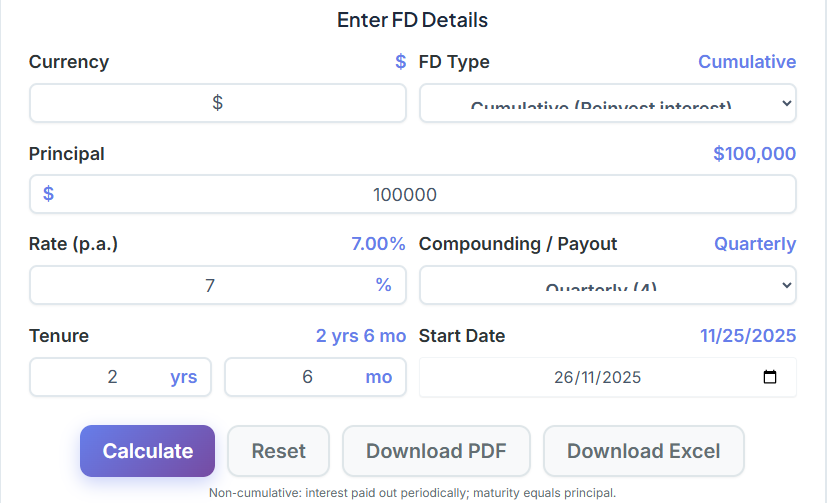

Enter FD Details

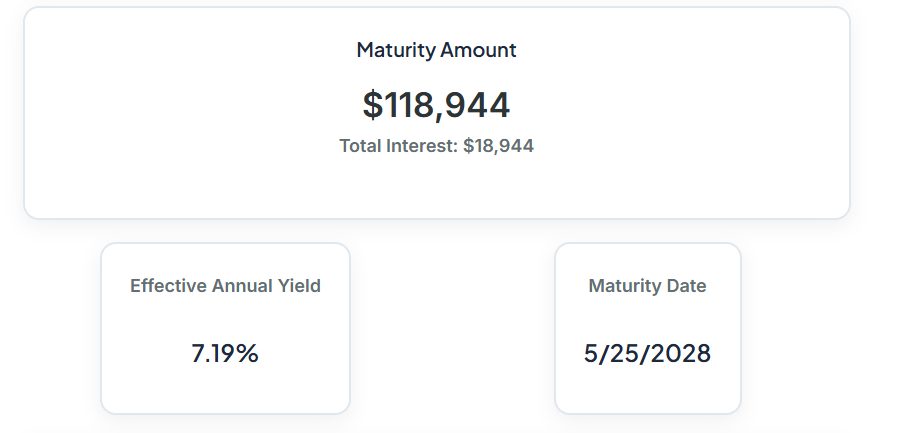

Maturity Amount

Total Interest: $0

Effective Annual Yield

0%

Maturity Date

—

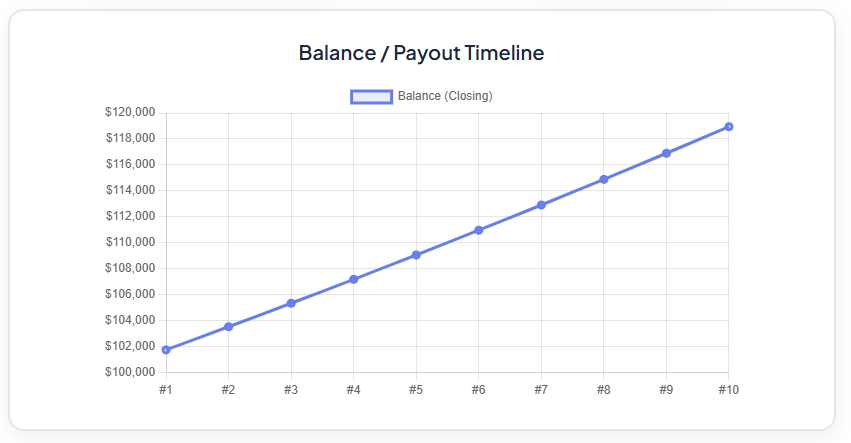

Balance / Payout Timeline

Schedule

| # | Date | Opening | Interest | Closing |

|---|---|---|---|---|

| — | ||||

Master Your Savings: A Guide to Using a Calculator for Fixed Deposit Interest

A fixed deposit (FD) is a secure and reliable way to grow your savings. You invest a sum of money for a set period, and the bank pays you interest. But how much will you actually earn? Guesswork isn’t a financial strategy. To make smart investment decisions, you need precise figures, and that’s where a calculator fixed deposit interest tool becomes your most valuable asset.

This guide will move beyond theory and dive into real-life scenarios. We’ll show you how a calculator fixed deposit interest tool can help you plan for major life goals, compare offers from different banks, and ultimately maximize your returns. Understanding how to use this tool effectively can transform the way you save, turning abstract financial goals into achievable realities.

