💵 Enter Your Savings Details

Total Savings

$77,641

Total Deposits

$61,000

Interest Earned

$16,641

Return on Investment

27.3%

Savings Breakdown

Year-wise Growth

| Year | Deposits | Interest | Balance |

|---|---|---|---|

| Click Calculate | |||

🆘 Emergency Fund Setup

Target Amount

$18,000

Current Fund

$5,000

Still Needed

$13,000

Months to Goal

26

Fund Progress

🏖️ Retirement Planning

Retirement Corpus

$2,180,000

Total Contributions

$470,000

Investment Growth

$1,710,000

Years to Retirement

35

Retirement Growth

Monthly Retirement Income

| Withdrawal Rate | Monthly Income |

|---|---|

| 3% (Conservative) | $5,450/mo |

| 4% (Standard) | $7,267/mo |

| 5% (Aggressive) | $9,083/mo |

Your Ultimate Guide to Using a Smart Savings Calculator Online

Taking control of your finances can feel like a monumental task. You know you need to save, but the questions can be overwhelming. How much is enough? How long will it take? Is my goal even realistic? It’s easy to get stuck in a cycle of uncertainty, putting off planning for another day. But what if you had a tool that could instantly clear away the fog, turning vague financial hopes into a concrete, actionable plan?

This is where a Smart Savings Calculator Online becomes your most valuable ally. It’s not just a numbers tool; it’s a personal financial roadmap. It helps you visualize your future, understand the power of compounding, and make informed decisions that align with your life goals. Whether you’re saving for a down payment, a dream vacation, or just building a safety net, this guide will walk you through every feature of a modern Smart Savings Calculator Online, transforming how you see and manage your money. We’ll move from the basic inputs to advanced saving strategies, so you have the confidence to build the future you deserve.

Why a Smart Savings Calculator Online is a Game-Changer

With so much financial advice out there, a Smart Savings Calculator Online stands out for its clarity and personalization. It’s not about generic rules—it’s about your numbers, timeline, and goals. The calculator provides instant clarity and motivation by letting you see how your saving habits shape your future.

Seeing your money grow—even hypothetically—serves as a powerful motivator. Instead of guessing, you can try out different strategies on a savings planner calculator for budgeting and goals and see how a small change (like saving $50 more each month or finding an account with higher interest) can impact the outcome. Try plugging those tweaks into a Compound Interest Calculator or a Simple Interest Calculator for a quick comparison, and you’ll appreciate the flexibility even more. A Smart Savings Calculator Online gives you real insight, helping you map out choices that fit your real life.

Getting Started: A Step-by-Step Walkthrough

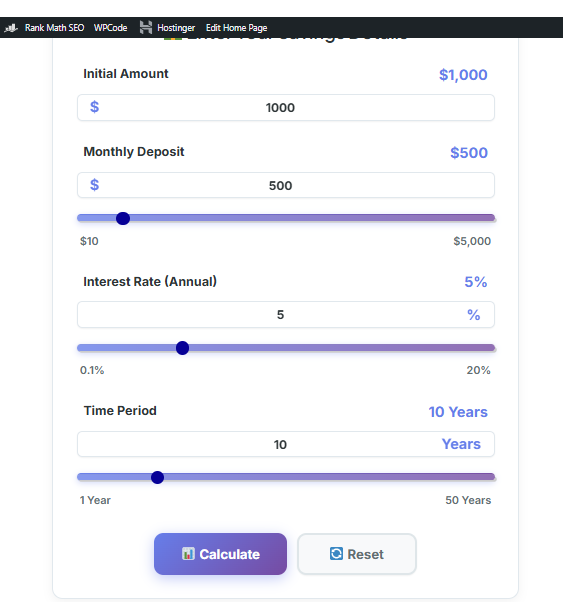

Let’s break down using this tool into easy steps. We’ll emphasize the main “Savings” tab where most people begin. The idea is to turn your financial situation into inputs that reveal your road ahead.

- Open the Calculator: Start at the Smart Savings Calculator Online. You’ll usually find three tabs: Savings, Emergency, and Retirement. Make sure “Savings” is selected.

