Enter Details

Future Cost

Purchasing Power Loss

0%

Salary Needed (same power)

$0

Half‑life of purchasing power

— yrs

Real Return (vs inflation)

0%

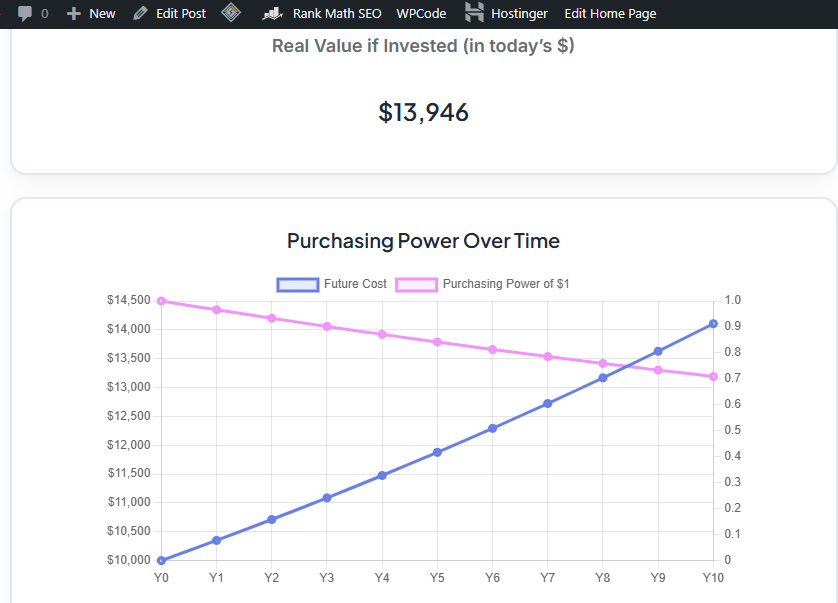

Real Value if Invested (in today’s $)

$0

Purchasing Power Over Time

Year‑by‑Year

| Year | Inflation Rate | Cumulative Factor | Future Cost | $1 Power |

|---|---|---|---|---|

| — | ||||

Advanced Inflation Calculator with Variable Rates

It was a Tuesday evening, nothing special, but for the Sharma family, it felt like another financial puzzle they just couldn’t solve. Rohan stared at the grocery bill on the kitchen table, his forehead creased with worry. The total was nearly 20% higher than it was just a year ago, yet their shopping cart seemed to hold less. His wife, Priya, was trying to figure out their son’s future education fund, but the numbers refused to cooperate.

The savings plan they had so carefully put together five years ago now looked painfully small. “Will this even cover his first year?” she asked, her voice quiet and filled with the kind of worry that so many families feel today. “It feels like we’re running on a treadmill, Rohan. We keep saving, but we never seem to get any closer to our goals.”

This feeling—the quiet, creeping anxiety that your hard-earned money is losing its strength—is the personal story of inflation. It’s not just a headline you see on the news or a number announced by the government; it’s the invisible force that makes your salary feel smaller, your savings less secure, and your retirement dreams more distant.

For years, we’ve been told to save and invest, but what happens when the very value of our money disappears faster than we can gather it? How can you possibly plan for a future when the financial goalposts are constantly moving? The usual advice often misses the mark because it fails to address a critical detail: inflation isn’t a steady, predictable line. It’s a volatile, fluctuating force.

This is exactly why a more sophisticated tool is necessary—one that can help you navigate the unpredictable waters of the economy. This is where our advanced inflation calculator with variable rates comes into play. It is more than just a simple number-cruncher; it’s a powerful financial planning partner designed for the real world.

This tool acts as an effective inflation impact on purchasing power calculator, showing you not just the future cost of things, but the tangible loss of your money’s value over time. It lets you go beyond simple projections by entering different inflation rates for each year, which mirrors the economic ups and downs we actually live through.

Moreover, it serves as a real return vs inflation calculator, helping you see if your investments are truly growing or just treading water against rising costs. By comparing your nominal returns against changing inflation, you get a clear, honest picture of your financial health.