Why a Fixed Deposit Interest Calculator is Essential

Before we explore specific scenarios, let’s understand the core problem this tool solves. The interest on a fixed deposit is typically compounded, meaning you earn interest not just on your initial investment (the principal) but also on the accumulated interest. The final maturity amount depends on four key factors:

- Principal: The amount you invest.

- Interest Rate: The annual rate offered by the bank.

- Tenure: The length of time you lock in your investment.

- Compounding Frequency: How often the interest is calculated and added to your balance (e.g., quarterly, half-yearly).

Manually calculating this can be complex and prone to errors. A calculator fixed deposit interest automates this entire process, providing instant and accurate results. It empowers you to see the future value of your money, making financial planning concrete and data-driven.

Real-Life Scenarios: Putting the Calculator to Work

Let’s explore practical situations where a calculator fixed deposit interest proves indispensable.

Scenario 1: Saving for a Down Payment on a Home

Meet Priya, a young professional who wants to buy her first apartment. She needs to save $30,000 for a down payment in five years. She has $20,000 in savings ready to invest.

The Challenge: Will a fixed deposit help her reach her goal?

Using the Calculator:

Priya uses a calculator fixed deposit interest to explore her options. She inputs:

- Principal: $20,000

- Tenure: 5 years

Now, she experiments with different interest rates based on current bank offerings.

- At 6.5% interest (compounded quarterly): The calculator shows a maturity amount of approximately $27,600. She’s short of her goal.

- At 7.25% interest (compounded quarterly): The calculator shows a maturity amount of roughly $28,700. Closer, but not quite there.

The Insight:

The calculator shows Priya that her initial investment alone isn’t enough at current rates. She realizes she needs to either find a higher interest rate or increase her principal. This clarity prevents her from simply investing and hoping for the best. She can now make an informed decision, perhaps by adding to her principal or exploring other investment avenues.

Deciding between buying and continuing to rent is a major financial crossroad. To analyze this specific decision, Priya could also use a Rent vs Buy Calculator to weigh the long-term costs and benefits of each path.

Scenario 2: Planning for Retirement with a Regular Income

Consider Mr. Sharma, who is about to retire. He has a lump sum of $150,000 from his retirement funds and wants to generate a steady quarterly income without touching his principal.

The Challenge: Can a non-cumulative fixed deposit provide a reliable income stream?

Using the Calculator:

Mr. Sharma uses an advanced calculator fixed deposit interest that offers a “non-cumulative” or “payout” option. He finds a bank offering a 7.5% interest rate for senior citizens.

- Principal: $150,000

- Interest Rate: 7.5%

- Tenure: 10 years

- FD Type: Non-cumulative

- Payout Frequency: Quarterly

The Result:

The calculator instantly shows him that he will receive an interest payout of $2,812.50 every quarter. His principal of $150,000 will remain intact and be returned to him at the end of the 10-year tenure.

The Insight:

This calculation gives Mr. Sharma the confidence to proceed. He knows exactly how much income to expect, allowing him to plan his retirement budget effectively. He can now use a Budget Calculator to manage his quarterly earnings and expenses with precision. Using a calculator fixed deposit interest in this way is crucial for anyone depending on investments for regular income.

Scenario 3: Comparing Offers from Different Banks

Let’s follow Rohan, a savvy investor who wants to get the absolute best return on his $50,000 investment for a 3-year period. He’s comparing offers from two major banks, SBI and Axis Bank.

The Challenge: Which bank offers a better deal? It’s not just about the rate.

Using the Calculators:

Rohan first checks the banks’ dedicated tools. He uses a rate of interest on fixed deposit sbi calculator and finds they offer 7.0% compounded quarterly. Then, he uses a fixed deposit calculator axis and sees an offer of 7.1% compounded half-yearly.

At first glance, Axis Bank’s 7.1% seems better. But the compounding frequency is different. To make a true comparison, Rohan uses a universal calculator fixed deposit interest.

- SBI Scenario:

- Principal: $50,000

- Interest Rate: 7.0%

- Tenure: 3 years

- Compounding: Quarterly

- Maturity Amount: $61,646

- Axis Bank Scenario:

- Principal: $50,000

- Interest Rate: 7.1%

- Tenure: 3 years

- Compounding: Half-Yearly

- Maturity Amount: $61,594

The Insight:

Despite offering a lower interest rate, SBI’s more frequent (quarterly) compounding results in a slightly higher maturity amount. The difference is small, but over larger principals or longer tenures, it can become significant. This demonstrates why a versatile calculator fixed deposit interest is superior to relying solely on advertised rates. Whether you use an sbi bank fixed deposit interest calculator or a fixed deposit calculator axis, comparing the final numbers in a standardized tool is key.

Before investing, it’s also important to understand your disposable income. A Salary Calculator is a great tool to see how much of your paycheck is left for savings after taxes and deductions.

Scenario 4: Funding a Child’s Education

Sunita and Raj want to save for their daughter’s university education, which they estimate will cost $40,000 in 10 years.