- Enter Your Details: Plug in your existing savings, planned monthly deposit, expected annual interest rate, and how many years you plan to save.

- Calculate Your Future: Hit “Calculate.”

- Analyze Your Results: Instantly, you’ll see a projection of your total savings, a clear split between what you deposited and what you earned in interest, your return on investment, and visuals like charts and year-by-year tables for deeper context.

You can try these steps alongside a Budget Calculator if you want to clarify how much you can save each month. Once you see those projections, you’ll have real numbers to work with, which often feels like a breath of fresh air.

Deep Dive: Understanding Every Input and Output

A calculator is only as smart as the data you give it—and your understanding of the outputs. Here’s what the main fields in the Smart Savings Calculator Online really mean and why they matter.

| Input Field | What It Means | Why It’s Important |

|---|---|---|

| Initial Amount | The starting money you already have in savings. | A bigger initial amount lets you take advantage of compounding from day one. Even small sums matter—everyone begins somewhere! |

| Monthly Deposit | Amount you plan to save each month on top of your starting amount. | This is the engine of your plan. Small, steady savings are shockingly effective—if you want a comparison, plug different values into the SIP Calculator and see for yourself. |

| Interest Rate (Annual) | The yearly growth rate you expect from your bank or investments. | The higher your rate, the faster your savings multiply over time. This forms the core of any future savings value calculator with interest—and you can compare rates at sites like high-yield bank reviews. |

| Time Period (Years) | How long you plan to keep building your savings for this specific goal. | Time is your greatest asset—long periods let compounding do most of the work. Using a long-term savings calculator for financial goals is a smart move for anything big, like a wedding or house. |

If you’re just starting out, you might find it helpful to play with a Simple Interest Calculator before coming back here. Experts check and re-check the interest rate, often comparing options with a Fixed Deposit / FD Calculator or High Yield Savings Calculator, optimizing for growth but being realistic.

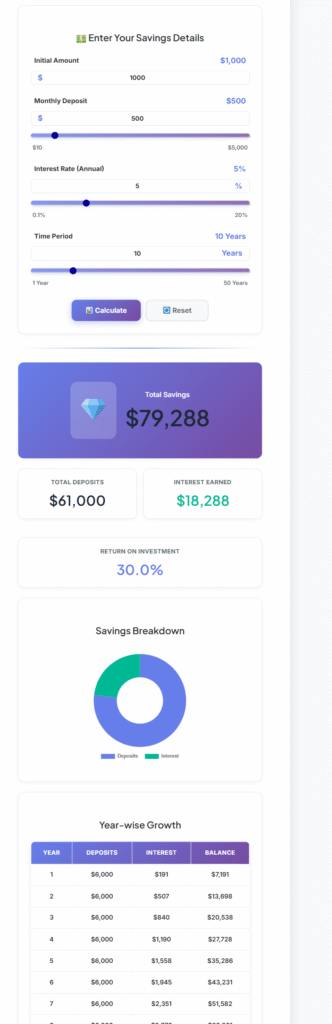

The Results: Your Financial Future Visualized

Here’s what you’ll see after calculation:

- Total Savings: The magic number—the total you’ll have at the end by adding your initial amount, deposits, and all the interest earned.

- Total Deposits: This is your contribution, letting you see exactly how much progress came from discipline.

- Interest Earned: The “free money” result of compounding. Watch this grow each year; it’s the most motivating number, and it’s what a savings return calculator highlights best.

- Return on Investment (ROI): Your interest as a percentage of your total deposits. For example, 25% ROI means you earned $25 for each $100 saved—this feature is core to any ROI savings calculator.

- Savings Breakdown Chart: A visual, at-a-glance doughnut chart of deposits vs. interest. As years go by, the interest section grows huge.

- Year-wise Growth Table: Your detailed progress by the year: deposits, interest, and balance—a perfect tool for staying on track. Great for an annual savings growth calculator.

Real-World Scenarios: Putting the Calculator to Work

Here’s how real people put the Smart Savings Calculator Online to work:

Sarah’s First Car

At 22, Sarah is saving for her first car down payment—her dream is $5,000 in three years.

