Unlock Your Financial Future with Our Simple Interest Calculator

I still remember the moment I first learned about interest. I was around ten, saving up pennies and dimes from odd jobs and birthday cards. My father sat me down one day, explaining how banks and borrowing worked. He said, “If you lend $50 to a friend for two months at a 10% rate, he’ll owe you a little extra: five dollars—to thank you for letting him use your money.” Of course, when you’re ten, both the math and the concept seem a bit fuzzy.

But years later, when I got my first car loan and had to calculate interest by hand, my dad’s lesson came flooding back. That’s when I realized: understanding how simple interest works is more than math. It’s the key to making better financial decisions at every age.

We live in a world where money moves instantly, and decisions need to be quick—and precise. You don’t want to make a costly mistake simply because you misunderstood how much you’ll pay (or earn) in interest. That’s where a Simple Interest Calculator—the right one—changes everything.

A Simple Interest Calculator is a straightforward, practical tool designed to help you figure out exactly what you’ll pay or receive, without complicated formulas or confusion. Unlike calculators that require you to know advanced math or confuse you with technical vocabulary, a good Simple Interest Calculator lays out the facts in plain English and lets you focus on the big picture: your goals.

This article explores our Simple Interest Calculator—how it looks, feels, and works—so you can use it for everything from car loans and personal savings to planning school projects or side hustles. You’ll learn not only the technical side, but also why using a dedicated calculator can change your relationship with money. Think of this as your expert guide to a tool you’ll return to again and again, no matter where you are on your financial journey.

Why a Simple Interest Calculator Matters

Let’s talk about how simple interest really works, before jumping into design or features. Simple interest doesn’t build on itself; it’s always computed on the original amount, or principal. If you borrow $10,000 at 6% for three years, you’ll pay $600 a year in interest—or $1,800 total. No surprises. No extra layers.

Yet, mistakes happen all the time. People sometimes mix up simple and compound interest, or miscalculate monthly to annual rates. I’ve seen friends overestimate what they’ll earn from a savings bond or underestimate what they’ll owe on a personal loan. Even a few percentage points or misreading time frames can cost—or save—you hundreds or thousands. That’s why a trustworthy Simple Interest Calculator is priceless.

But why does it need to be online, accessible, and intuitive? The answer: the real world doesn’t wait for you to dust off a math textbook or boot up a spreadsheet. When you’re at the car dealer, on the phone with a bank, or sitting at your kitchen table planning your future, you want answers—fast, clear, and correct.

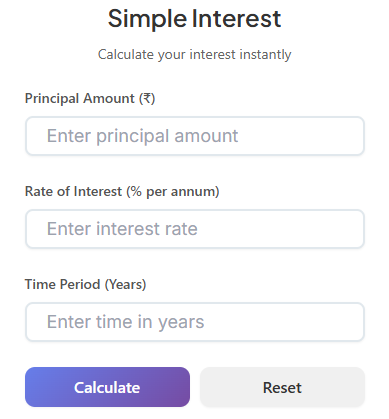

The Visual Experience: First Impressions that Build Confidence

Opening our Simple Interest Calculator is a little like walking into a thoughtfully designed space. The page greets you with a soft gradient background that’s calming, not distracting. In the center, everything you need sits on a crisp white card, slightly elevated and rounded at the corners. Immediately, you feel like you’re in a premium environment—one designed to help you focus on the numbers that matter.

We chose a clean, sans-serif font for effortless reading. The labels—Principal Amount, Interest Rate, Time Period—are easy to spot, never crammed or hidden. Each number you enter appears large, centered, and easy to verify. It sounds simple, but this is what financial confidence feels like: being able to double-check your work and feel sure you’re getting it right.

Our Simple Interest Calculator isn’t static. It quietly responds as you use it. Enter numbers, and the focus highlight gently guides your eyes. Buttons “lift” slightly when you hover; they’re snappy to click, never laggy or unresponsive—a subtle sign that this calculator is working for you, not against you.

