Cash Flow Setup

How to Calculate Free cash flow: A Guide for Business Owners

Understanding your company’s financial health is critical for survival and growth. While metrics like revenue and profit are important, they don’t tell the whole story. The true measure of a company’s financial flexibility and operational efficiency lies in its free cash flow (FCF). This figure shows how much cash a business generates after accounting for the capital expenditures needed to maintain or expand its asset base. For business owners, investors, and finance managers, mastering how to calculate free cash flow is not just an accounting exercise; it’s a strategic necessity.

Many leaders get bogged down in complex spreadsheets and manual calculations, which are prone to errors and consume valuable time. This is where a modern Cash Flow Calculator transforms the process. This guide will walk you through a simplified, tool-based approach, demonstrating how to calculate free cash flow without needing to memorize complex formulas. We will explore the free cash flow definition, why it matters, and how you can use a powerful, intuitive calculator to gain instant clarity on your financial position. Understanding this process is the first step toward making smarter, data-driven decisions that propel your business forward. Learning how to calculate free cash flow with the right tool empowers you to forecast, plan, and invest with confidence.

What is Free Cash Flow and Why Is It So Important?

Before we dive into the specifics of how to calculate free cash flow, it’s essential to grasp the concept itself. The free cash flow definition refers to the cash a company produces through its operations, less the cost of expenditures on assets. In simpler terms, it’s the cash left over after a company pays for everything it needs to run and grow its business. This remaining cash can be used for various purposes: paying dividends to investors, reducing debt, buying back stock, or investing in new opportunities.

This metric is a favorite among savvy investors and analysts because it provides a clear picture of a company’s ability to generate cash and is less susceptible to accounting manipulations than reported earnings. A positive and growing free cash flow is a sign of a healthy, thriving business. It indicates that the company has more than enough money to cover its expenses and investments, leaving a surplus for shareholders and future growth initiatives.

Conversely, negative free cash flow can be a red flag, suggesting the company is not generating enough cash to support its operations and growth plans. For any business leader, mastering how to calculate free cash flow is a fundamental skill for assessing performance and strategic planning. This is where understanding both FCFF (Free Cash Flow to the Firm) and FCFE (Free Cash Flow to Equity) becomes relevant, as they represent different views of the cash available to all capital providers or just equity holders, respectively. This guide focuses on the practical application, showing you how to calculate free cash flow in a way that gives you actionable insights.

The Challenge of Traditional Calculation Methods

Traditionally, the process of figuring out how to calculate free cash flow involved pulling data from multiple financial statements, like the income statement and balance sheet, and plugging them into specific formulas. This manual approach is not only tedious but also carries a significant risk of human error. A single misplaced decimal or an incorrect entry can skew the entire result, leading to flawed financial analysis and poor business decisions.

For busy business owners and finance teams, the time spent on these manual calculations is time that could be better used for strategic analysis and decision-making. The complexity of the formulas for FCFF and FCFE can also be a barrier for those without a deep accounting background.

This is why many are now turning to digital solutions that automate the process. A dedicated tool removes the complexity, making it simple for anyone to understand how to calculate free cash flow accurately and efficiently. It shifts the focus from the “how” of the calculation to the “what” of the results, enabling you to interpret the data and take meaningful action. Knowing how to calculate free cash flow becomes less about arithmetic and more about strategy.

Introducing the Cash Flow Calculator: A Modern Solution

Our Cash Flow Calculator is designed to eliminate the friction and complexity associated with traditional methods. It provides a streamlined, user-friendly interface that guides you through each step, making the process of how to calculate free cash flow accessible to everyone, regardless of their financial expertise. You no longer need to worry about formulas or wrestle with spreadsheets. The tool does the heavy lifting, allowing you to focus on what the numbers mean for your business.