- Initial: $500 from birthday money

- Monthly: $120

- Interest Rate: 4% (see what a High Yield Savings Calculator can offer)

- Time: 3 years

Result: The Smart Savings Calculator Online projects $5,135 for Sarah. She crushes her goal, thanks to compounding. Those forms that work as a car savings calculator are spot-on for planning out vehicle purchases.

The Millers’ Dream Vacation

The Millers want a $15,000 trip in five years and have $2,000 saved.

- Initial: $2,000

- Monthly: Not sure—this is where the tool shines

- Interest Rate: 4.5%

- Time: 5 years (run the numbers as a 5 year savings calculator)

The Smart Savings Calculator Online helps them work backwards; they learn that saving $185 a month gets them to $15,080. Plug in your own trip scenario as a travel savings calculator and see your dreams become targets.

David’s Long-Term Ambition

David wants $100,000 in savings by forty. He uses the “how much should I save monthly calculator” feature.

- Initial: $10,000

- Monthly: To be found via calculations

- Interest Rate: 7% in a balanced portfolio

- Time: 10 years (perfect for a 10 year savings calculator)

After some adjustments, the Smart Savings Calculator Online reveals a monthly savings goal of about $475. This lets David set a plan for his own long term savings calculator for financial goals—no more guessing.

Advanced Insights: Thinking Like a Financial Pro

Once you’re comfortable, ramp up your usage like a pro:

1. Run “What If” Scenarios: Try out new monthly contributions, different rates, or adjusting your timeline. Watch how even a year’s delay hurts with the Smart Savings Calculator Online—it provides instant accountability. Sometimes running this with a SIP Calculator or even an EMI Calculator helps you see where savings can be squeezed from your budget.

2. Account for Inflation: Numbers are only powerful if they keep their value. Test what your future funds will really be worth using an Inflation Calculator. Always shoot for a rate of return that beats inflation, or your gains may not feel as good as predicted. Run results with an inflation-adjusted savings calculator for added realism.

3. Set Milestone Goals: Big goals feel smaller when broken down. Set near-term milestones with the built-in milestone-based savings calculator features—think $10,000, then $25,000, and so on. Curious how fast you hit your first $100,000? Use a Million Dollar Savings Calculator for even bigger ambitions, or try for $100,000 (1 lakh) using the relevant tab for a 1 lakh savings calculator.

4. Compare Savings Frequencies: Paid bi-weekly? Adjust your monthly average. Want to test quarterly inputs? Just use a Quarterly Savings Calculator for comparison, or check out a Bi-Weekly Savings Calculator.

Comparing Savings Strategies

Here’s a direct comparison to help clarify the value of small changes:

| Strategy | Monthly Deposit | Interest Rate | Total Deposits | Interest Earned | Final Amount |

|---|---|---|---|---|---|

| “Slow and Steady” | $300 | 4% | $72,000 | $38,542 | $110,542 |

| “Slightly Ambitious” | $400 | 6% | $96,000 | $90,305 | $186,305 |

Small increases in monthly savings and interest create massive differences over 20 years. This is one of many ways the Smart Savings Calculator Online inspires bigger thinking and consistent action.

Exploring the Other Tabs: Emergency and Retirement Funds

The best Smart Savings Calculator Online also prepares you for financial curveballs and your golden years.

The Emergency Fund Calculator

Wondering how much you need for peace of mind? The “Emergency” tab helps you find the right size for a rainy day fund. Enter monthly expenses, desired months of coverage, and the tool will show you both your target and the savings plan to get you there. For more details, try using a Simple Interest Calculator for basic comparisons, but do rely on emergency fund features for full accuracy—this is the role of a short-term savings calculator.

The Retirement Calculator

The “Retirement” tab is your long-horizon planning hub. Fill in your age, target retirement age, current savings, and what you can contribute monthly. The calculator estimates your future nest egg and simulates potential retirement income at different withdrawal rates. Curious how your projections might differ with investment changes? Try a Compound Interest Calculator or check the results in a Retirement Planner for confirmation. Having a robust future savings value calculator with interest is invaluable as you plan for life after work.

