that feeling of being stuck under the weight of credit card debt is something many of us know all too well. It’s a cycle of stress and uncertainty that can feel impossible to break. But clarity is the first step toward control. A well-designed credit card interest calculator online free provides exactly that. It translates your anxiety into an actionable plan, showing you a clear path forward. It’s a digital mentor that helps you experiment with different strategies until you find one that fits your life.

From the calming first impression to the empowering finality of the amortization schedule, every element is designed to move you from a place of worry to a place of confidence. It’s a journey I’ve taken myself, and one I’ve been privileged to witness in others. So if you’re standing at the base of your own debt mountain, know that you don’t have to climb it with a teaspoon. Find a great credit card interest calculator online free, and let it be the map that guides you to the summit. Your journey to financial freedom is waiting for you to take that first, informed step.

I am confident that a reliable credit card interest calculator online free can be a game-changer. The search for a credit card interest calculator online free is your first step. Remember that a credit card interest calculator online free can provide immense value. Always opt for a comprehensive credit card interest calculator online free. This credit card interest calculator online free is an incredible asset. A user-friendly credit card interest calculator online free makes all the difference. Finding the right credit card interest calculator online free is essential.

FAQs

What is a credit card interest calculator online free, and how does it help?

A credit card interest calculator online free is a tool that helps you understand and plan your credit card debt repayment. By entering details like your current balance, APR (Annual Percentage Rate), and desired monthly payment or payoff timeline, the calculator provides insights such as how long it will take to pay off your debt, how much interest you’ll pay, and what your monthly payments should be. It’s a simple, user-friendly way to take control of your finances and create a clear, actionable plan to become debt-free.

Can I trust the results from a credit card interest calculator online free?

Yes, you can trust the results from a reliable credit card interest calculator online free, as long as you input accurate information like your balance and APR. These tools are designed to provide clear, front-end calculations based on your data, helping you visualize your repayment plan. While they’re not a substitute for professional financial advice, they’re an excellent starting point for understanding your debt and exploring repayment strategies.

Let me know if you’d like to refine these or add more!