Whether you’re a young professional trying to understand your salary’s real worth, a parent planning for big future expenses, or a retiree carefully managing a fixed income, this advanced inflation calculator with variable rates gives you the power to make informed choices. It turns abstract fears about inflation into solid data, giving you the clarity and confidence you need to protect your financial future. This is the primary mission of a well-designed advanced inflation calculator with variable rates.

The Silent Thief in Your Wallet: Why Variable Inflation Matters

At its core, inflation is the rate at which prices for goods and services go up, and as a result, the purchasing power of your money goes down. Think of it this way: the dollar in your pocket today will buy you less than it did last year. This isn’t just an abstract economic idea; it’s a real force that quietly changes our daily lives and long-term dreams.

It’s the reason your grandparents can talk about buying candy for a nickel, a story that sounds like a fantasy today. Using an advanced inflation calculator with variable rates helps you measure this change over time.

Imagine you have a $100 budget for your weekly groceries. A few years ago, that might have filled your cart to overflowing with essentials and even a few treats. Today, that same $100 bill might only cover the absolute basics, forcing you to choose between things you used to buy without a second thought.

That is the inflation effect on money value in action. Your money hasn’t changed, but its power—what it can actually get for you—has faded. This is why a simple Inflation Calculator isn’t always enough. You need an advanced inflation calculator with variable rates to see the whole story.

This loss of purchasing power is especially hard on those with a fixed income. Think about a retiree who planned their finances perfectly, saving enough to live comfortably on $50,000 a year. When they first retired, this was plenty. But as the years pass and inflation rises, their income stays the same while the cost of everything—from healthcare and utilities to food and fuel—goes up.

Their financial security slowly comes apart, not because of bad planning, but because the value of their savings is being silently eaten away. An advanced inflation calculator with variable rates can help you visualize this decline, turning a vague fear into a quantifiable problem that can be addressed.

Why Constant Inflation Rates Are a Dangerous Assumption

For decades, financial planning tools have tried to simplify this complex problem by using a single, average inflation rate—often around 3%—to project future costs. While it’s better than ignoring inflation completely, it gives you an incomplete and dangerously rosy picture. The truth is that inflation is rarely stable. Economic conditions, global events, and government policies cause it to swing wildly.

A simple cost of living inflation calculator using a fixed average just can’t show the real impact of these volatile spikes. Relying on a single number is like trying to sail through a storm with a compass that only points in an average direction—it ignores the turbulent waves that can throw you completely off course. A proper advanced inflation calculator with variable rates accounts for these waves.

This is where the need for a more sophisticated approach becomes obvious. To truly understand and get ready for the future, you have to account for this volatility. You need a tool that lets you see how different scenarios—a few years of high inflation followed by a period of stability, for instance—will affect your financial goals.

This is why an advanced inflation calculator with variable rates is no longer a luxury but a flat-out necessity for anyone serious about protecting their financial future. It allows you to model real-world economic swings, providing a much more accurate forecast of your money’s future worth. By moving past simplistic averages, you can build plans that are tough enough to handle the economy’s ups and downs. This is the distinct advantage of using an advanced inflation calculator with variable rates.

The difference between a fixed-rate projection and a variable-rate one can be shocking. A few years of high inflation can do much more damage to long-term savings than decades of low, steady inflation. An advanced inflation calculator with variable rates is built to capture this important difference, giving you a clearer path forward.

This inflation trend analysis calculator is critical for any serious long-term planning. Without an advanced inflation calculator with variable rates, you are planning with one eye closed. The best financial plans are built with the most realistic data, which is what a top-tier advanced inflation calculator with variable rates provides. It’s a fundamental shift from hopeful guessing to strategic planning.

