Rent vs Buy Calculator

Make Smart Property Decisions – Compare Renting vs Buying

Updated 2025Property & Financial Details

Enter property information and costsGeneral Information

Buying Costs

Renting Costs

Investment & Returns

Rent or Sell Calculator: The Ultimate Guide for Homeowners

Deciding whether to sell your property or rent it out is one of the most significant financial choices a homeowner can make. The answer isn’t always straightforward and depends on a complex mix of personal goals, market conditions, and financial realities. Do you cash in on your investment, or do you build a long-term income stream? This is where a powerful rent or sell calculator becomes an indispensable tool. It moves the decision from a gut feeling to a data-driven conclusion, providing clarity and confidence.

For many, the question of whether to “sell or rent my house” is fraught with uncertainty. You might have an emotional attachment to the property, or perhaps you see its potential as a source of passive income. On the other hand, selling could provide a substantial lump sum to invest elsewhere or fund your next life chapter. Using a comprehensive rent or sell calculator helps you weigh these options objectively. This guide will walk you through the factors you need to consider, explain the financial metrics that matter, and show you how to use our interactive rent or sell calculator to make the best choice for your unique situation.

We will demystify the process, breaking down everything from upfront costs to long-term returns. By the end, you’ll not only understand the “why” behind the numbers but also the “how.” You’ll be equipped to use a rent or sell calculator effectively, turning complex financial data into a clear, actionable plan for your property.

Understanding the Core Dilemma: To Sell or To Rent?

The decision to sell or rent your home hinges on your financial goals, lifestyle, and risk tolerance. There is no one-size-fits-all answer. Selling provides immediate liquidity, freeing you from the responsibilities of being a landlord. This can be ideal if you need capital for a new home, want to pay off debt, or wish to diversify your investments. It offers a clean break, allowing you to move on without lingering ties to the property.

Conversely, renting your house transforms it into an income-generating asset. This path can provide a steady monthly cash flow, build equity as the mortgage is paid down by tenants, and offer long-term appreciation. However, it also comes with the responsibilities of property management, including finding tenants, handling repairs, and navigating potential vacancies. This is a business, and it requires time, effort, and a certain temperament.

A sophisticated rent or sell calculator helps quantify these two scenarios. It takes your inputs—property value, mortgage details, potential rent, and associated costs—to project the financial outcome of each choice over a specific time period. This comparison is crucial. Without a tool like this, you are essentially guessing which path will be more profitable. A good rent or sell calculator removes the guesswork, giving you a side-by-side financial breakdown.

A Step-by-Step Guide to Using Our Rent or Sell Calculator

Our rent or sell calculator is designed to be intuitive yet powerful. It guides you through entering the necessary financial details to generate a comprehensive comparison. Let’s break down each section so you can use it with confidence.

Property & Financial Details Section

This is the starting point of your analysis. The accuracy of the information you provide here will directly impact the quality of the results. This section gathers the fundamental data about your property and the financial landscape you’re operating in.

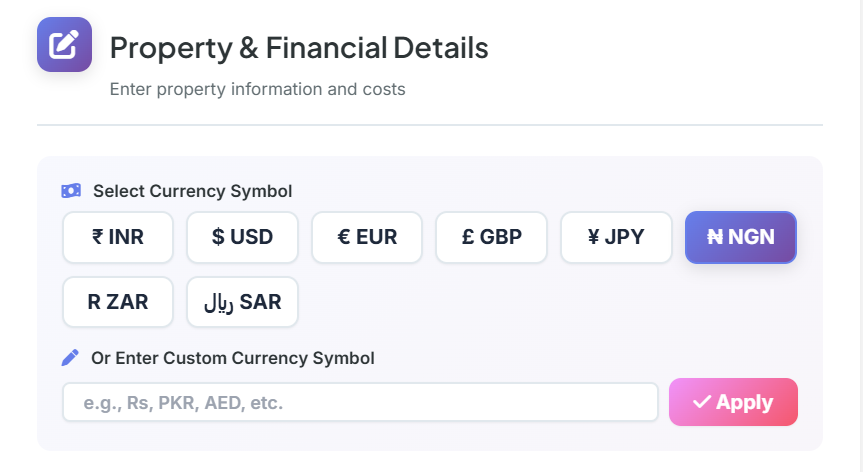

Currency Selection

Before diving into the numbers, you can select your local currency. Our tool supports major world currencies like the INR, USD, EUR, and GBP, and even allows you to enter a custom symbol. This ensures the entire report is presented in a context that is familiar and easy for you to understand.