This calculator is more than just a number-crunching machine; it’s a comprehensive financial planning tool. It helps you visualize your cash movements, identify trends, and forecast your future financial position with remarkable accuracy. By simplifying how to calculate free cash flow, it empowers you to take control of your company’s financial destiny. Whether you are a startup founder trying to manage burn rate, a CFO preparing a board report, or an investor analyzing a potential opportunity, this tool provides the clarity you need. It is the definitive modern answer to the question of how to calculate free cash flow.

Getting Started: Setting Your Financial Baseline

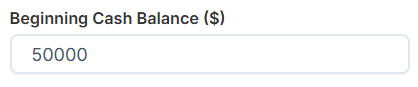

The first step in using the calculator is establishing your starting point. This is crucial for an accurate projection and a key part of learning how to calculate free cash flow over a specific period.

Enter Your Beginning Cash Balance

Your beginning cash balance is the total amount of cash your business has on hand at the start of the period you want to analyze. This includes cash in bank accounts, petty cash, and any other cash equivalents. Inputting this figure accurately is the foundation of your entire cash flow projection. The calculator uses this number as the starting block from which all inflows and outflows are added or subtracted.

Set Your Analysis Period

Next, you need to define the timeframe for your analysis. The tool allows you to set the number of months you want to project, from a single month to a full year or more. This flexibility enables you to conduct both short-term operational planning and long-term strategic forecasting. Setting the period is a critical component of understanding how to calculate free cash flow for budgeting, seasonal planning, or investment analysis.

Step 2: Tracking Your Cash Inflows

Once your baseline is set, the next stage in how to calculate free cash flow involves detailing all the money coming into your business. A comprehensive view of inflows is essential for a realistic financial picture.

Add Sales Revenue

This is the primary source of cash for most businesses. You can input your expected monthly sales revenue based on historical data, sales forecasts, or market trends. The calculator allows you to enter different figures for each month, accommodating for seasonality or expected growth. Accurately forecasting sales is a vital skill when learning how to calculate free cash flow.

Include Other Income and Custom Inflows

Businesses often have multiple streams of income beyond core sales. The tool provides dedicated fields for these. You can add expected income from investments, asset sales, grants, or any other source. The “custom inflows” feature offers even more flexibility, allowing you to add and label any unique cash receipts specific to your business model. This detailed approach is what makes this method of how to calculate free cash flow so powerful. It ensures no source of cash is overlooked.

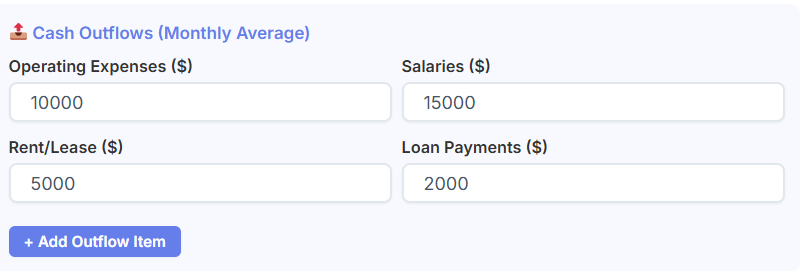

Step 3: Detailing Your Cash Outflows

A precise understanding of your expenses is just as important as your income when determining your FCF. This part of the process shows you how to calculate free cash flow by accounting for every dollar that leaves your business.

Enter Operating Expenses

This category includes the regular costs associated with running your business, such as marketing, utilities, software subscriptions, and supplies. Breaking these down helps you see where your money is going and identify potential areas for cost savings. This granular detail is fundamental to the process of how to calculate free cash flow.

Input Salaries and Payroll Costs

Employee compensation is often one of the largest expenses for a company. You can input your total monthly payroll costs, including salaries, wages, benefits, and payroll taxes. Consistency in tracking these costs is key to a reliable cash flow analysis.

Factor in Rent and Loan Payments

Fixed costs like rent for your office or facility and payments on business loans must be included. These are often predictable, making them easy to input into the calculator for each month of your projection period. This step is a non-negotiable part of how to calculate free cash flow.