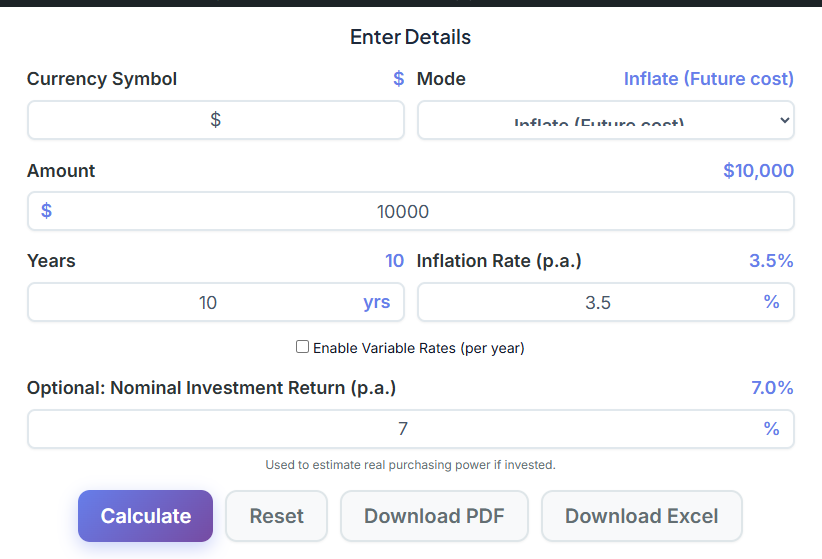

A Walkthrough of the Advanced Inflation Calculator with Variable Rates

Financial tools can often feel intimidating, packed with jargon and confusing layouts. We designed this advanced inflation calculator with variable rates with simplicity and clarity at its core. It’s built to give you powerful insights without you needing a degree in economics. Let’s walk through how you can use this tool to turn your financial questions into clear, understandable answers. The interface is designed to be intuitive, guiding you through the process of understanding your money’s future without any friction.

Your Starting Point: Setting Up the Calculation

The top part of the tool is your control panel. This is where you give it the basic details for your scenario. The layout is clean, with clearly labeled fields to ensure you know exactly what information is needed to get started.

- Currency Symbol & Mode: First, you can set your currency. The default is dollars ($), but you can easily change it to pounds (£), euros (€), or any other symbol that matches your financial world. Next to that, you choose a mode from a dropdown menu.

- The “Inflate (Future cost)” mode answers questions like, “If a wedding costs $30,000 today, what will it cost me in 10 years?” This is perfect for goal setting and future planning. The “Deflate (Present equivalent)” mode does the opposite, answering, “What is the real-world value of a $1,000,000 retirement fund in 20 years, in today’s money?” This flexibility makes our advanced inflation calculator with variable rates incredibly useful for different financial questions.

- Amount & Years: These two fields are the foundation of your calculation. The “Amount” field is where you enter the monetary value you want to analyze—it could be your current salary, the cost of a new car, a down payment, or a big savings goal. In the “Years” field, you define the period you want to project over.

- For a university fund for a young child, you might enter “$50,000” as the amount and “10” for the years. It’s simple, direct, and gets you on the path to clear answers quickly. An advanced inflation calculator with variable rates should always be this user-friendly.

- Inflation Rate (p.a.): For a quick, back-of-the-napkin projection, you can type a single, constant rate here. This represents the average annual inflation rate you expect over the entire period. This is useful for a baseline calculation. But the true power of this advanced inflation calculator with variable rates is unlocked with the next, more dynamic feature, which moves beyond simple averages.

Unlocking Realistic Projections with Variable Rates

This is what makes our advanced inflation calculator with variable rates so different and powerful. Below the main inputs, you’ll find a checkbox that says “Enable Variable Rates (per year).” When you click this, the tool transforms into a dynamic yearly inflation rate comparison calculator. A new section appears with a list of input fields, one for each year of your timeline. This is where the magic happens.

Now you can map out a more realistic path, reflecting economic forecasts or historical trends. For instance, you could model 6% inflation for two years during a volatile period, followed by 4% for the next three, and a stable 3% for the five years after that. This feature elevates a simple guess into a detailed, year-by-year projection, making this the best advanced inflation calculator with variable rates for planning out different “what-if” scenarios and stress-testing your financial plans.

You can create an optimistic case, a pessimistic case, and a realistic case to see a full range of potential outcomes. This level of detail is something only a premium advanced inflation calculator with variable rates can offer.