General Information

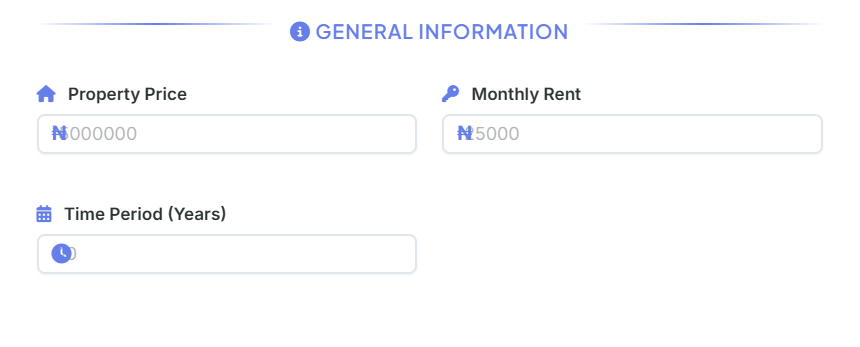

This is the most critical part of the input process.

- Property Price: Enter the current estimated market value of your home. This is the price you believe you could realistically sell it for today. Be objective and use recent comparable sales in your area as a guide.

- Monthly Rent: This is where you address the question, “how much could I rent my house for?” Research similar rental properties in your neighborhood to determine a competitive monthly rent. Online rental platforms are a great resource for this.

- Time Period (Years): Specify the number of years you want to forecast the comparison. A common period is 5-10 years, as this provides a meaningful timeframe to assess appreciation, loan paydown, and rental income growth.

Buying Costs (Your Costs as an Owner)

This section details the ongoing expenses associated with owning the property if you were to keep it.

- Down Payment (%): While you already own the home, this field is used by the rent or sell calculator to understand the equity you have. You can enter the percentage of the property’s value that is paid off.

- Home Loan Interest Rate (%): Input the annual interest rate on your current mortgage.

- Loan Tenure (Years): Enter the total original term of your mortgage (e.g., 20 or 30 years).

- Stamp Duty & Registration: These are one-time costs associated with purchasing a property. If you are analyzing a potential new purchase vs. renting, this is critical. For an existing property, you can consider this as a sunk cost or enter 0.

- Maintenance (Monthly): Estimate your average monthly spending on upkeep, repairs, and homeowner association (HOA) fees. A common rule of thumb is 1% of the property’s value annually, divided by 12.

- Property Tax (Annual): Enter the amount you pay in property taxes each year.

Renting Costs

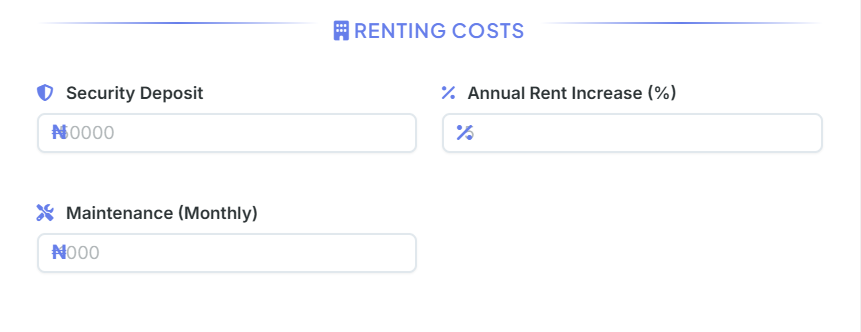

Here, you’ll outline the costs from the perspective of a landlord.

- Security Deposit: The typical amount you would collect from a tenant, which is usually equivalent to one or two months’ rent.

- Annual Rent Increase (%): Project a realistic percentage by which you expect to increase the rent each year. This is often tied to inflation or local market trends, typically between 2-5%.

- Maintenance (Monthly): As a landlord, you are still responsible for certain maintenance costs. This might be different from the owner-occupier maintenance figure, depending on what your rental agreement covers.

Investment & Returns

This final input section allows the rent or sell calculator to project future growth.

- Expected Property Appreciation (%): Estimate the annual rate at which you expect your property’s value to increase. This is highly location-dependent, so research historical trends in your area.

- Investment Return Rate (%): This is a key variable. If you were to sell the house, you would have a large sum of money (your equity). This field asks you to estimate the annual return you could earn by investing that money elsewhere (e.g., in stocks, bonds, or other assets). This helps the calculator determine the opportunity cost of keeping your money tied up in the property.

Once all fields are completed, you can click the “Compare Rent vs Buy” button. The rent or sell calculator will then process this information to generate a detailed results page.

Interpreting the Results from the Rent or Sell Calculator

After you’ve entered your data, the rent or sell calculator provides a clear, visual summary of your two options. This section is designed to be easily digestible, helping you see the bottom-line impact of your choice.