Use Custom Outflows for Unique Expenses

Just as with inflows, the calculator lets you add custom outflow categories. This is perfect for one-time purchases, capital expenditures (a key component of the free cash flow metric), taxes, or any other expense that doesn’t fit into the standard categories. Capturing these details is what separates a basic cash summary from a true analysis that shows you how to calculate free cash flow. It provides a complete picture of your financial commitments.

Step 4: Generating Your Comprehensive Cash Flow Report

After you have entered all your inflows and outflows, the calculator instantly processes the data to provide a wealth of insights. This is the moment where the tool truly demonstrates how to calculate free cash flow and presents it in an easily digestible format.

Review Your Monthly Net Cash Flow

The tool calculates your net cash flow for each month by subtracting total outflows from total inflows. This figure shows you whether you had a cash surplus or a deficit in a given month. Monitoring this trend is crucial for managing your liquidity. This part of the process, showing how to calculate free cash flow on a monthly basis, helps you spot seasonal patterns or the impact of large, one-time expenses.

Analyze Your Ending Cash Balance

For each month in your projection, the calculator will show your ending cash balance. This is calculated by taking the beginning balance, adding the net cash flow for the month, and arriving at the final amount. This running total is perhaps the most important output, as it tells you your projected cash position over time. It answers the core question of how to calculate free cash flow and see its cumulative effect.

Visualize Your Financials with Charts

Numbers in a table are useful, but a visual representation can be much more impactful. The calculator generates a dynamic bar and line chart that displays your monthly inflows, outflows, and ending cash balance. This visual aid makes it easy to spot trends, identify cash-tight months, and communicate your financial story to stakeholders. The chart is a powerful feature that simplifies understanding how to calculate free cash flow.

Download a Professional PDF Report

With a single click, you can generate and download a professional-grade PDF report of your cash flow analysis. This report includes the detailed monthly table, the visual chart, and summary metrics. It’s perfect for sharing with your bank, investors, board members, or your internal finance team. Having this polished document ready is another way the tool streamlines the entire task of how to calculate free cash flow. This output makes reporting seamless.

Interpreting the Results: Beyond the Numbers

Knowing how to calculate free cash flow is only half the battle. The real value comes from interpreting the results and using them to make informed decisions. A consistently positive free cash flow (often abbreviated as FCF) indicates strong operational health. It means your business is generating more cash than it consumes, giving you the power to invest in growth, pay down debt, or return capital to shareholders. This is the goal for any healthy enterprise. The journey to get there starts with knowing how to calculate free cash flow.

If your analysis reveals a negative or declining free cash flow, it’s a signal to investigate further. Are your sales lower than expected? Are your operating costs too high? Did a large capital expenditure temporarily deplete your cash? Our calculator helps you pinpoint the exact cause by breaking down your inflows and outflows month by month. This detailed insight is crucial. This is how a simple tool can transform your ability to manage your business, moving beyond just knowing how to calculate free cash flow to understanding the story behind the numbers. It is an essential step in financial management.

By mastering how to calculate free cash flow with this tool, you can proactively manage your finances. For instance, if you foresee a cash-tight month coming up, you can take action now—perhaps by launching a sales promotion to boost inflows or delaying a non-essential purchase to reduce outflows. This proactive approach to cash management is what sets successful businesses apart. The ability to forecast and plan is a direct benefit of understanding how to calculate free cash flow.

Related Financial Planning Tools

Mastering your cash flow is a cornerstone of financial management, but it’s part of a larger ecosystem of financial planning. As you grow your business and your financial needs become more complex, other specialized tools can provide critical insights. Understanding how to calculate free cash flow is a great start, and these related calculators can help you make even smarter decisions across different areas of your business.

💵 Discount Calculator

Once you understand your cash position, you might decide to run a sales promotion to boost inflows. The Discount Calculator is an essential tool for this. It helps you determine the impact of offering discounts on your products or services. You can calculate final sale prices, see the total amount saved by the customer, and analyze how different discount percentages affect your profit margins. This ensures your sales strategy doesn’t inadvertently harm your bottom line.