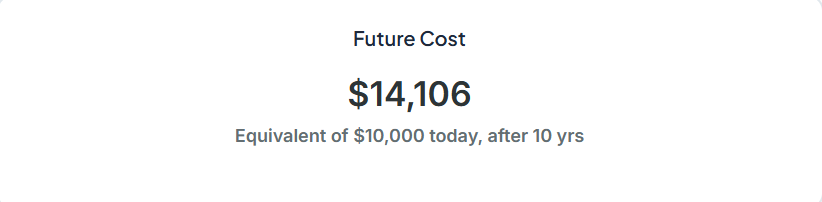

Calculating and Understanding Your Results

Once you hit the “Calculate” button, the advanced inflation calculator with variable rates instantly shows you a full breakdown of the results in the sections below. The main output box gives you the big headline number—the final future cost or present equivalent value. It’s the answer to your initial question. But the insights go much deeper, with several output boxes dedicated to key metrics that tell the full story:

- Purchasing Power Loss: This shows the percentage by which your money has become weaker over the specified period. It’s a stark, numerical representation of inflation’s corrosive effect. Seeing that your money will lose 30% of its value over a decade is a powerful motivator.

- Salary Needed: This is an incredibly useful metric for career planning. It calculates the future salary you’d need to have the same lifestyle and buying power you do now. It’s the perfect data point to bring into a salary negotiation.

- Half-life of purchasing power: A striking metric showing how many years it would take for your money’s value to be cut in half, based on the average inflation rate of your scenario. This can be a real eye-opener.

- Real Return: Your actual gain after inflation. If you enter an optional nominal investment return (e.g., from a mutual fund), this box shows you what your real growth is after inflation has taken its share. This is the truest measure of an investment’s performance and a key feature of a comprehensive advanced inflation calculator with variable rates.

Finally, this advanced inflation calculator with variable rates presents a year-by-year table and a simple chart. The table provides a detailed breakdown of how the values change each year according to your inputs. The chart gives you an immediate visual of your money’s journey over time, with lines representing future cost and the declining power of your money. This is why a superior advanced inflation calculator with variable rates focuses on both the numbers and making them easy to understand visually.

From Theory to Reality: Applying the Calculator to Your Life

Numbers on a screen are one thing; what they mean for your family, your career, and your future is what truly matters. The power of this advanced inflation calculator with variable rates is unleashed when you use it to answer the financial questions that keep you up at night. The true value of this advanced inflation calculator with variable rates lies in its real-world application, turning abstract numbers into life-changing insights. Let’s look at more detailed scenarios.

Scenario 1: The Young Family and the Ever-Expanding Budget

Meet Mark and Sarah, who feel like their monthly budget is shrinking even though they’re earning more. They use the advanced inflation calculator with variable rates to project their $5,000 monthly budget five years into the future. Instead of a flat rate, they input the actual inflation they experienced: 6% two years ago, 5% last year, and a projected 3.5% for the next three years.

The result is a shock: they’ll need over $6,200 a month to live the same life. This isn’t just a number; it’s the cost of their children’s future activities, family vacations, and savings goals. This advanced inflation calculator with variable rates gives them a concrete target to aim for, transforming vague worry into a specific financial goal. They can now adjust their budget and savings strategy with purpose.

Scenario 2: The Ambitious Professional and the Shrinking Salary

Anika, a talented software developer, got a 4% raise but felt like she was falling behind. She uses the tool as a salary inflation adjustment calculator. With inflation running at 5.5% that year, her raise was actually a pay cut in real terms. Her wage value over time tool proved it.

The “Salary Needed” output showed she required a salary of $94,950 just to maintain her purchasing power, but her raise only brought her to $93,600. Armed with this data from the advanced inflation calculator with variable rates, she can now make a better case for her true worth in her next performance review. This income erosion calculator is a powerful tool for any career negotiation. Using an advanced inflation calculator with variable rates empowers her to advocate for herself effectively.

Scenario 3: Planning for a Dream—The Future Education Fund

Let’s go back to the Sharmas, who were so worried about their son’s education fund. They use the advanced inflation calculator with variable rates to project the future cost of a $50,000 degree in 10 years. By using a path of variable rates—two years of 5% inflation, three of 4%, and five of a stable 3%—the tool shows the cost could easily top $72,000. This real buying power forecast is scary but also empowering. It replaces their anxiety with a clear target, something a basic Compound Interest Calculator could never do.

This demonstrates the immense value of a high-quality advanced inflation calculator with variable rates when planning for major life goals. This kind of planning requires a tool as robust as this advanced inflation calculator with variable rates.

