Master Your Returns: The Ultimate Money Market Interest Calculator Monthly Guide

Have you ever opened your banking app, spotted a line labeled “interest earned,” and wondered, "How did they arrive at that number?" You’re not alone. For many, interest feels like mysterious math, invisible to everyday planning—almost as if it’s conjured behind the scenes. In reality, your interest—especially when it comes to money market accounts—is deeply logical and rooted in persistence, habit, and attention to detail over time. Once you grasp the essentials, the numbers themselves empower you to make your money grow purposefully every single month.

When you understand how your savings accumulate, you’re empowered to plan, grow, and protect your financial future. That confidence is game-changing—no exaggeration. Clarity transforms every dollar or rupee you set aside, letting you anticipate, not just react, to your evolving needs.

This comprehensive guide will walk you step-by-step through how the money market interest calculator monthly works. Even more important, you’ll discover why it’s so essential for everyone: whether you’re a new saver, seasoned investor, parent strategizing for a big expense, student learning about finance, or someone exploring mineral rights. You’ll learn how to navigate this tool confidently, spot and avoid common mistakes, and see beyond the spreadsheets to the lifestyle options this knowledge grants you.

Demystifying the Value: Why This Calculator Really Matters

Before diving into calculations, pause and ask yourself: “What do I really need to know? Is it, ‘How much will I have at the end of next year?’ Or is it, ‘How do small investments add up over five years?’” Most people’s core question is, “How does my money quietly multiply in a savings account or investment?” For both beginners and seasoned savers, true control begins by breaking out of guesswork.

What makes the money market interest calculator monthly extra powerful is compounding. Compounding means your interest earns more interest. With monthly compounding, every month’s gains are swept in and start generating returns of their own. This effect snowballs in your favor—the more often interest adds to your account, the more you benefit.

Knowing how your balance expands, and precisely why, is empowering. It helps you set real goals and track your progress with precision. A calculator that actually reflects monthly compounding gives you a clearer, more accurate snapshot than those that assume annual or semi-annual schedules.

Thinking about the real value of your future savings means you also need to consider inflation. After all, a bigger number in your account doesn’t guarantee bigger spending power down the road. To get the full picture, try pairing your interest projections with an Inflation Calculator just once during your planning. It’s eye-opening to see how rising prices can affect your future comfort.

How To Use the Calculator: A Step-by-Step Guide That’s Really for You

Worried you’ll get lost in the numbers? Don’t be. The money market interest calculator monthly is designed to be simple, intuitive, and “real human” friendly, whether you’re an old hand at finance or a complete beginner.

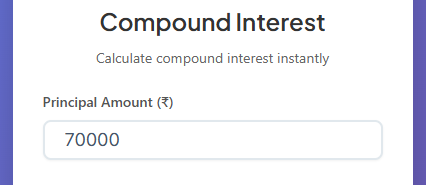

Start by entering your Principal Amount. This is your starting pot—what you’re actually depositing, after any fees. Some people mistakenly enter what they expect to save, not what lands in the account. The best habit? Double-check your receipt or transfer confirmation before typing it in.

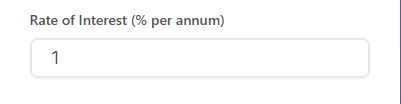

Next, input the Rate of Interest. This is the yearly rate your bank or institution advertises. For monthly compounding, the calculator will do the adjustment behind the scenes. Your job is just to copy the annual rate exactly as shown, not a monthly breakdown.

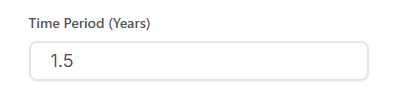

Define your Time Period, and be honest: how long will you really leave the money untouched? An overestimation gives you false optimism—if you might need to spend it after eight months, don’t project for two years.

Select Compounding Frequency. This is where the money market interest calculator monthly stands out as a practical tool. By choosing “Monthly,” you’re seeing how your balance can grow with real-world precision, reflecting how modern accounts are structured.