Comparison Results: Renting vs. Buying

The output is split into two main cards, one for “Renting” (meaning you rent out your property) and one for “Buying” (meaning you keep the property).

The Renting Card (as a Landlord):

This card breaks down the financial outcome if you become a landlord.

- Total Rent Paid: This shows the cumulative rental income you would collect over the specified time period, accounting for the annual rent increases you projected.

- Total Maintenance: The total cost of maintenance you would incur as a landlord over the years.

- Security Deposit: The refundable deposit you hold.

- Investment Returns: This is a crucial, often overlooked figure. It calculates the potential returns you would have earned if you had invested your down payment (or initial equity) instead of keeping it in the house.

- Net Cost: This is the bottom-line number. It represents your total expenses minus your total income and gains from renting. A negative number here often indicates a net profit.

The Buying Card (Keeping the Property):

This card summarizes the financial implications of continuing to own and live in your property (or holding it vacant, though the primary comparison is against renting it out).

- Down Payment: The initial equity you have in the home.

- Total EMI Paid: The total amount of mortgage payments (both principal and interest) you will make over the time period.

- Stamp Duty & Tax: The total of one-time transaction fees and cumulative property taxes paid.

- Property Value: This shows the projected future value of your home at the end of the time period, based on the appreciation rate you entered.

- Net Cost: This is the final figure for the buying scenario. It is calculated as your total cash outlay (down payment, mortgage payments, taxes, maintenance) minus the future value of the property. A negative number here indicates a gain in net worth.

The Winner Card: Your Recommended Option

Based on the net cost calculations, the rent or sell calculator will declare a “winner.” It highlights which option—selling your property and investing the proceeds, or keeping it as a rental—is financially superior over your chosen timeframe. It explicitly states which choice is better and quantifies the financial advantage, showing you the total estimated savings of one path over the other. This direct recommendation is the core function of a reliable rent or sell calculator.

Cost Comparison Breakdown Chart

For a more visual analysis, the tool presents a bar chart comparing the total net costs of each scenario. This allows you to see, at a glance, the magnitude of the financial difference between the two choices. Seeing the costs visualized side-by-side can often make the decision feel more concrete.

Important Considerations

Finally, the rent or sell calculator provides a list of qualitative factors to consider. Financial metrics are critical, but they don’t tell the whole story. This section reminds you to think about lifestyle preferences, job stability, and the non-monetary benefits and drawbacks of being a landlord versus a seller.

Deeper Dive: The Financial Metrics That Matter

A rent or sell calculator juggles several key financial concepts to arrive at its conclusion. Understanding these concepts will help you appreciate the depth of the analysis.

Cash Flow

When you rent out your property, your primary goal is positive cash flow. This is the money left over after you’ve collected rent and paid all the expenses, including the mortgage (PITI – principal, interest, taxes, insurance), maintenance, and property management fees. If you’re asking, “could I rent this house for a profit?” you’re asking about cash flow. A good rent or sell calculator helps you project this not just for one month, but over many years, factoring in rent increases and rising costs.

Equity and Appreciation

Equity is the portion of your home that you truly own. It’s the difference between the property’s market value and your outstanding mortgage balance. When you sell, you cash out this equity. When you rent, you continue to build equity in two ways:

- Loan Paydown: Each mortgage payment you (or your tenant) make increases your equity.

- Appreciation: As the property’s value increases over time, your equity grows.

A rent or sell calculator uses your appreciation estimate to show how much your net worth could grow simply by holding onto the asset.

Opportunity Cost

This is a powerful concept that a quality rent or sell calculator must incorporate. Opportunity cost is the potential gain you miss out on by choosing one alternative over another. In this context, if you decide not to sell, the opportunity cost is the return you could have earned by investing your home equity in the stock market or another venture. Our calculator quantifies this by using the “Investment Return Rate” you provide, making for a more honest and complete comparison. This is a feature that distinguishes a simple calculator from a comprehensive rental investment calculator.

The 1% Rule in Rental Investing

A common guideline in real estate is the 1% rule, which suggests that the monthly rent should be at least 1% of the property’s purchase price to be a worthwhile investment. For example, a $300,000 property should ideally rent for at least $3,000 per month. While this is a useful starting point when you’re wondering “how much could I rent my house for?”, it’s a very rough estimate. A robust rental investment calculator provides a much more nuanced analysis, considering all associated costs, taxes, and appreciation to give you a true picture of profitability. Don’t rely on simple rules of thumb when a detailed rent or sell calculator can provide a precise forecast.