Scenario 4: The Retiree’s Dilemma—Protecting a Fixed Nest Egg

David retired with a $1 million nest egg, and he withdraws $50,000 every year. He uses the advanced inflation calculator with variable rates in “Deflate” mode and sees that his withdrawal today only has the buying power of about $42,000 from when he first retired. He then uses it as an investment inflation impact calculator.

Even though his portfolio grew by 6% on paper, his “Real Return” was a tiny 1.5% after accounting for inflation. The advanced inflation calculator with variable rates shows him the unfiltered truth, allowing him to adjust his strategy with his financial advisor. This highlights the tool’s importance as a safe withdrawal inflation tool. For any retiree, an advanced inflation calculator with variable rates is an essential piece of their financial toolkit. He realizes that to maintain his lifestyle, his withdrawal amounts need to be adjusted upwards, a conclusion he could only reach with an advanced inflation calculator with variable rates.

This advanced inflation calculator with variable rates is more than a utility; it’s a partner in your financial journey. Each of these stories shows how the advanced inflation calculator with variable rates brings clarity. For anyone who is serious about their money, an advanced inflation calculator with variable rates is indispensable. The insights you can gain from a top-tier advanced inflation calculator with variable rates can completely redefine your financial strategy. An advanced inflation calculator with variable rates is simply a must-have for modern financial planning. Making smart decisions requires an advanced inflation calculator with variable rates.

Fighting Back: Practical Strategies to Protect Your Money from Inflation

Understanding inflation’s impact with an advanced inflation calculator with variable rates is the crucial first step. The second, and more important, step is taking action. Knowledge without a plan just leads to worry. Here are some practical, real-world strategies you can use to protect and grow your purchasing power when costs are rising. The clarity you get from an advanced inflation calculator with variable rates should fuel your strategy.

1. Invest to Outpace Inflation

The single most effective long-term strategy against inflation is to invest your money wisely. Cash sitting in a low-yield savings account is guaranteed to lose purchasing power over time. You can use a Simple Interest Calculator to see this for yourself. The goal is to achieve a real return—a return that is higher than the rate of inflation. The real return calculator feature in our advanced inflation calculator with variable rates is perfect for this.

- Stocks and Equities: Historically, the stock market has provided returns that significantly outpace inflation over the long run. Investing in a diversified portfolio of stocks or low-cost index funds gives your money the potential to grow faster than costs are rising.

- Real Estate: Property can be a good hedge against inflation. As the cost of living increases, so do rental incomes and property values. Whether it’s a primary residence or an investment property, real estate can provide a tangible asset that appreciates in value.

- Inflation-Protected Securities: Assets like Treasury Inflation-Protected Securities (TIPS) are specifically designed to protect against inflation. Their principal value increases with inflation, providing a safe haven for a portion of your portfolio. Use our advanced inflation calculator with variable rates to see how these might fit into your plan.

- Commodities: Investing in raw materials like gold, silver, or oil can also be a hedge. The prices of these goods often rise with inflation, protecting the value of your investment.

2. Focus on Growing Your Income

Your earning power is your most valuable financial asset. Actively working to increase your income is a direct way to combat the effects of a rising cost of living. Don’t just rely on standard annual raises, which may not even keep up with inflation. An advanced inflation calculator with variable rates will prove this.

- Negotiate Your Salary: Use tools like our advanced inflation calculator with variable rates to understand your real wage growth. Armed with data, you can negotiate for raises that not only reward your performance but also account for the loss of purchasing power.

- Develop New Skills: Investing in yourself by learning new, in-demand skills can open doors to higher-paying roles and industries. This is a proactive way to ensure your income doesn’t stagnate.

- Create Additional Income Streams: Consider freelancing, consulting, or starting a small side business. A diversified income is more resilient to economic shifts and provides an extra cushion against rising expenses.

3. Manage Your Debts and Major Expenses

High-interest debt can be a significant drain on your finances, especially in an inflationary environment where every dollar counts. A solid financial plan requires a smart debt management strategy. An EMI Calculator can help you understand loan payments.

- Refinance High-Interest Debt: If you have high-interest credit card debt or personal loans, consider consolidating them into a lower-interest loan. This can free up cash flow that can be redirected toward savings or investments.