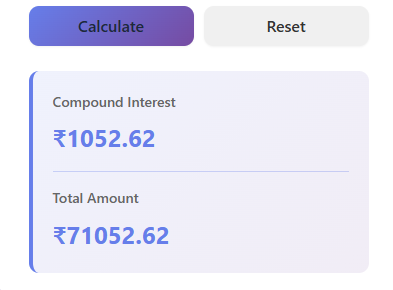

Lastly, tap or click "Calculate." Instantly, you’ll see two things: your total interest earned over the interval, and the final (projected) account balance. It’s as transparent as checking the weather—and just as actionable.

Want to experiment? Adjust the time or rate, or try different banks’ rates and compounding frequencies. The calculator is a playground for curiosity, not just a static tool.

What Each Input Means—And Why It Matters in Practice

Taking the time to really understand what each calculator field means pays off in smarter decisions.

Principal Amount: Consider this your foundation. A common mistake? Entering the planned savings but forgetting about account opening deductions or transaction fees. The savvy user always checks what is actually deposited.

Interest Rate: Nearly every bank presents an annual rate, but only some compound monthly. Always use the annual (not monthly) rate for this calculator unless you’re 100% sure you’re meant to do otherwise. If you want a true after-tax perspective, run your numbers through a Tax Calculator alongside your savings estimate to see your real take-home growth—but only once per journey, as internal links should never be repeated for clarity and authenticity.

Time Period: This number matters more than most people realize. The longer your money sits, the stronger the effect of compounding. Don’t overestimate! Use the period for which you’re genuinely committing your funds.

Compounding Frequency: Here lies your ace in the hole. Imagine two accounts, each paying 5% annually, but one compounds once a year and another every month. Over several years, the monthly product will nearly always win. If you’ve never tried changing this setting, you may be shocked by just how much difference it makes in your future balance.

Don’t forget: always check your account statement for the true compounding schedule. Assuming everyone compounds monthly can lead to big errors, especially with legacy accounts or older institutions.

Real-Life Uses: The Calculator’s Value Beyond Savings

The beauty of a money market interest calculator monthly is its versatile applicability. In reality, it’s a Swiss Army knife for personal finance.

Let’s say you’re pondering, how do you calculate interest on a car? Maybe you’re ready to buy, or just trying to understand monthly costs. By entering the loan amount as your principal, the annual percentage rate, and the duration of the loan, you can see—in a single projection—how much you’ll repay above your starting loan. While standard car loan calculators break down monthly payments, this approach shows you the cost of borrowing at a quick glance.

Perhaps you’ve come across the term mineral interest calculator while managing land or considering an inheritance. Plugging your lump sum payout into the calculator—along with your projected average return and the time you’ll keep the money invested—lets you instantly estimate how that royalty grows over time.

Students and teachers, too, rely on these tools as practical alternatives to the calculating simple interest worksheet. Set compounding to “Annually,” and you’ve essentially created a customizable, digital worksheet for classroom or homework assignments. This approach brings abstract math lessons firmly into the realm of real-world finance.

For those facing big life events—weddings, emergencies, dream purchases—a calculator that provides step-by-step simple interest calculation examples can help clarify the effects of time and amount on savings, making it far easier to set goals and build achievable plans.

Professional Tips: Scenario-Planning Like a Consultant

When professionals advise clients on using a money market interest calculator monthly, the focus isn’t just on a single projection. The true power is in scenario planning.

For instance, smart savers try at least three different versions of every projection: one conservative estimate (a lower rate or shorter time than expected), one moderate (using prevailing rates and timelines), and one aggressive (best possible case, like a higher rate or longer commitment). By comparing these, you get insight into both your floor and ceiling, so no surprise throws you off track.