The Power of Automation and Smart Planning

The Smart Savings Calculator Online works best when paired with action. Once you see your target, set up automated transfers using your bank app. This combo of a great automated savings calculator and real-world automation ensures your plan turns into actual results.

Because it’s a truly personalized savings calculator, you can use it for any goal—weddings (check out a Wedding Savings Calculator), dream trips, or special events (use a Special Event Savings Calculator). The methodology is the same; only the target changes.

Tips for Maximum Accuracy

Here’s how to get the best from your Smart Savings Calculator Online:

- Be Realistic with Your Interest Rate: Don’t guess—use your bank’s real rate or check averages with a High Yield Savings Calculator.

- Be Honest with Your Monthly Deposit: Not sure what’s realistic? Use a Budget Calculator to track spending and find your “true” monthly surplus.

- Update Regularly: Your finances (and goals) change, so review your plan every few months. Stay flexible and use an EMI Calculator if you’re managing loans alongside savings.

- Add Extra Deposits: Tax refund? Bonus? Log one-time spikes as “Initial Amount” and rerun the plan for a nice surprise—this is an essential feature of a great savings planner calculator for budgeting and goals.

Don’t forget: consistency works wonders. Make using a Smart Savings Calculator Online a regular part of your financial check-ins.

Frequently Asked Questions (FAQs)

How much should I save each month?

Start by tracking your real spending—then use the Smart Savings Calculator Online to work backwards from your goal. If you need help understanding loan commitments, jump over to the EMI Calculator.

What interest rate is realistic for long-term goals?

For plans lasting 10+ years, historical stock market averages (about 7–10%) are common, but be conservative. For short-term plans, use what you can get from a High Yield Savings Calculator. Having this flexibility, and seeing both scenarios, is one of the tool’s biggest strengths.

Is my data secure?

Absolutely—your info isn’t stored or shared. The Smart Savings Calculator Online works right in your browser, just like many reputable online calculators.

Can this calculator help while managing debt?

Definitely. Build a parallel savings plan, focusing first on a small emergency fund. For debt insights, check out our helpful Credit Card Calculator, which breaks down high-interest costs.

How is a Smart Savings Calculator Online different from a simple compound interest calculator?

They share some math, but this tool ties in regular contributions, starting balance, and long-term planning—all in one spot. For quick context, try a Compound Interest Calculator or a Simple Interest Calculator, but come back for full tracking and goal-based planning.

What if I save quarterly, not monthly?

Divide your quarterly savings by three for a monthly average, or use the built-in quarterly savings calculator tab if available.

Can I use this for wedding or other special goals?

Can I use this for wedding or other special goals?

Certainly. Just enter your timeline and target. Tweak monthly savings using the special event savings calculator feature—or check a Wedding Savings Calculator for focused projections.

Can I use this for wedding or other special goals?

Certainly. Just enter your timeline and target. Tweak monthly savings using the special event savings calculator feature—or check a Wedding Savings Calculator for focused projections.

Are the projections accurate?

Mathematically they’re precise, but the accuracy depends on your inputs—mainly the interest rate, which can change over time.

Does the calculator factor in taxes on interest?

No, it estimates pre-tax returns. For insights on after-tax yield, try a Tax Calculator.

Why are my results different from someone else with “the same” numbers?

Small input differences make big changes over time—especially the interest rate or timeline. That’s the teaching power of the Smart Savings Calculator Online.

Conclusion: Your Journey to Financial Clarity Starts Now

Financial planning doesn’t have to be guesswork or stress. A Smart Savings Calculator Online brings clarity and motivation—guiding you from scattered goals to a clear, actionable plan. Continue to experiment, update regularly, and lean on smart tools like the Budget Calculator and Compound Interest Calculator as you go.

The future is built on countless small, smart steps. By embracing a Smart Savings Calculator Online, you empower yourself to make those steps confidently—watching your progress every month. Stick with the process, and you’ll look back with pride on how steady savings, clear planning, and the right tools changed your life for the better.