📈 Stock Calculator

For business owners who have issued stock or for investors analyzing a company’s performance, the Stock Calculator is invaluable. After using our main tool to understand how to calculate free cash flow, which is a key metric for stock valuation, you can use this calculator to compute potential returns on stock investments, calculate dividend yields, and analyze the overall performance of equity holdings. It’s a powerful tool for both corporate finance and personal investment decisions.

🏢 Rent vs Buy Calculator

A major decision for many businesses is whether to rent or buy commercial property. This choice has significant long-term implications for your cash flow and balance sheet. The Rent vs Buy Calculator helps you compare the financial outcomes of both scenarios. It takes into account factors like mortgage payments, property taxes, maintenance costs, and potential property appreciation versus monthly rent expenses. Making this decision with data-backed analysis, informed by your overall cash flow health, can save your company millions over its lifetime. The process of learning how to calculate free cash flow provides the foundation for making such large-scale decisions.

Conclusion: Take Control of Your Financial Future

In today’s competitive landscape, you cannot afford to manage your business finances by guesswork. Understanding how to calculate free cash flow is no longer a task reserved for accountants and financial analysts. It is a vital skill for every business owner, founder, and manager who wants to build a resilient and profitable enterprise. The challenge has always been the complexity and time involved in the manual process.

Our Cash Flow Calculator demystifies this crucial metric. It transforms a once-daunting task into a simple, intuitive, and even insightful process. By guiding you through each input and automating the calculations, the tool empowers you to see your complete financial picture with clarity and confidence. It provides a definitive, modern answer for anyone asking how to calculate free cash flow efficiently. You can finally move beyond the numbers on a page to understand the story they tell about your business.

Stop wrestling with complicated spreadsheets and start making proactive, data-driven decisions. Use this tool to master how to calculate free cash flow and unlock the strategic insights needed to navigate challenges, seize opportunities, and steer your business toward sustainable growth. Your financial future is too important to leave to chance. Take control today by embracing a smarter way to manage your cash flow. This is more than just a calculation; this is your pathway to financial clarity and strategic advantage. Knowing how to calculate free cash flow is the key.

FAQs

What is the difference between free cash flow and net income?

Net income, often called the “bottom line,” is an accounting measure of a company’s profitability after all expenses, taxes, and interest have been deducted from revenue. While important, it can include non-cash items like depreciation.

Free cash flow (FCF), on the other hand, represents the actual cash a company generates after accounting for the cash outflows required to maintain or expand its asset base (capital expenditures). FCF is a direct measure of a company’s financial liquidity and operational efficiency, showing how much cash is available to pay down debt, distribute to shareholders, or reinvest in the business. In short, net income is about profitability, while free cash flow is about cash generation.

Why is free cash flow a more reliable indicator of financial health than earnings?

Free cash flow is often considered a more reliable indicator of a company’s financial health because it is much more difficult to manipulate with accounting practices than reported earnings. Earnings can be influenced by decisions about depreciation schedules, inventory valuation, and revenue recognition policies.

Conversely, free cash flow focuses on the tangible movement of cash in and out of the business. It provides a clear, straightforward picture of a company’s ability to generate cash from its core operations. A business with positive and growing free cash flow is generally in a strong position to fund its own growth, weather economic downturns, and create value for its stakeholders.

Can a company be profitable but still have negative free cash flow?

Yes, it is entirely possible for a company to report a profit (positive net income) while experiencing negative free cash flow. This scenario often occurs in rapidly growing businesses that are investing heavily in new equipment, inventory, or facilities (high capital expenditures) to support future expansion.

For example, a company might sell a large volume of products on credit, which boosts reported revenue and net income. However, if customers are slow to pay their invoices, the actual cash has not yet been collected. When combined with significant investments in growth, these factors can lead to more cash leaving the business than coming in, resulting in negative free cash flow despite being profitable on paper. This highlights the importance of monitoring both metrics for a complete financial picture.