When Selling Makes More Sense

While renting can be a fantastic way to build wealth, there are many situations where selling is the clear winner. A rent or sell calculator will often favor selling under these conditions:

- Hot Seller’s Market: If home prices in your area have skyrocketed, selling allows you to capitalize on that growth and lock in your profits. Trying to time the market is risky, but selling when demand is high ensures you get the best possible price.

- Negative Cash Flow: If the projected rent doesn’t cover your mortgage, taxes, insurance, and maintenance, your rental property will be a monthly financial drain. The decision to “sell or rent my house” becomes much easier when renting means losing money each month.

- Need for Liquidity: If you need a large sum of cash for a down payment on a new home, starting a business, or paying for education, selling is the most direct way to access your home equity.

- You’re Moving Far Away: Being a long-distance landlord is challenging. While property managers can help, it adds a layer of cost and complexity. Selling can provide a clean break and peace of mind.

- You Don’t Want to Be a Landlord: The responsibilities of managing a property are not for everyone. If the thought of late-night repair calls, difficult tenants, and eviction processes fills you with dread, selling is the right lifestyle choice, regardless of what the numbers say. The best rent or sell calculator is one that informs a decision you can live with.

When Renting Is the Better Option

Conversely, holding onto your property and becoming a landlord can be an incredibly rewarding long-term strategy. The rent or sell calculator might point towards renting if:

- You Have Positive Cash Flow: If the rent comfortably covers all your expenses, you have a profitable asset on your hands. This steady income stream can supplement your primary salary or build your retirement nest egg. It’s a strong signal when you ask “could I rent this house?” and the answer is a resounding “yes, and profitably!”

- Strong Market for Appreciation: If your property is in an area with strong long-term growth prospects (e.g., due to job growth, new infrastructure, or high demand), holding onto it allows you to benefit from future appreciation. This is where your property acts as a powerful rental investment calculator in itself, growing your net worth over time.

- You Plan to Return: If there’s a chance you might want to move back into the home in the future, renting it out keeps that option open. Selling is a permanent decision.

- Market Is Cold for Sellers: If you’re in a buyer’s market where prices are stagnant or falling, renting allows you to wait for better market conditions before selling. You can generate income while your asset (hopefully) recovers its value. The question changes from “sell or rent my house” to “rent my house now, and sell later.”

- Tax Advantages: As a landlord, you can often deduct mortgage interest, property taxes, maintenance costs, and depreciation from your taxable income, which can provide significant savings. A comprehensive rent or sell calculator implicitly factors in the benefits of these deductions through its cost analysis.

Conclusion: Making Your Final Decision

The choice between renting and selling your home is a major financial crossroads. It requires a careful balance of quantitative analysis and qualitative self-reflection. A rent or sell calculator is the ultimate tool for handling the quantitative side. It organizes the complex variables, from mortgage payments and maintenance costs to appreciation and opportunity costs, into a simple, comparative framework.

By walking through our guide, you now understand how to effectively use a rent or sell calculator to model your specific financial situation. You can confidently enter your property’s details, your local market conditions, and your personal financial data to see a clear projection of both potential paths. It transforms abstract questions like “how much could I rent my house for?” into concrete numbers that form the basis of a solid financial plan.

Ultimately, the best decision is an informed one. Use the rent or sell calculator to see what the data says. Then, consider your lifestyle, your long-term goals, and your tolerance for risk. Does the idea of managing a property excite you as a business venture, or does it feel like a burden? Does the prospect of a large, liquid sum from a sale open up new opportunities you’re eager to pursue?

By combining the powerful, objective insights from the rent or sell calculator with a clear understanding of your personal priorities, you can move forward with confidence, knowing you’ve made the best possible choice for your financial future.

FAQs

How accurate is a rent or sell calculator?

A rent or sell calculator provides a highly accurate financial forecast based on the data you input. Its precision depends on how realistically you estimate variables like your property’s market value, potential rent, maintenance costs, and appreciation rate. While the calculator performs the math perfectly, it’s best used as a strong directional guide, as it cannot predict unforeseen market shifts or property-specific issues.

What is the most important factor to consider when using the calculator?

While every input is important, the “Investment Return Rate” is one of the most critical and often overlooked factors. This figure represents the opportunity cost of not selling. By estimating the return you could get from investing your home equity elsewhere, the calculator provides a true “apples-to-apples” comparison between keeping your property as a rental and cashing out to invest the proceeds.

The calculator says I should rent, but I don’t want to be a landlord. What should I do?

The calculator’s recommendation is purely financial. It’s essential to weigh this data against your personal lifestyle and goals. If the idea of managing tenants and property maintenance is unappealing, selling might still be the right choice for your peace of mind. You could also explore hiring a property management company, but be sure to factor their fees (typically 8-12% of the monthly rent) into the calculator’s expense fields to see how it impacts the financial outcome.