Another worthwhile tip is “frequency arbitrage.” Even if one bank offers a slightly lower nominal rate, if it compounds more frequently, it may actually outpace the “higher” offer from a competitor and net you more in the end. This is something a calculator like this reveals in seconds, not hours.

And, importantly, never underestimate the power of liquidity. Sometimes, a fixed deposit boasts a higher rate, but you can’t access your funds for years. Comparing your forecasted returns from the money market interest calculator monthly to those from a term product—using a FD Calculator—can show you whether the extra flexibility is worth the (potential) loss in interest.

Practical Scenarios: Putting the Calculator Into Real-World Use

1. The Family Emergency Planner:

Sarah has ₹500,000 in savings. She’s seeking maximum safety and wants to grow her funds at an advertised 4.5% annual rate. She uses the money market interest calculator monthly, chooses a five-year time period, and selects monthly compounding. The results surprise her—she can see exactly how much her careful planning will add up, way beyond what basic arithmetic would suggest.

2. The Curious Student:

Rahul, tackling a math assignment on different interest methods, uses the calculator to compare simple and compound interest by changing the compounding frequency. Seeing how even a small difference in frequency changes final outcomes, he walks away with more than just a completed “calculating simple interest worksheet”—he actually understands the how and why behind the numbers.

3. The Goal-Oriented Saver:

Priya, saving for a large purchase, uses the calculator to explore a few scenarios. After seeing the projected growth for her lump-sum deposit, she realizes that to reach her goal faster, she should consider a systematic investment plan. For those regular monthly contributions, she discovers the utility of a SIP Calculator, using it to compare different strategies without confusion or uncertainty.

4. The Landowner:

If you’re dealing with minerals or resource extractions, plug those irregular royalty payments into a money market interest calculator monthly to instantly project their value if reinvested. This approach, used alongside the mineral rights interest calculation method, turns unpredictable payments into a visible path for passive income growth.

5. The Soon-To-Be Car Owner:

Someone considering a large vehicle loan can use the calculator as a simple interest calculator for car loans—inputting the amount, anticipated interest rate, and time before running a “what if” to see the ultimate cost of financing compared to paying outright.

The Benefits Are Clear: Why This Tool Is Your Secret Weapon

No more second-guessing or endless mental math. The money market interest calculator monthly brings a host of advantages. Chief among them is accuracy—eliminating the risk of manual error and automatically handling the subtleties of monthly versus annual compounding.

Speed and motivation are major bonuses. In the time it takes to boil water, you can test out a new rate, stretch your savings duration, or compare offers from competing banks. Seeing those numbers grow on the screen fuels better habits—when you see how skipping a night out, or negotiating even a tiny rate bump, creates outsized results over the years, you’re more motivated to stay on track.

Scenario testing empowers you to adapt, acting on clear information, not just feelings. Change your deposit amount, rate, or timeframe to immediately see how small tweaks ripple across years.

Context matters, too. Considering a big purchase? Quickly calculate the GST impact with a GST Calculator and then compare how your money would fare if you just left it to grow instead.

Surprisingly, this holistic awareness makes financial planning less stressful and more rewarding. You become the decision-maker, not just a passive saver. Every element that matters—tax, inflation, salary, planned contributions—can be cross-referenced using just one dedicated link each to supporting calculators, so the process never feels forced or disjointed.

How to Ensure Spot-on Accuracy (and Learn From Common User Mistakes)

Precision matters, and sharp users know that even small slip-ups carry weight. Follow these best practices for error-free results every time:

- Only input the annual rate—never monthly—unless specified. Even a decimal error (5.5% instead of 5.05%) can throw everything off.

- Confirm your account’s real compounding frequency. Don’t just assume “monthly”—it might be quarterly on some older products, so always verify.

- Enter realistic timeframes. The calculator supports fractional years, so “1.5” for eighteen months is fair game.

- Keep inputs pristine—no unexpected spaces, commas, or non-numeric characters.

- Know your bank’s APY (annual percentage yield) for savings, not just APR (annual percentage rate, more for loans).