- Lock in Fixed Rates: If you are planning a major purchase like a home or a car, locking in a low, fixed-rate mortgage or loan can protect you from future interest rate hikes, which often accompany periods of high inflation.

- Delay Large Purchases: If possible, consider postponing major non-essential purchases during periods of peak inflation when prices are inflated and borrowing costs may be high. Planning with an advanced inflation calculator with variable rates can help you decide the best time to buy.

4. Optimize Your Budget for What Matters

A budget isn’t about restriction; it’s about intentionality. An inflationary environment is the perfect time to review and optimize your spending. It’s not about cutting out all joy, but about making sure your money is going toward what you value most.

- Review Subscriptions and Recurring Charges: Small monthly charges for services you no longer use can add up. Take an hour to audit your subscriptions and cancel what you don’t need.

- Look for Deals and Alternatives: Be a smart consumer. Look for discounts, buy generic brands, and plan your meals to reduce food waste. These small habits can lead to significant savings over time.

- Automate Your Savings: Treat your savings like a bill. Set up automatic transfers to your investment and savings accounts each payday. This “pay yourself first” approach ensures you are consistently building wealth. You can use an FD Calculator to see how fixed deposits grow, but remember to compare that growth to inflation using our advanced inflation calculator with variable rates.

Conclusion: Taking Control with Clarity and Confidence

Navigating the complexities of personal finance can feel like trying to find your way in a thick fog. Inflation, with its silent and steady erosion of your hard-earned money, is one of the biggest reasons for this uncertainty. It creates a gap between where you think you are and where you actually stand, making it nearly impossible to plan for the future with any real confidence. This is where the true value of an advanced inflation calculator with variable rates shines brightest.

Throughout this guide, we’ve explored how this powerful tool does more than just crunch numbers. It tells a story—the story of your money. By moving beyond simplistic, fixed-rate averages and embracing the real-world volatility of variable inflation rates, you gain a level of clarity that is transformative.

You can see precisely how a few years of high inflation will impact your retirement, what that “standard” raise really means for your lifestyle, and what the true target for your child’s education fund should be. The advanced inflation calculator with variable rates pulls back the curtain on the abstract concept of inflation and reveals its tangible, personal impact.

The journey from the Sharma family’s kitchen table worries to David the retiree’s strategic adjustments is a journey from anxiety to empowerment. This is the path that an advanced inflation calculator with variable rates makes possible. It provides the data-driven foundation you need to have meaningful conversations with your family, your employer, and your financial advisor. It equips you to build a financial plan that is not based on hope, but on a realistic understanding of the economic forces at play.

Ultimately, financial planning is a dynamic process. The economy changes, your life changes, and your goals change. Using a powerful tool like the advanced inflation calculator with variable rates gives you the ongoing clarity needed to adapt and thrive. It empowers you to move from a position of anxiety to one of confidence, armed with the knowledge to make proactive decisions. Your financial future isn’t something that just happens to you; it’s something you build, one informed choice at a time.

And with the right tools, like this advanced inflation calculator with variable rates, you are the architect of that future. This is why every modern financial toolkit should include an advanced inflation calculator with variable rates. To plan effectively, you need an advanced inflation calculator with variable rates. Your journey to financial clarity starts with an advanced inflation calculator with variable rates. Trust an advanced inflation calculator with variable rates to guide you. An advanced inflation calculator with variable rates is your best defense. Finally, don’t forget to factor in taxes on any investment gains using a Tax Calculator to get the full picture of your financial health.

Faqs

What is an advanced inflation calculator with variable rates?

An advanced inflation calculator with variable rates is a financial tool that helps you project the future value of money by accounting for changing inflation rates over time. Unlike basic calculators, it allows you to input different inflation rates for each year, providing a more accurate and realistic forecast of your financial goals.

How can an advanced inflation calculator with variable rates help me?

This tool helps you understand how inflation impacts your purchasing power, savings, and investments. Whether you’re planning for retirement, budgeting for a major expense, or negotiating a salary, it provides clear insights to make informed financial decisions.

Who should use an advanced inflation calculator with variable rates?

Anyone looking to plan their financial future can benefit from this tool. It’s especially useful for families budgeting for education, professionals tracking salary growth, and retirees managing fixed incomes. It’s a must-have for anyone serious about long-term financial planning.