The Importance of Mobile-First Design

How often do you sit at a desk with a desktop computer when you’re making financial decisions? Probably less than you’d think. Maybe you’re in a car dealership parking lot, your phone in hand, comparing loan options. Or you’re at a family dinner, checking a savings scenario on a tablet between bites. That’s why we built this Simple Interest Calculator to be truly mobile friendly.

The interface scales gracefully, from wide monitors to small mobile screens. You’re never left pinching, zooming, or hunting for a “submit” button. The inputs remain large enough for fingers, not just a mouse pointer, and everything flows naturally from top to bottom, one logical step at a time. When you need answers quickly—wherever you are—this kind of design makes all the difference.

Input Fields: Making Data Entry Effortless

Let’s get practical. At the heart of every Simple Interest Calculator are the fields that collect your numbers: Principal Amount, Interest Rate, and Time Period.

- Principal Amount ($): This is your starting figure. Whether it’s the amount you’re borrowing, lending, or investing, our input is set up for numbers only—a safeguard against errors. As you type, the amount is clearly displayed, so you can’t miss an extra digit or decimal place.

- Interest Rate (%): Too often, calculators make you second-guess: do I enter “5” or “0.05”? Ours expects a percentage—just punch in “5” for 5%. Clear labeling above the input box removes any doubt. There’s no need to mentally convert or worry about formatting.

- Time Period: Maybe your scenario is just a few months, or perhaps it spans years. Our Simple Interest Calculator offers a toggle so you can enter time in the format that fits your question. If it’s months, the calculator does the conversion quietly. Labels and inputs are visually aligned, making the flow seamless—no awkward tabbing or squinting needed.

These seemingly simple design choices make all the difference. They speed things up, increase accuracy, and reduce frustration. You can feel this difference every time you use the Simple Interest Calculator, whether you’re in a rush or taking your time.

Buttons that Guide the Experience

With data in place, you face two choices: run the numbers, or start over. Our Simple Interest Calculator gives you a prominent “Calculate” button, colored and placed to catch your attention. It responds to a hover with a slight animation—just enough to feel modern, not distracting.

Hit Calculate, and in an instant, you see your results. There’s no page refresh, no waiting, and definitely no awkward spinning icons. You immediately know how much interest you’ll pay or earn, and what the total repayment or payout will be.

If you make a mistake or want to try a different scenario, the “Reset” button is there—different in appearance so you won’t click it by accident. One tap clears out every field and result, and you’re ready to start again. It’s a flow that respects your time and works just as intuitively on desktop as it does from a touch screen while you’re on the go.

Result Section: Clear and Dynamically Revealed Answers

Some calculators dump the answer on the page without finesse, forcing you to hunt for the numbers that matter. Ours treats your results with care. Once you hit Calculate, they don’t just appear—they glide onto the screen, highlighted against the card background.

You get two clear values:

- Simple Interest: This is the extra you’ll pay (or receive), the heart of the calculation.

- Total Amount: The full payback or payoff—the principal plus simple interest during the period you chose.

No clutter, no hidden details, no confusion. The numbers are big and bold enough to check at a glance, but set within context, so you always understand exactly what you’re seeing. If you want to try a different scenario, the reset clears everything and waits for your next entry—no fuss, every time.

The Logic Under the Hood: Understanding the Simple Interest Calculation

Even if you don’t write code for a living, knowing what happens behind the scenes can deepen your trust in the tool. Let’s break down the process—no technical jargon required.

When you fill in the three inputs and click Calculate, the calculator’s logic goes to work. It grabs your principal, rate, and time period, making sure all three are filled out and numbers make sense—no random letters or triple-digit interest rates. If you try to enter something impossible, the Simple Interest Calculator gently lets you know instead of giving a wrong answer.

Next, it applies the formula:

Simple Interest = Principal x Rate x Time / 100

If your time was entered in months, it automatically divides by 12, converting months to years behind the scenes. The calculator then multiplies principal by rate (converted from a percentage to a decimal), times the time period. Out pops the interest amount, and from there, the final payout or payback total.