The Challenge: How much do they need to invest today in a single fixed deposit to reach their goal?

Using the Calculator (Goal-Oriented Approach):

This time, they use the calculator fixed deposit interest tool to work backward. They know the future value they need ($40,000) and the tenure (10 years). They assume an average interest rate of 7% compounded quarterly.

They can’t input the goal directly, but they can experiment with the principal amount.

- Try 1 (Principal $20,000): The calculator shows a maturity value of approximately $40,030.

- Try 2 (Principal $19,500): The calculator shows a maturity of around $39,029.

The Insight:

The calculator tells them they need to invest approximately $20,000 today in a fixed deposit to meet their future goal. This transforms a daunting, far-off expense into a clear, actionable investment plan. A quality calculator fixed deposit interest helps turn dreams into financial roadmaps.

Of course, a fixed deposit is just one piece of the puzzle. For a long-term goal like education, they should also explore equity investments. A SIP Calculator could show them how small, regular investments in mutual funds might lead to even greater wealth creation over 10 years.

Scenario 5: Managing Debt and Savings

Anjali has some savings but also carries a balance on her credit card. She’s considering investing $5,000 in a fixed deposit for one year at 6.8%.

The Challenge: Is investing in an FD the best use of her money right now?

Using the Calculators:

First, Anjali uses a calculator fixed deposit interest.

- Principal: $5,000

- Interest Rate: 6.8%

- Tenure: 1 year

- Result: She will earn about $345 in interest.

Next, she uses a Credit Card Calculator for her $5,000 debt, which has an annual interest rate of 24%.

- Debt: $5,000

- Interest Rate: 24%

- Result: Over one year, the interest cost could be $1,200 or more if left unpaid.

The Insight:

By comparing the numbers, Anjali sees that the interest she would pay on her debt far outweighs the interest she would earn from the fixed deposit. The logical financial decision is to use the $5,000 to pay off her high-interest credit card debt first. This strategic thinking is facilitated by using the right financial tools for both sides of the balance sheet. This comparative analysis is an advanced use of a calculator fixed deposit interest—using it to evaluate opportunity costs.

For small business owners or freelancers, managing finances involves more than personal savings. A tool like a GST Calculator becomes essential for handling tax obligations correctly.

The Ultimate Power of a Calculator for Fixed Deposit Interest

As these scenarios show, a calculator fixed deposit interest is more than just a number-cruncher. It’s a strategic planning tool that provides:

- Clarity: It replaces vague estimates with concrete numbers.

- Comparison: It enables objective, data-driven comparisons between different investment options, like those found using a rate of interest on fixed deposit sbi calculator versus a fixed deposit calculator axis.

- Confidence: It empowers you to make financial decisions with a clear understanding of the outcomes.

- Control: It allows you to model different scenarios to find the best path toward your financial goals.

Whether you’re a seasoned investor comparing rates on an sbi bank fixed deposit interest calculator or a beginner planning your first savings goal, a reliable calculator fixed deposit interest is the first step toward building a secure financial future. Don’t just save your money—plan its growth. Use a calculator fixed deposit interest to see exactly what your money can do for you.

Conclusion

A fixed deposit interest calculator is a key ally in today’s financial journey. It helps you cut through the confusion and make confident, data-driven choices for your savings. With the ability to compare rates, forecast maturity amounts, and plan for real-life goals, you gain financial clarity and control at your fingertips. Take advantage of this practical tool to map out your savings strategy, make the most of every rupee you invest, and ensure your hard-earned money is working its hardest for you. Start using a calculator fixed deposit interest and take the first step toward mastering your financial future.

FAQs

How can a calculator for fixed deposit interest help me plan my finances?

Using a calculator for fixed deposit interest gives you a clear and accurate picture of how your savings can grow over time. Instead of guessing, you can input your investment amount, the interest rate, and how long you plan to save. The tool instantly shows you the final maturity amount. This is incredibly useful for planning major life goals, like saving for a down payment on a home, funding a child’s education, or building a retirement fund, because it turns your financial goals into concrete, achievable numbers.

Is there a difference between a bank’s official calculator and a general one?

Yes, there can be slight differences. A bank’s specific calculator, like a rate of interest on fixed deposit sbi calculator, is pre-loaded with their exact interest rates and compounding rules. A general calculator offers more flexibility, allowing you to compare offers from multiple banks side-by-side. The best approach is to use the bank’s tool to get their official figures and then use a general calculator to see how that offer stacks up against competitors, ensuring you find the best possible return.

How accurate is the maturity amount shown by an FD calculator?

The calculations are highly accurate, as they are based on the standard mathematical formula for compound interest. The final maturity amount you receive from the bank should match what the calculator shows, provided you input the correct details: principal amount, interest rate, tenure, and the bank’s compounding frequency (e.g., quarterly, annually). Always double-check that the inputs you’re using reflect the exact terms of the fixed deposit offer.