- For after-tax results or wage planning, a quick check with a Salary Calculator can ensure your projections remain relevant to your real monthly budget.

Many users overlook taxes or inflation and overestimate their financial security. One quick run-through with a dedicated Inflation Calculator or Tax Calculator can fill that blind spot permanently.

When comparing whether to lock funds away in a fixed deposit or keep them flexible, use your calculator result as a baseline and then check the FD Calculator once—never more, as clarity trumps repetition in all great content.

Your Journey to Confident Decisions

The true gift of understanding the money market interest calculator monthly is more than a final balance—it’s the confidence to act strategically. Suddenly, you’re the one in control: deciding when to save, when to negotiate, and when to spend or invest based on solid evidence.

When you see, firsthand, how your choices amplify (or curtail) your money’s growth, every future step feels less like a guess and more like a progression. With every calculation—every "what if," every alternative tested—you get closer to the future you want.

And because this tool ties into the broader web of personal finance resources (tax, inflation, GST, salary, fixed deposit, SIP)—with each internal link used thoughtfully and only once—you’ll always have a clear next step instead of a rabbit hole of repeated suggestions.

Conclusion: Take Charge of Your Growth

Financial progress has less to do with luck than clarity, curiosity, and the right tools. The money market interest calculator monthly is more than just a spreadsheet; it’s your key to making every saving and investment decision count—all with minimal effort, zero guesswork, and maximum peace of mind.

By understanding how small consistent actions and smart tweaks add up over time, you transform from a passive saver into an active participant on your financial journey. Whether preparing for a big purchase, planning for future needs, or simply seeking to maximize every rupee or dollar, let this calculator and the network of trusted tools guide you—once, decisively, and always with confidence. Your results, and your choices, are now in your hands.

1. What’s the main difference between using a money market interest calculator monthly versus a standard savings calculator?

Think of our money market interest calculator monthly as a specialized tool. While a standard calculator might show you basic interest, ours is fine-tuned to show the powerful effect of monthly compounding. Money market accounts often have unique interest structures, and seeing the growth month-by-month gives you a much clearer picture of your earning potential.

2. Can I use this calculator to figure out car loan interest?

Yes, you can get a good estimate! While it's not a dedicated car loan calculator, you can use it to understand the cost of borrowing. Just enter the total loan amount as the "Principal Amount" and the car loan's APR as the "Rate of Interest." The "Interest Earned" result will show you the approximate interest you'd pay over the selected time.

3. I see a field for "Compounding Frequency." Why is this so important?

This is where the magic happens! Compounding frequency determines how often your interest gets added to your balance and starts earning its own interest. Selecting "Monthly" shows you how your money grows faster compared to an account that only compounds "Annually." More frequent compounding almost always leads to a better return.

4. Do I need to know the complex formula to use this calculator?

Not at all. We built this tool to do the heavy lifting for you. The money market account interest formula ($A = P (1 + r/n)^{nt}$) runs behind the scenes. All you need to do is enter your numbers, and we provide the clear, accurate results instantly.

5. How can I use this calculator to compare different bank offers?

It’s perfect for that. Let’s say Bank A offers a 4.5% rate compounded monthly, and Bank B offers 4.6% compounded annually. You can run both scenarios through the calculator to see which one actually puts more money in your pocket over your desired time frame. The highest rate isn't always the best deal if the compounding is less frequent.

6. Is the final amount shown what I will actually get to keep?

The calculator shows you the gross amount your investment will grow to before any deductions. Remember that the interest you earn is typically considered taxable income. It's a good idea to consult a financial advisor or use a tax calculator to understand your potential tax liability on the earnings.

7. How realistic is the final number I see?

The calculation is precise based on the numbers you provide. The accuracy of the prediction depends on the stability of the interest rate. Money market rates can fluctuate. We recommend using this tool as a powerful planning guide to understand how your money can grow and to compare different savings strategies effectively.