All this happens instantly, right in your browser, without sending information anywhere else. That keeps things private, fast, and always accessible, no matter your internet connection quality.

When you’re ready for a fresh calculation, hitting Reset clears every field and restores the Simple Interest Calculator to a ready state—like shaking an Etch A Sketch. The logic is robust and user-proof, resulting in a tool you can rely on again and again.

Real-Life Scenarios: How a Simple Interest Calculator Changes the Game

Let’s get personal. Over the years, I’ve seen—and used—a Simple Interest Calculator for more situations than I can count. Here are some you may recognize, whether for yourself or someone you know:

- Buying a Car: You snag a $15,000 car loan at 6% for five years. Plug it into the Simple Interest Calculator and you’ll see exactly how much interest you’re in for—no last-minute shocks when you add up payments.

- Borrowing from a Friend: You’re short $500 and agree to pay your friend back with a little interest as a thank-you, over a year. Enter the figures and you both know, upfront, how much extra you’ll pay—clear, honest, and fair.

- Short-Term Investment: Grandma is offering to “bank” your $1,000 at 3% for six months. The calculator reveals just what you’ll earn, so you can decide whether to park your money there or somewhere else.

- Payday Loan Warning: You’re tempted by a payday loan of $300 with a staggering fee. The Simple Interest Calculator uncovers just how brutal the real annual interest rate is. It’s an eye-opener—often enough to change your mind.

- Student Loan Grace Period: Loans don’t always start accruing right away. Quickly calculate the simple interest on $8,000 at 4% over the six-month grace period, so you know what you’ll owe before payments even start.

- Contractor Payments: You’re a contractor and want to impose a 5% penalty for late payments. When a client runs 60 days behind, you can document—right from your phone—the exact late fee owed, with no arguments.

- Comparing Savings Accounts: Maybe your bank offers 2%, but an online bank offers 2.3%. Plug in $5,000 for three years into both, and you can see, instantly, which deal earns you more and by how much.

- Family Lending: Parents sometimes lend to kids or grandkids, wanting fairness but also wanting to teach real-world lessons. The Simple Interest Calculator sets clear expectations, preventing confusion or resentment down the line.

- Small Business Loans: You’re thinking about financing inventory. With a few numbers, you can compare loan offers or structure repayment plans, all before signing anything.

- Fixing a Misunderstanding: One friend assumes monthly interest, another assumes yearly. The Simple Interest Calculator, set to the right mode, settles debates once and for all.

In each case, knowing the answer isn’t just comforting—it’s empowering. Accurate, real-time numbers mean you make better choices, avoid mistakes, and sometimes save a small fortune over time.

The Undeniable Benefits of a Modern, Online Simple Interest Calculator

So why give up on pen and paper, or handheld calculators, or clunky spreadsheets? Here are reasons that become obvious once you use an online Simple Interest Calculator:

- It’s Instant: Type in the numbers, tap Calculate—answers appear right away. No formulas to remember, no number keys to fat-finger.

- No Guesswork: You’re not trusting your napkin math (or risking a brain freeze). The Calculator repeats the correct formula every time. No deviation, no rounding confusion.

- Stress-Free for Beginners: You don’t need to know anything about interest. The explanation lives in the layout and labels. You’re guided step-by-step, so you never get lost.

- Context on the Go: Whether you’re in a store, at a bank, or even at a family dinner, you can reach for your phone and run the calculation—no setup, login, or download required.

- Safe and Private: No one else sees your data. The calculations stay between you and your device, never shared or stored.

If you’re an educator, the Simple Interest Calculator is a painless way to walk students through real-world examples. For parents, it’s an easy “teachable moment” dispenser. For anyone making financial decisions—big or small—it’s a fast route to honest numbers.

Why This Simple Interest Calculator Stands Above the Rest

A quick web search shows there’s no shortage of calculators. But why should you use this Simple Interest Calculator over another?

First, let’s talk design. Our calculator wasn’t an afterthought. Every shade, animation, and font was chosen to make your experience calm and focused. It isn’t buried in ads or overloaded with choices you don’t understand. It’s as inviting to a fifteen-year-old learning finance as someone refinancing their home.

Second, the accuracy. We use the established, recognized formula—every step you see is backed by years of financial best practice. The logic all runs in the browser, instantly, so you’re never stuck waiting for a server or worrying about privacy.

Third, usability. The Simple Interest Calculator doesn’t make you learn its quirks. It fits your behavior—accepting numbers as you naturally enter them, toggling between months and years, always responding instantly. You’ll never have to squint or hope you clicked the right place.

And most importantly: trust. Every design feature, every function, is meant to empower you with clarity—no confusion, no hidden tricks, no missing information. When you finish using the calculator, you feel smarter and more prepared, not more anxious.

Common Mistakes People Make—And How the Calculator Helps

I’ve seen people make the same errors time and again:

- Entering wrong rate formats: They enter “0.05” thinking it’s 5%, or vice versa. Our calculator standardizes this, so you never have to guess.

- Forgetting to convert months and years: Enter 6 for time, meaning “6 months,” but then apply an annual rate. We let you select the right period and do the math.

- Leaving out a field: Maybe you forget the rate, or accidentally swipe the last zero. The calculator refuses to run until all fields are ready—saving you from incomplete calculations.

- Overcomplicating the formula: Some people, especially when anxious, try to mix in repayments or compounding. The Simple Interest Calculator strips away all but the essentials, ensuring clarity.

Every aspect of the Simple Interest Calculator is built to close these gaps, so you never fall into “gotchas” that even finance professionals sometimes make when hurrying.

Storytelling: Changing Real Lives With a Simple Interest Calculator

Let’s bring this home with a few stories from my own circle (personal details changed):

Jessica’s Furniture Dilemma:

She wanted a new sofa and found a store offer: “No interest for six months, then 20% annual simple interest retroactive if not paid off.” The numbers sounded scary, but with the Simple Interest Calculator, she discovered that failing to pay in time would cost her $300 extra. That knowledge pushed her to set aside a savings plan and pay off within the grace period—avoiding the penalty altogether.

Eddie’s Emergency Loan:

When his car broke down, Eddie asked his uncle for a $2,500 loan at 4% over one year. He used the calculator to see that he’d owe $100 extra—not a fortune, but enough to budget. Being able to explain it to his uncle built trust and avoided conflict.

Two Sisters, One Savings Account:

When Sara and Mia both inherited $2,000, they asked their parents whether saving at 1.8% or 2% was better over three years. Running both scenarios side-by-side showed the difference—small, but real. The calculator turned an abstract choice into dollars and cents.

Entrepreneur in a Hurry:

A friend was opening a pop-up shop, deciding between a traditional small business loan and a special vendor offer. The Simple Interest Calculator let her model each option instantly. She saw, at a glance, what the extra cost was for more flexibility—enabling a decision she wouldn’t regret later.

The Human Touch: Why Experience Still Matters

No matter how sophisticated, the core value of a Simple Interest Calculator is personal empowerment. It’s about stripping away worry and confusion so you can see your next best step. Whether you’re a student, parent, business owner, or someone planning for retirement, a reliable calculator allows you to project, compare, and plan with confidence.

It’s helped me, my friends, and family avoid costly mistakes. It lets you quickly “gut-check” what sounds good, ensuring you have full clarity before signing on the dotted line. A small investment of time returning a lifetime of stronger choices.

In Conclusion: Your Trusty Financial Sidekick

The Simple Interest Calculator isn’t just a digital tool. It’s a decision-making companion. When you use it, you gain more than a total—you gain understanding, peace of mind, and a sense of agency over your finances. It fits seamlessly into real life, handling everything from curiosities and teaching moments to major life milestones.

Bookmark it, use it, share it. The next time you need an instant answer on interest—whether the number is $100 or $100,000—you’ll know you have a friend in your corner, ready at a moment’s notice.

Try our Simple Interest Calculator today and discover just how empowering simple financial clarity can be—one honest answer at a time.